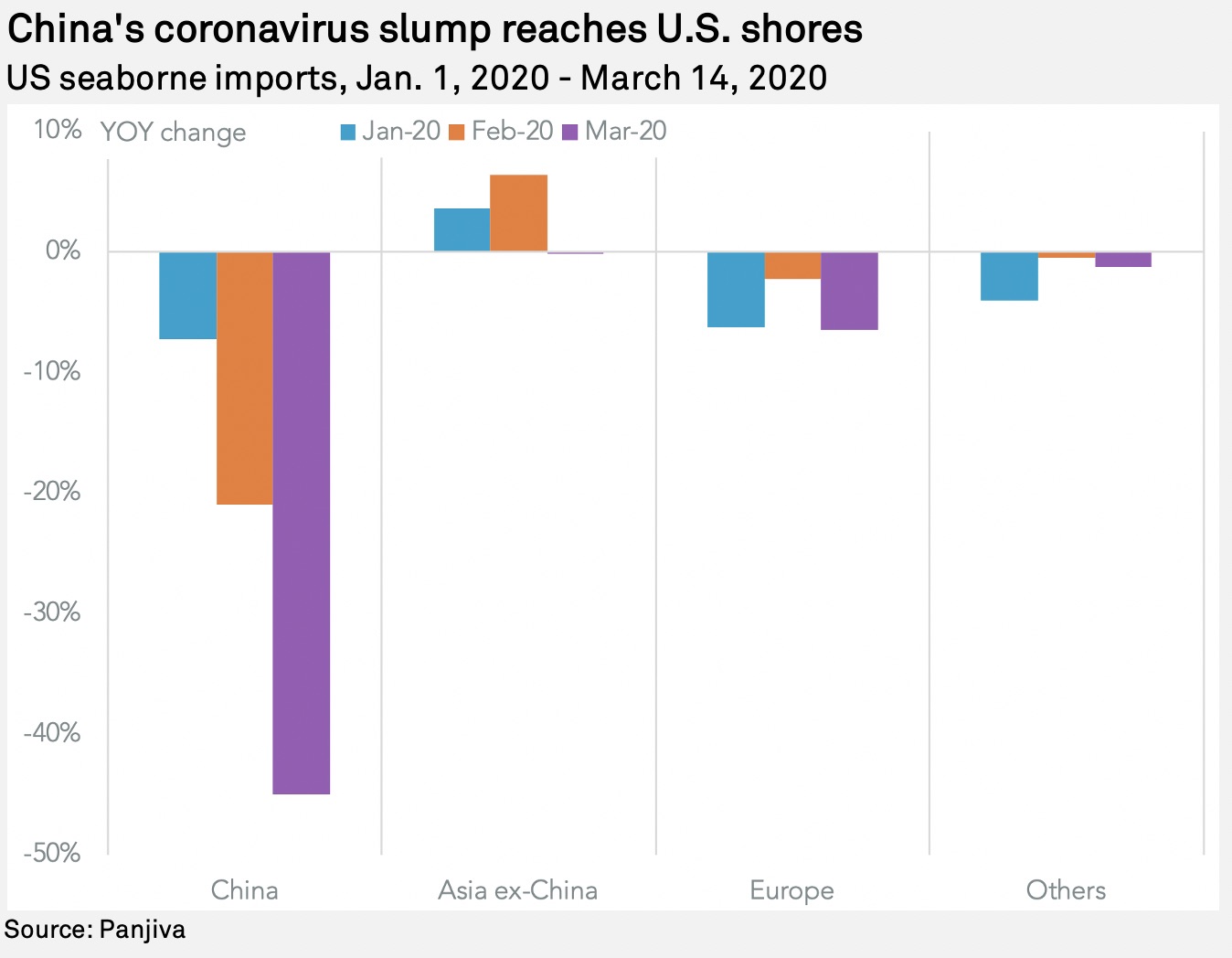

The rapid spread of coronavirus brings unprecedented challenges for global supply chains, as discussed at length in Panjiva's March 16 analysis and subsequent reports. Regular datastreams struggle to keep up, leading us to update our monthly read of preliminary U.S. seaborne import data to a biweekly approach. U.S. seaborne imports fell 15.0% year over year in the first two weeks of March, Panjiva data shows.

That included an unprecedented 44.9% slump in imports from China, reflecting the extended post-Lunar New Year shutdown as the government there reacted to the spread of coronavirus. At this stage, the concern for port operators and supply chains globally is that a similarly harsh shutdown from other countries — currently being applied in Europe, Malaysia and India, for example — could lead to similar rates of decline.

Imports from Asia excluding China only declined by 0.1%, though it is worth noting that in the prior two months imports rose by 6.4% in February and 3.6% in January.

Indeed, imports from Europe were already in decline with a 6.5% year-over-year drop in the first two weeks of March, led by a 10.6% slide in shipments from Germany and a 12.5% slump in shipments from France. Imports from Italy have only fallen by 5.2% — it may be a few more weeks before the impact of disruptions in north Italy is seen.

|

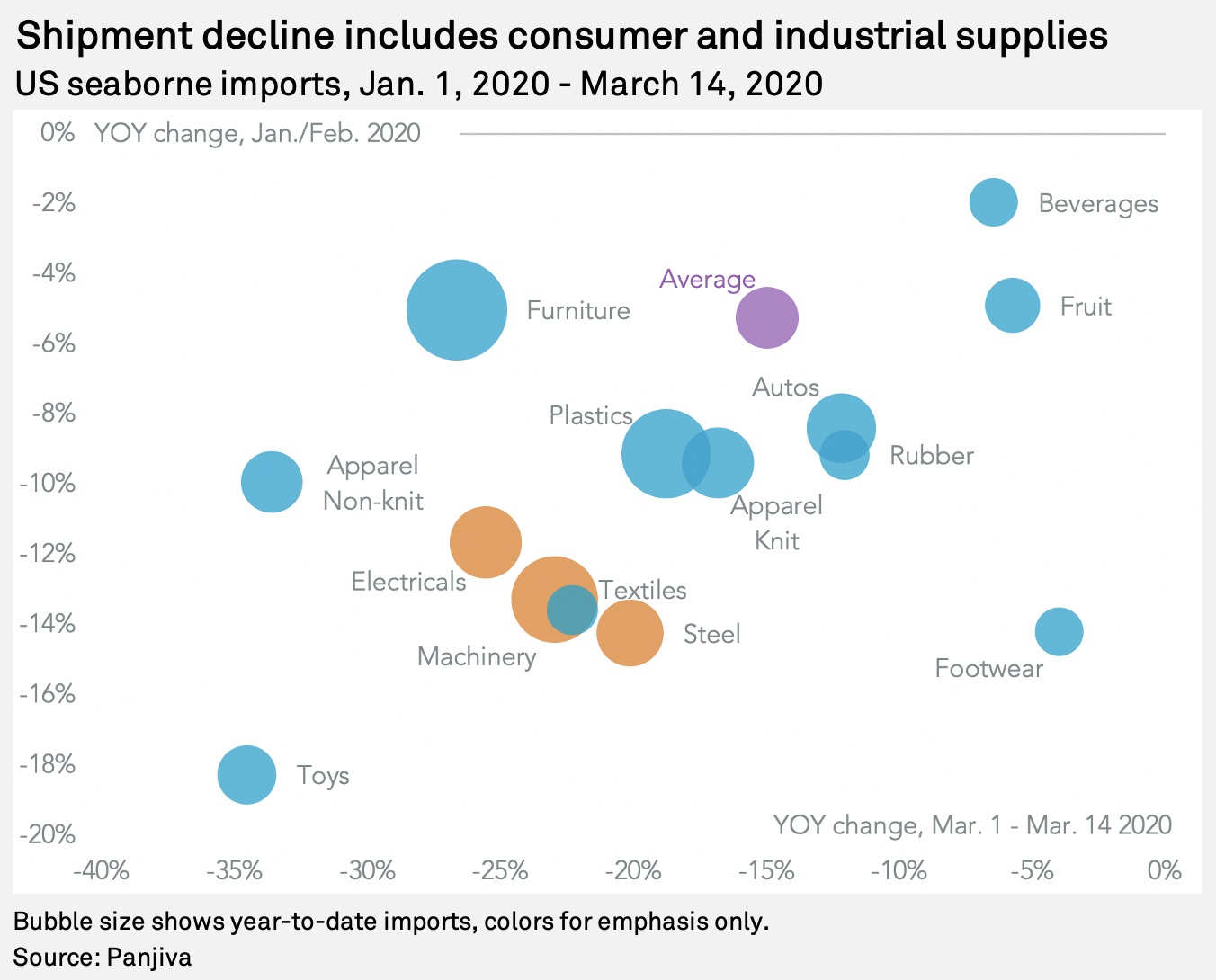

Among the major products (categorized at the HS-2 tariff code level), the fastest rate of decline in total U.S. imports has included consumer goods such as toys, which fell by 34.5% but are in the low season, and non-knit apparel, which fell by 33.6%. Of more concern though is a widespread drop in imports of electrical products of 25.6% and a decline in machinery imports of 23.0%.

|

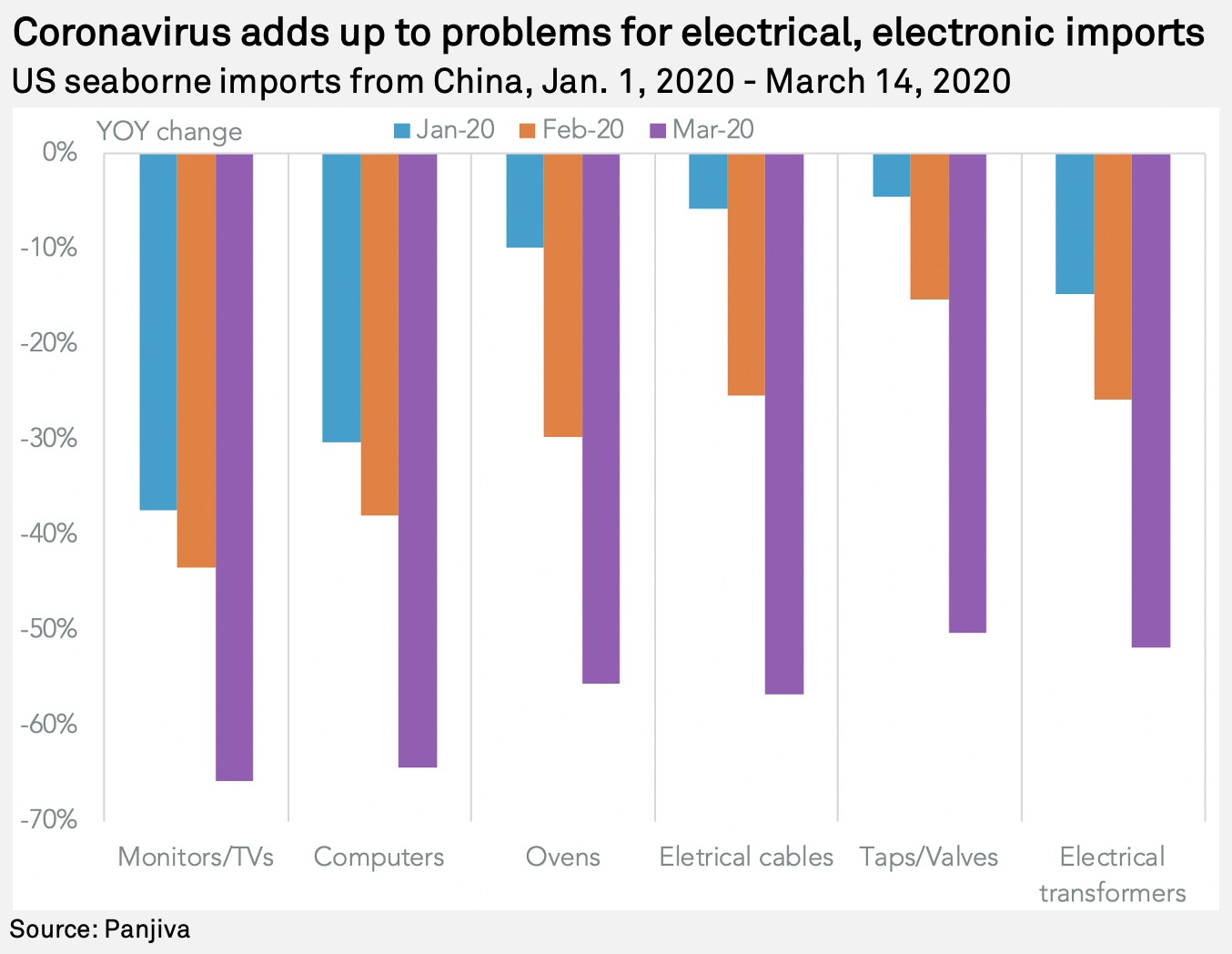

In terms of imports specifically from China among machinery and electricals and electronics, there was a 65.8% slide in imports of monitors and TVs year over year in the first two weeks of March. Similarly, shipments of computers dropped 64.4% which may be a concern as companies gear up for work-from-home operations. Among slower-moving consumer goods there was a 55.6% slide in imports of ovens. Major importers that may be at risk of a slowdown in those product groups include retailers such as Best Buy Co. Inc. and manufacturers including Qisda Corp.

On the industrial component side, there was a 65.8% drop in imports of taps/valves, a 56.7% drop in electrical cables and a 51.8% decrease in shipments of electrical cables. The disruptions could be widespread including importers such as Rexnord Corp. and Kohler Co. Inc..

|

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.