Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Dec, 2022

The pricey gas utility acquisitions that marked the start of 2022 may have tapered off, but there is still plenty of potential dealmaking activity for industry watchers to monitor heading into 2023.

Rising borrowing costs have lately created barriers to mergers and acquisitions, just as potential buyers were regaining confidence in the longevity of the natural gas utility industry. Yet gas utilities continue to explore a variety of options to finance their strategic priorities and enhance shareholder value, from selling minority stakes to spinning off nonregulated businesses.

The year got started with a flurry of M&A activity. In February alone, Dominion Energy Inc. agreed to sell its West Virginia gas utility, South Jersey Industries Inc. announced an $8.1 billion deal to go private, and NiSource Inc. President and CEO Lloyd Yates kicked off his tenure by launching a strategic review. On March 1, Southwest Gas Holdings Inc. said it would separate its regulated gas business from its energy infrastructure construction unit.

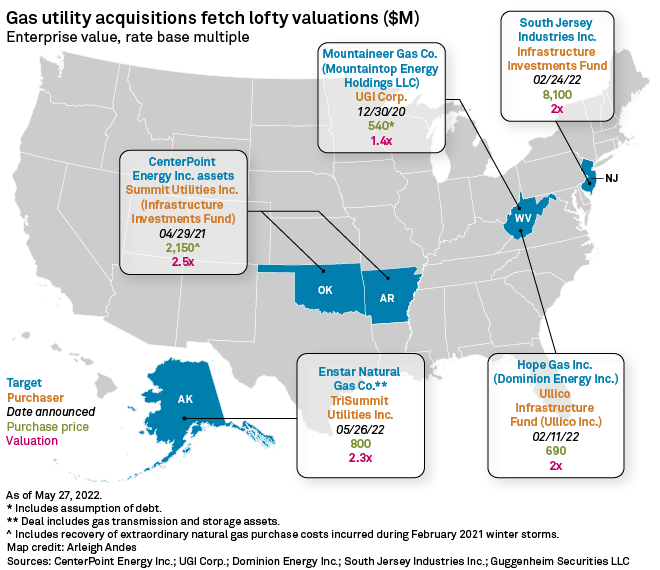

The valuations in the Dominion and South Jersey Industries deals — and AltaGas Ltd.'s sale of its Alaska gas utility in May — established a trend that stirred Wall Street's interest. Like CenterPoint Energy Inc.'s sale of two gas utilities in 2021, the buyers in the 2022 deals were infrastructure funds willing to pay twice the target's rate base. The M&A speculation helped to bolster gas utility stocks, which also benefited from a flight to safe-haven assets as inflation fear gripped the market and war broke out in Ukraine.

Utilities pursue stake sales

Utility-level dealmaking did not continue in the second half of 2022, and at times, investors punished executives for dashing their hopes.

Facing a proxy battle with activist investor Carl Icahn, Southwest Gas launched a strategic review in April, saying the board would contemplate an outright sale of the holding company. Four months later, the company said it would not sell its core Southwest Gas Corp. utility, sending its stock price tumbling.

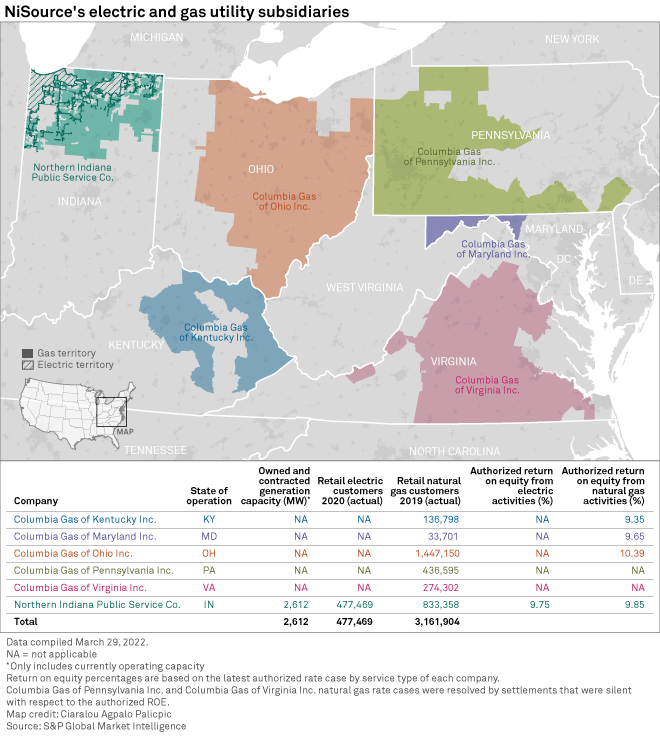

The conclusion of NiSource's strategic review Nov. 7 also surprised some investors. Rather than divest one or more gas utilities as some expected, executives said they would pursue a 19.9% stake sale in their Indiana multi-utility. The news initially got a cool reception from the market; shares of NiSource fell nearly 6% on the day but have risen 7.5% since then.

Analysts were generally positive. Wolfe Research's Steve Fleishman at the time called NiSource's discount to peers "extreme," writing that the company had "a lower-risk, executable growth plan with a balance sheet that will soon have ample cushion." Guggenheim Partners analyst Shahriar Pourreza dismissed the pullback as a "sell-on-the-news event" fueled by unfulfilled expectations. In an early November research note, Pourreza estimated the stake sale could raise $2.6 billion-$3.1 billion.

Just a few days earlier, Black Hills Corp. announced it was evaluating a minority interest in its gas utilities, which span six states from Arkansas to Wyoming. Like NiSource, Black Hills said the sale could potentially fund its equity needs in the coming years.

Breaking up the business

Though operating company divestments have slowed, operators nevertheless continue to rationalize their businesses, creating more pure-play gas utilities.

Southwest Gas on Dec. 15 announced it would sell its recently acquired midstream gas subsidiary MountainWest Pipeline LLC to Williams Cos. Inc. at a loss, part of the fallout from a settlement with Icahn, who opposed the 2021 purchase. Southwest Gas will also spin off its energy infrastructure services subsidiary into a separately traded company and focus on operating its three-state gas utility.

MDU Resources Group Inc., which distributes gas across eight northern states, is pursuing a similar transaction. In August, MDU said it would spin off its Knife River Corp. construction materials business. That left its third business line, MDU Construction Services Group Inc., tethered to its regulated electric and gas utilities and pipeline segment. In November, MDU said it would explore strategic alternatives for the construction services unit, strongly signaling it would cleave it from the regulated business.

"The board of directors has unanimously determined the best way to optimize value would be to create two pure-play public companies, a leading construction materials company and a pure-play regulated energy delivery company," MDU President and CEO David Goodin told analysts on a conference call.

Multi-utilities hit pause

Lately, there have been other signs that utility-level M&A is cooling off.

In November, CenterPoint said it would not sell additional gas utilities to fund an incremental $2.3 billion in new capital investments. CenterPoint President and CEO Dave Lesar had previously left the door open to divesting gas utilities to fund grid enhancements at CenterPoint Energy Houston Electric LLC.

On Nov. 4, Dominion joined the ranks of utility operators conducting business reviews, with an eye toward improving its stock price performance and funding investment opportunities. Asked whether the company would consider gas utility sales, Dominion Chairman, President and CEO Robert Blue did not directly answer, prompting other analysts to press the executive on divestments.

"This is not about corporate M&A," Blue said. "This is about a business review, a top-to-bottom business review ... looking at strategies that maximize value, business mix, capital allocation, all those kinds of things."

Dominion's stock price has fallen about 11% since then, while the S&P 500 Utilities Sector is up 6.9% over the same period.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.