Amid pressure from Congress to fix abuses on its platform, Facebook Inc. faces growing calls from shareholders for greater transparency and risk oversight. But CEO Mark Zuckerberg's grip on the social media company could make change unlikely, analysts said.

Two of six shareholder proposals set for its 2018 annual meeting on May 31 take aim at risks highlighted by recent controversies. While Facebook has rebuffed them as "inefficient" or "unnecessary," backers of the proposals say publicity over mishandling of user data and the resulting political fallout give them more momentum, especially given the increasing risk of government regulation.

One proposal — backed by Arjuna Capital LLC, an investment firm focusing on sustainable and impact investing, and New York State Comptroller Thomas DiNapoli, who oversees the New York State Common Retirement Fund, the third largest public pension fund in the U.S. — calls on Facebook to issue a content governance report to shareholders, outlining operational and financial risks around content posted by users and advertisers. As of the end of 2017, the New York State pension fund held more than 6.7 million shares in Facebook, or 0.23% of outstanding stock, with a market value of nearly $1.12 billion. Other co-filers of the proposal include the Illinois State Treasurer, the nonprofit Open MIC, Baldwin Brothers Inc. and Harrington Investments.

A second proposal — put forward by Trillium Asset Management LLC, which owned 73,305 shares in Facebook worth roughly $12 million as of December — calls for a risk oversight committee to focus on the unique challenges the social media giant faces.

|

The two proposals were filed in response to what the investors deemed to be abuses on Facebook and on rival social media platform Twitter Inc., including sexual harassment, fake news and hate speech.

Speaking in an interview, Open MIC Executive Director Michael Connor said Facebook is "playing whack-a-mole with these issues." Connor, whose nonprofit group works with investors to improve corporate governance standards for online privacy, added that Facebook's responses to how it plans to eliminate abuses have been "awfully vague."

Recently, the company introduced a new privacy shortcuts menu that guides users through steps such as making their accounts more secure, controlling personal information as well as ads they see, and managing who can access their posts and profile information. It also redesigned its settings menu on mobile devices to let users review and delete data they have shared.

Natasha Lamb, managing partner at Arjuna Capital and lead-filer of one of the proposals, said recent developments boosted its chances of success.

"There's so much more awareness of the critical risk to Facebook's business and … we've reached a point where investors need to speak up," Lamb said in an interview.

But some industry observers doubt the company will bow to pressure to work with shareholders on these issues, largely because although Zuckerberg owns only about 16% of Facebook shares he controls 60% of voting rights.

"The thing about Facebook is Zuckerberg has complete control," Pivotal Research Group analyst Brian Wieser, who follows internet advertising companies, said in an interview.

Wieser noted that similar proposals in the past have not garnered much support. In 2017, a proposal by Arjuna seeking a report on fake news and its associated risks received less than 1% of shareholder votes.

"Most investors think that Facebook management mostly does a good job. They are wrong, but that is the dominant view," Wieser said. "So I don't think you'll see meaningful pressure — yet."

Wieser holds a "sell" rating on the company's shares with a $138 price target.

Other analysts, however, are more positive on Zuckerberg's handling of the recent scandals, pointing to his two appearances before Congress and the favorable Wall Street reaction.

"In a nutshell, so far the fundamental damage to the Facebook platform has been 'contained' ... and is better than feared," GBH Insights analyst Daniel Ives wrote in a research note after Zuckerberg's first day of testimony. "Zuckerberg is conciliatory and taking ownership, but holding the stance of Facebook, its $50 billion advertising fortress and golden business model, which is sending a bullish message to the Street."

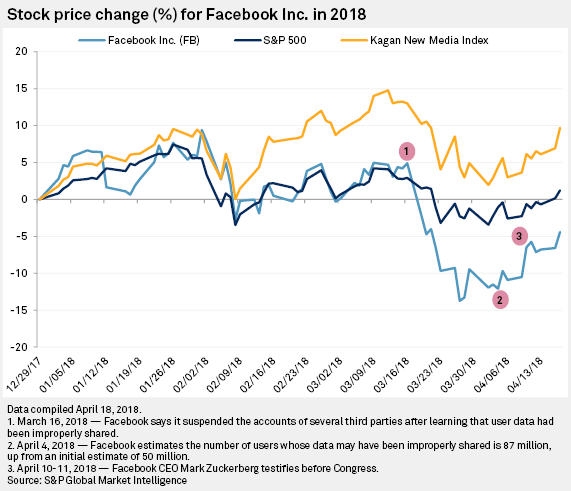

After Facebook said March 16 that tens of millions of users' data had been improperly shared, its share price dropped by more than $30 per share, from a March 16 close of $185.09 to a March 27 close of $152.22. But the stock began to regain lost ground on April 10 during Zuckerberg's testimony, closing that day at $165.04, up from a previous day close of $157.93. While shares in Facebook still have not returned to their pre-scandal heights, they have slowly crept northward.

|

In a proxy statement filed April 13, the company said a risk oversight committee, as proposed by Trillium, was unnecessary given that Facebook's board of directors and committees "spend a significant amount of time on matters relating to risk oversight as part of their existing duties." Moreover, the company argued against filing a content governance report, noting it already communicates updates through its online newsroom, offers a "Hard Questions" blog to address such matters and files a transparency report twice a year.

Connor, though, argued that Facebook's approach to transparency has been piecemeal. To figure out the company's position on things, he said one must "stitch together a whole series of blog posts ... and so it's not a corporate position — it's a blog post by a midlevel executive explaining what they're doing right now."

This is also a complaint that has been raised by lawmakers, with Senate Commerce Committee Chairman John Thune, R-S.D., telling Zuckerberg during an April 10 Senate hearing that Facebook has "a 14-year history of apologizing for ill-advised decisions regarding user privacy." Thune suggested a more comprehensive approach, and perhaps even more comprehensive regulation, may be needed.

Connor said he does not support specific regulation but would like to see Facebook's board be more aggressive in addressing these issues. "In any other public company, if you had a CEO with these kinds of problems, there'd be a much greater degree of accountability," said Connor. "In fact, by this point in the game, the CEO would have been asked to resign, or he would have been fired. But that's not going to happen because of the shareholdings."

Regardless of who leads the company, New York State Comptroller DiNapoli wrote in a statement that Facebook must continue to demonstrate to its customers as well as investors the specific steps it is taking to protect users' data.

"The company has already suffered a drop in value and severe reputational damage and failure to address these concerns will only further jeopardize the company's reputation and financial well-being," DiNapoli said.