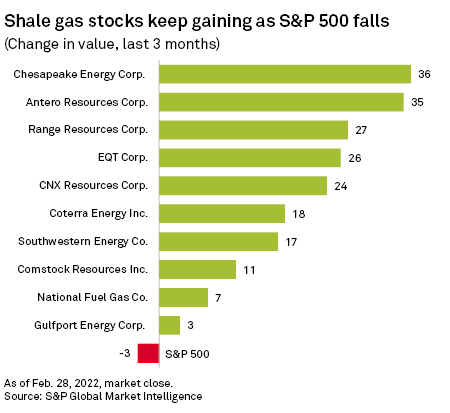

Pure-play shale gas producers delivered the results that investors were looking for in the fourth quarter of 2021: modest spending increases, flat production growth and shareholder returns.

"Producers continued to tout 'maintenance mode' on production and a strong commitment to capital discipline with a formulaic capital allocation approach focused on returning free cash flow to shareholders," TortoiseEcofin's managing director and senior portfolio manager Brian Kessens said.

Matthew Portillo, an analyst at energy investment bank Tudor Pickering Holt & Co., gave shale exploration and production companies, or E&Ps, a grade of A-minus for the quarter for spending discipline and keeping growth expectations low, knocking a bit off a perfect grade for operating expenses, which increased more than expected due to inflation.

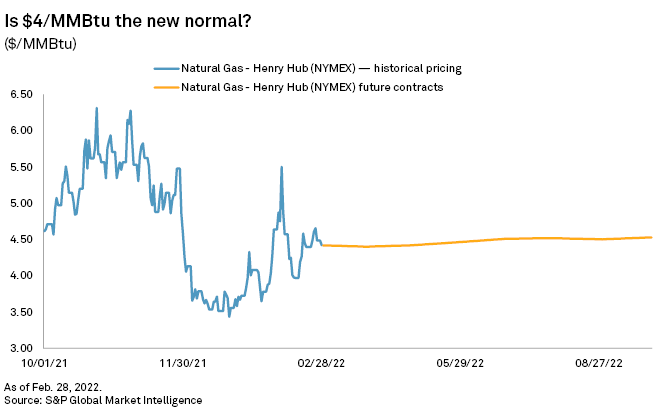

"Companies continue to clip additional free cash flow at these elevated commodity prices, which will translate to higher dividends and buybacks with Q1 reports," Tudor Pickering Holt told clients on Feb. 28. Portillo said West Virginia and Ohio wet gas E&P Antero Resources Corp. is his top pick in natural gas.

Most of the major shale gas producers reported higher capital spending year over year, but that guidance took into account a bunch of hefty new acquisitions in 2021. In the Marcellus Shale, Chesapeake Energy Corp. bought out privately held neighbor Chief Oil & Gas, while rival EQT Corp. is still digesting its $2.9 billion purchase of the Pennsylvania dry gas operations of Alta Resources LLC.

In the Haynesville, Southwestern Energy Co. was snapping up private operators Indigo Natural Resources LLC and GEP Haynesville LLC, while Chesapeake bought out Vine Energy Inc. in a $2.3 billion deal in 2021.

None of these transactions cooled off the increasing amounts of cash going to shareholders, helping fuel continued gains in stock prices. EQT kicked off a chain of billion-dollar buyback plans in December 2021, Chesapeake recommitted to a $1 billion buyback in January and Antero rolled out its own $1 billion buyback plan in February.

"The shift in capital allocation priorities in terms of what to do with that cash flow may be the most notable change for the industry," Charles Johnston, a senior analyst at credit research firm CreditSights, said in a January email. "The wave of consolidation that picked up in 4Q20 continued throughout 2021, resulting in higher quality E&Ps."

"I'm not sure anything within energy can be considered permanent, but for now, both debt and equity investors seem to be maintaining pressure on management teams to focus on cash flow," Johnston said. The analyst noted that stock price gains may be pricing the shale oil and gas sector out of the value category, while cash to shareholders has little benefit for bondholders.

"While we do continue to see value in certain [high-yield] E&Ps, it's difficult to characterize the entire sector as a value play at this point in the credit cycle given many upstream names have reached their leverage targets and the cash flow being generated will be direct toward equity holders," Johnston said.