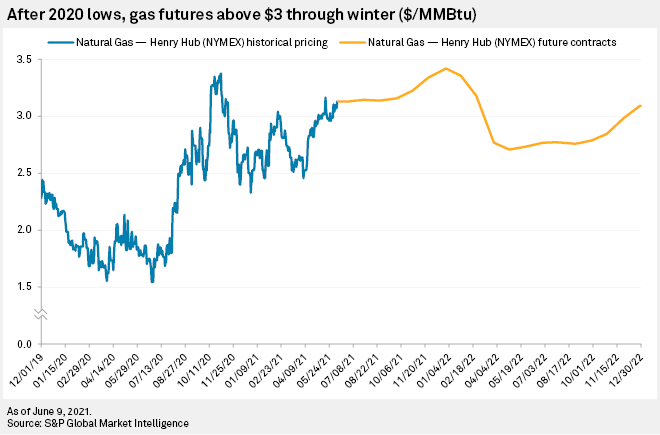

High summer temperatures and increasing LNG exports, combined with a show of discipline by U.S. shale gas producers, have pushed current and future prices for natural gas above $3/MMBtu through the end of winter 2022.

Shale gas drillers uncharacteristically kept their money in their pocket with low-cost maintenance drilling plans holding production flat at roughly 91 Bcf/d in June, analysts said. The drillers now expect to reap a windfall of free cash, a strategy investors continued to reward over the last three months, even after a year of stock outperformance in 2020. Shares in most pure-play shale gas producers showed double-digit gains in value through the June 9 market close, S&P Global Market Intelligence data showed.

"The uptick in prices has been a combination of factors, including flat production, robust export demand, and at least in June, very strong power burns given the recent heat," said S&P Global Platts Analytics' manager of North America gas, Luke Jackson. "LNG exports are going full throttle given $4-5 [/MMBtu] netbacks into the European and Asian markets."

U.S. producers have increased production by 3 Bcf/d year over year, but demand is up 5 Bcf/d, said Sheetal Nasta, managing editor at energy analysis firm RBN Energy. "This is mainly being driven by LNG export demand."

Despite the gap between supply and demand, U.S. shale gas drillers have not thrown more rigs into chasing higher prices, as they have in the past.

"U.S. producers are unable, or more accurately unwilling, to grow production in lockstep with recovering LNG demand for fear of investor backlash," BTU Analytics energy analyst Connor McLean said. "The market expects producers to continue exercising capital discipline despite a stronger commodity price environment. We don't expect natural gas production to be able to make up the supply deficit until at least 2022, but maybe even longer."

Sanford C. Bernstein & Co. gas analyst Jean Ann Salisbury raised her 2021 natural gas price forecast by 25 cents to $3/MMBtu on June 11, saying the private equity-backed producers that dominate Louisiana's Haynesville Shale had not bumped their production up. "Haynesville discipline exceeding expectation, and we reduce growth expectation to +1.2 Bcf/d," Bernstein said. "Appalachia rigs have ticked up to 40 but remain below the roughly 50 mark needed for growth, suggesting [drilled but uncompleted wells] drawdown is still the plan to remain flattish in 2021."

According to analysts at energy investment bank Tudor Pickering Holt & Co., the latest numbers from the U.S. Energy Information Administration indicate an even larger price bump may be in the cards because large amounts of power generation are not switching back to coal as prices rise.

"Power gen is up nearly 7 Bcf/d week-over-week to levels normally reserved for late June/early July but, more importantly, gas' share of thermal generation has averaged 61% this week," Tudor Pickering Holt told clients June 11. "While we're always cautious reading too much into a small sample, the weak coal gen numbers equate to an incremental 3.5 Bcf/d of power burn and if this trend continues into summer it would bring material upside for Henry Hub into $3.50-plus [/MMBtu] territory."

If prices stay high and cash flows into drillers' coffers, most of it will go to pay off debt, Goldman Sachs oil and gas analyst Neil Mehta said in a May 17 note recapping the first quarter's results. "Leverage reduction and return to shareholders remains key focus for [exploration and production companies]," Mehta said. "While this in part was driven by strong one-time pricing benefits, we believe the accelerated debt reduction will accelerate the return of capital to shareholders."

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.