Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jul, 2021

By Bill Holland

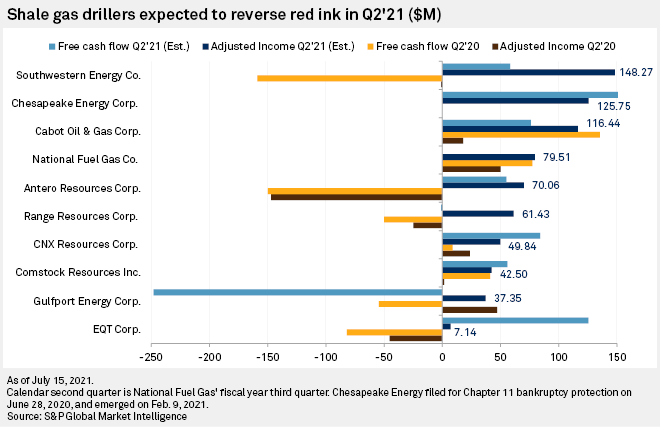

Wall Street expects pure-play shale gas drillers to report positive income and free cash flows for the second quarter of 2021, a sharp reversal from the red ink those companies were bleeding a year ago. Analysts say investors do not want to hear any plans by drillers to start chasing natural gas prices, which are hovering at 30-month highs above $4/MMBtu.

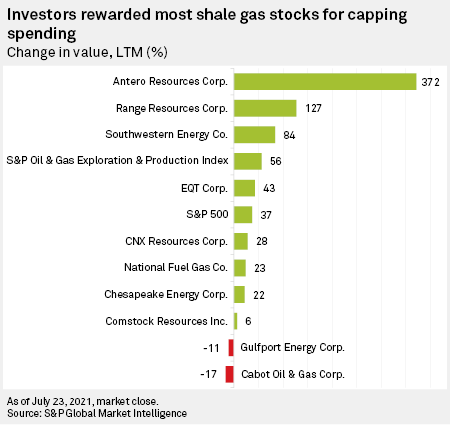

Investors took historically free-spending shale gas producers at their word in 2020 that they would stop drilling away cash in exchange for production growth and instead direct the cash they saved to debt and shareholders. Most shale gas exploration and production companies, or E&Ps, saw their stock gain value over the past year, in some cases doubling and tripling in value, according to S&P Global Market Intelligence data.

What investors will tune to is continued spending restraint, with any growth coming from low- or no-premium mergers and acquisitions in Appalachia and Louisiana's Haynesville Shale, analysts said.

"Notwithstanding the strongest gas prices the market has observed in many years, we expect the public producers will stick to the capital discipline script and focus on holding production flat," Piper Sandler & Co. senior analyst Kashy Harrison told clients July 21 on the eve of quarterly earnings calls. "'Growth' for the group will continue to be tied to consolidation, a trend that we expect to endure. Excess free cash flow '21/'22 above maintenance capital will be utilized to further reduce debt and accelerate shareholder returns."

Another year of restraint like the last 12 months would be good for the sector, analysts at energy investment bank Tudor Pickering Holt & Co. said July 20. "A multiyear maintenance capital program by U.S. producers would likely lead to higher equity prices and better investment traction with shareholders, but time will tell if the industry can hold back on growth beyond discipline showed in 2021."

Appalachian gas E&Ps face an additional source of pressure, according to Goldman Sachs oil and gas analyst Neil Mehta. While benchmark Henry Hub prices are north of $4, prices inside the basin are roughly $1/MMBtu less.

Two proposed pipelines that would transport gas from Appalachia to the national market — Mountain Valley Pipeline LLC and PennEast Pipeline Co. LLC — are hung up in regulatory and judicial reviews, limiting takeaway capacity and forcing producers to sell some production at lower prices within the basin, Sanford C. Bernstein & Co. gas analyst Jean Ann Salisbury said June 2. The problem is particularly acute in northeast Pennsylvania.

"The bad news is that we are close to maxed out on takeaway from the northeast Marcellus — local demand is 1.1 Bcf/d and current takeaway capacity is 10.5 Bcf/d, suggesting approximately 11.6 Bcf/d total capacity, just above current production which is at 11 Bcf/d," Bernstein said. "The implications for the three E&Ps in the area, Cabot Oil & Gas Corp., Chesapeake Energy Corp., and Southwestern Energy Co., are mixed. They should get higher prices on their production with takeaway even though growth potential is limited."

Cabot held its production flat over the past 12 months, while Chesapeake and Southwestern increased gas production by 24% and 10%, respectively, according to the latest data from the Pennsylvania Department of Environmental Protection. Southwestern operates in both the southwest and northeast portions of the state.

"Lower local Appalachia prices in [the second and third quarters] are expected to drive downside risks to cash flows for exposed gas producers," Goldman said July 20, leading the bank to estimate that some Appalachia E&Ps will report EBITDA below consensus estimates. Goldman forecasts EQT Corp., Cabot and National Fuel Gas Co. having a higher risk of exposure to in-basin pricing, while Range Resources Corp.'s strategy of adding NGL production carries a risk of lower netbacks due to rising costs to process liquids out of the gas stream.