Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Mar, 2021

By Casey Egan and Stefen Joshua Rasay

After Shenandoah Telecommunications Co.'s planned sale of its wireless assets and operations to T-Mobile US Inc., the company intends to dish out a special dividend to shareholders, which could amount to a large windfall for some of the company's largest institutional shareholders.

Shentel — a regional communications company that operates wireless, cable and fiber-optic networks in the mid-Atlantic region — agreed to sell its wireless assets and operations to T-Mobile for a purchase price of $1.95 billion in cash. The after-tax proceeds from the sale are expected to be about $1.5 billion. In a February guidance call, Shentel executives said the company has two large priorities in terms of how it will use the proceeds.

"We currently expect to use the after-tax proceeds of $1.5 billion, plus $195 million of cash on hand at December 31, 2020, to repay the approximately $700 million of outstanding term loans and interest rate swap obligations and fund the approximately $940 million special dividend," added Shentel CFO James Volk on the call.

The $940 million total works out to special dividend of $18.75 per share to the company's shareholders. The company expects to pay the special dividend in the second quarter following the close of transaction and approval from its board of directors.

The dividend could lead to large cash infusion for some of the company's largest institutional shareholders.

For example, assuming the reported stock holdings of the company's largest institutional shareholder, BlackRock Inc., are owned common shares, the investment giant could receive as much as $145.08 million from the dividend. Similarly, the company's second largest institutional shareholder, Vanguard Group Inc., could pull in as much as $94.72 million.

Assuming the reported stock holdings of the company's third largest institutional shareholder, Dimensional Fund Advisors LP, are owned common stock shares, the company could pull in $34.93 million.

Among the top ten largest institutional shareholders of the company, the remaining seven largest shareholders would each pull in over $10 million if their reported stock holdings are owned common shares.

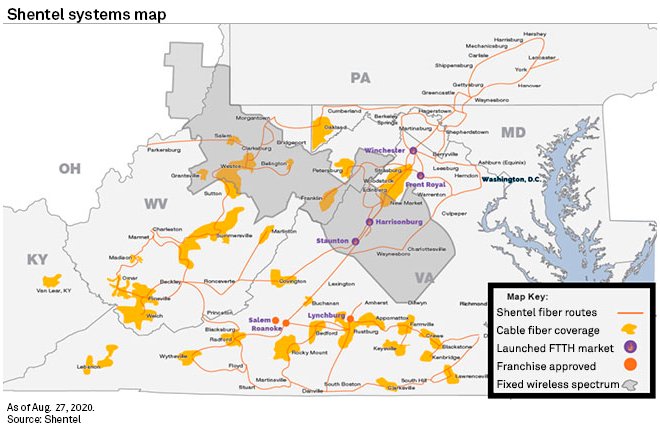

For more than two decades, Shentel operated as a Sprint affiliate, providing wireless service to 1.1 million customers in certain parts of Virginia, West Virginia, Kentucky, Ohio and Pennsylvania under the Sprint brand. After Sprint completed its merger with T-Mobile, the new T-Mobile and Shentel had 90 days to negotiate mutually agreeable terms and conditions under which Shentel could continue as an affiliate of T-Mobile. With no agreement in place at the end of three months, T-Mobile had a 60-day option to buy the assets of Shentel's wireless assets for 90% of the entire business value — an option that T-Mobile eventually exercised.