Sexual harassment is just a small part of a wider problem with the London insurance market's culture and how it treats female employees, according to some senior practitioners in the industry.

Despite recent furor over sexual misconduct at Lloyd's of London in particular, they argue that the underlying culture and structure of the London market, as well as fostering harassment, discriminates against women, prompting many to seek careers elsewhere.

The Bloomberg effect

Former Lloyd's |

Sexual harassment at Lloyd's was brought to the fore in a March 21 Bloomberg Businessweek article titled, "The old daytime-drinking, sexual harassing ways are thriving at Lloyd's." The article described a "deep-seated culture of sexual harassment" that ran "the full appalling range" from inappropriate remarks to physical sexual assault, and also included sexist and homophobic abuse directed at Inga Beale, the first woman to serve as CEO in the marketplace's three-plus centuries.

The revelations came as little surprise to several women who have worked in the Lloyd's and wider London insurance markets.

Such events "were very common across the market when I joined 25 years ago," said Katherine Bryant, founder of management training consultancy The Progress Partnership and a former broker and underwriter. "Happily I would say less widespread now. However, one incident is one incident too many, so clearly there is still an issue that we need to deal with."

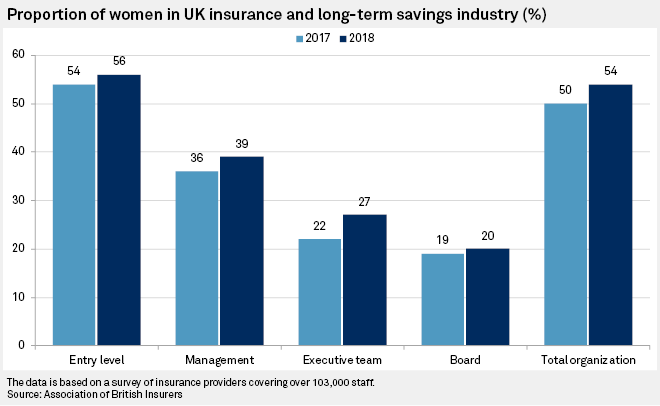

According to the Association of British Insurers, a trade group, the U.K. insurance industry as a whole employs just over 300,000 people, of whom around 94,000 work directly for providers and the remainder in third-party services including broking. Among those working directly for providers, 56% of entry-level employees in 2018 were women, yet that proportion was just 27% at executive level and 20% at board level, an ABI survey showed.

Karen Graves, former head of operations at reinsurer Scor SE's EMEA hub, who has also held senior positions at Lloyd's insurers, said harassment is "totally unacceptable and needs to be dealt with strongly by companies." But she also said there is a fear among women that speaking out will harm their careers, in particular given the continued importance of face-to-face trading in the London insurance market.

Lloyd's for its part responded within days to the Bloomberg article, announcing an action plan that included the potential for lifetime bans for inappropriate behavior and the establishment of an independent bullying and harassment support line. It also conducted a marketwide survey to gauge working cultures; the poll closed June 14, with results and a plan of action to be announced later.

Current Lloyd's |

CEO John Neal, who replaced Beale in October 2018, said when unveiling the market's new strategy May 1 that Lloyd's needed to create a culture where everyone is respected.

"Not [just] because it is the right thing to do, which it obviously is, but also because a successful future at Lloyd's requires diverse thinking and a culture that actually reflects our customer base," he said.

Since then, the story has continued to gather pace. Bloomberg reported June 11 that two executives at Lloyd's insurer Tokio Marine Kiln Group Ltd. resigned following allegations of sexual harassment. A day later, Bloomberg reported that reinsurance broker Guy Carpenter & Co. LLC had suspended two employees in London over a sexually suggestive email about a female colleague.

Alcohol was cited as a factor in the Tokio Marine Kiln report, and Lloyd's action plan included barring those under the influence from entering its premises during working hours. Beale in early 2017 prohibited employees of Lloyd's itself from drinking on the clock.

Graves, though, said the Bloomberg article in March had overemphasized the role of alcohol in fueling sexual harassment, saying, "I felt like I was reading something back in the 1990s." She added: "People behave like that whether they've had a drink or not if they are going to be inherently sexist about the way they view women in this industry."

Harassment or discrimination?

Rather than harassment, the overarching problem for women, according to Graves, is that they are discriminated against "in terms of being seen differently as a female, and [that] you don't look like the person who was in the role before you and you behave a bit differently."

In addition, she argues that although employment practices generally are shifting, the industry is more wedded to the traditional structures of regular office hours and needing to be seen in the office, requirements that are ill-suited to, for example, balancing a career and being a mother. This, according to Graves, tends to push women out of the industry before they can join a company's senior ranks, contributing to persistently wide gender pay gaps, among other concerns.

Barbara Schönhofer, CEO of insurance executive search firm Schönhofer and founder of a network of senior female insurance executives called the Insurance Supper Club, agreed, noting that there is no struggle to attract young women to join the industry.

"Our real problem," she said, "is that we lose this talent literally in huge amounts before they reach 30, and that then gives you a pipeline issue."

Members of the Insurance Supper Club, which operates both in the U.K. and internationally, tell Schönhofer "that they find the culture much more entrenched in masculinity in the London market and much tougher for them to break into." Harassment plays a part in this, she said, noting the "personal risk of speaking out" and saying there remains "a sort of silence about [harassment] even now."

But overall, "it is just how they are perceived and how they are treated that is very uncomfortable in some parts of the market and, it has been particularly pointed out to me, in Lloyd's," she added.

Getting better

Dealing with the problem will not be quick or easy, according to Schönhofer. "It is a very complex issue," she said. "[The culture] has been built up over many years and there is a lot of unconscious bias, both in men and women. It is an uphill battle from that point of view."

But Bryant said the industry has made "a huge effort" and "huge progress" over the years.

"If I look back to 25 years ago, it wasn't uncommon to see the Pirelli calendar in the office or even pornography left around on desks, and those things just wouldn't be thinkable today, thankfully," she said. Insurers still have more to do, she added, pointing to the potential for improvements in maternity and paternity support and shared parental leave.

But she also said the industry recognizes that ignoring the issue could be bad for business, and that putting out "a very inclusive message" is "a commercial necessity as well as a moral necessity."