Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Sep, 2021

By Brian Scheid

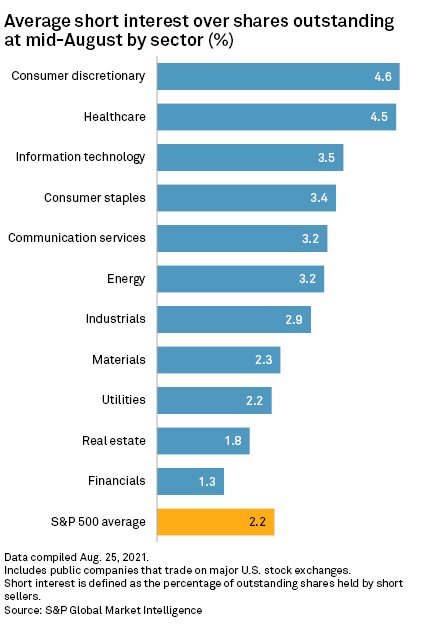

Consumer discretionary companies are now the most-shorted stocks on Wall Street as pandemic-era government support programs end and consumer confidence dips, according to the latest S&P Global Market Intelligence data.

As of mid-August, short sellers held 4.6% of outstanding shares in consumer discretionary stocks, more than double the 2.2% average for the S&P 500 and higher than any other sector on major U.S. exchanges. Short interest in the sector, which had climbed as high as 6.8% in mid-March 2020, fell to 4.2% at the end of February 2021 and had trailed the healthcare sector since January 2021 as the second most-shorted sector.

Consumer discretionary companies sell goods and services viewed as nonessential, such as apparel and vehicles. The sector — which includes Amazon.com Inc., Tesla Inc., The Home Depot Inc. and Nike Inc. as its largest constituents — largely thrived during the coronavirus pandemic as consumers, unable to spend on restaurant meals and vacations, splurged on retail online. But the recent rise in short bets comes as government stimulus has largely ended, expanded unemployment benefits are nearing an end and concerns over the spread of the coronavirus delta variant have squeezed consumer confidence.

"Investors are quite concerned about the move from fiscal stimulus to fiscal drag, which is creating a headwind for personal income and consumer spending," said Jeff Schulze, an investment strategist at ClearBridge Investments, in an interview.

Short sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If the strategy is successful, short sellers profit from the difference between the price they sold the stock for and what they pay to repurchase it.

Since the start of 2020, the S&P 500 consumer discretionary sector has climbed over 48%, compared to the S&P 500, which has jumped just about 40%. The consumer discretionary sector's performance over that time has trailed only information technology stocks, which have climbed nearly 73%, and the communication services sector, which has risen nearly 58%.

Consumer discretionary stocks typically outperform other sectors early in a market cycle as investors anticipate a jump in consumer spending, according to Schulze of ClearBridge.

But since June 30, consumer discretionary stocks have stagnated, climbing just over 2% and outperforming only the S&P 500 energy and industrial sectors. The S&P 500 has increased roughly 5.2% over the same period.

"As a bull market matures and moves from early to mid-cycle, investors tend to shy away from the more cyclical areas of the market, like consumer discretionary, instead favoring companies that exhibit quality and defensive characteristics," Schulze said.

Spending may cool as stimulus wanes

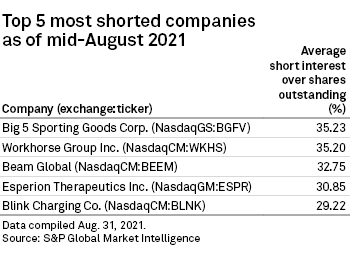

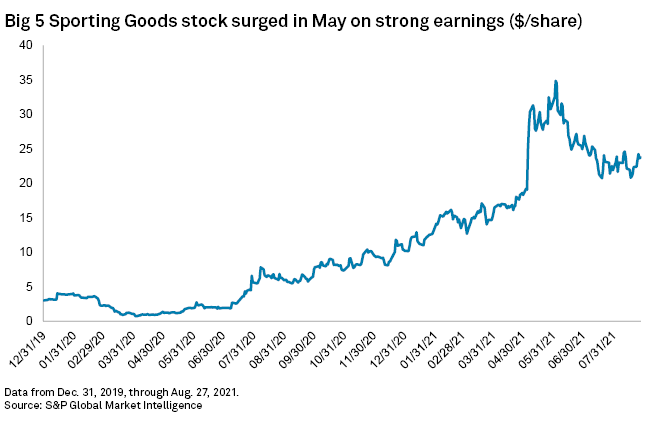

As of mid-August, Big 5 Sporting Goods Corp. was the most shorted company on any major U.S. exchange with over 35% of its outstanding shares held by short sellers, according to Market Intelligence data. Short interest in Big 5 was below 5.7% at the end of February 2021.

Two other consumer discretionary stocks were among the top five most shorted as of mid-August. Short sellers held more than 35% of outstanding shares in maker of electric vehicles and aircraft Workhorse Group Inc. and more than 29% of vehicle charging company Blink Charging Co. as bets continue against EV companies.

Stimulus checks to consumers have aided Big 5, a retailer with 430 stores in 11 western states, and other consumer discretionary companies in recent months. Same-store sales at Big 5 jumped more than 30% year over year in the first and second quarters of 2021. Company President and CEO Steve Miller said during an Aug. 3 earnings call that sales saw "some bump" from stimulus checks.

Consumer spending may soon be constrained without government action, limiting the rally in Big 5 and other consumer discretionary stocks, said Craig Erlam, a senior market analyst with OANDA.

"The lack of stimulus checks is surely a big factor here, along with the surge in delta cases," Erlam said.

In addition, federal emergency unemployment benefits are set to expire in early September for roughly 7 million Americans, following the loss of the extra unemployment pay for 10 million Americans in states that ended participation in the program early.

This could lead to some belt-tightening as the summer ends, Schulze of ClearBridge said.

On Aug. 31, The Conference Board reported that its monthly survey showed consumer confidence at its lowest point since February. The decline was mostly due to concerns about the effects of the delta variant and rising gasoline and food prices.

Still, it may be too early to tell what effect the confidence slump will have on spending.

"While the resurgence of COVID-19 and inflation concerns have dampened confidence, it is too soon to conclude this decline will result in consumers significantly curtailing their spending in the months ahead," Lynn Franco, The Conference Board's senior director of economic indicators, said in a statement.