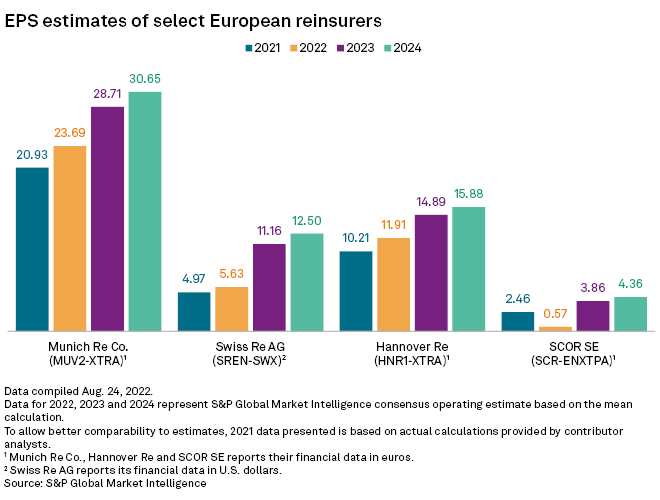

Scor SE was the only one of Europe's four biggest reinsurers to record a loss in the first half of 2022 as a combination of capital markets turmoil, natural catastrophe losses, the war in Ukraine and the lingering effects of the COVID-19 pandemic took their toll across the industry.

The French reinsurer reported a loss of €239 million in the first half of 2022, compared with a €380 million profit in the same period of 2021. Its peers — Munich Re, Swiss Re AG and Hannover Re — all reported lower profits year over year but avoided losses.

Scor was also the only one of the four to post an underwriting loss in its property and casualty reinsurance division, reporting a combined ratio of 107.7%, compared with a profitable 97.2% in the first half of 2021. The 10.5-percentage-point deterioration in Scor's combined ratio was the largest among the group.

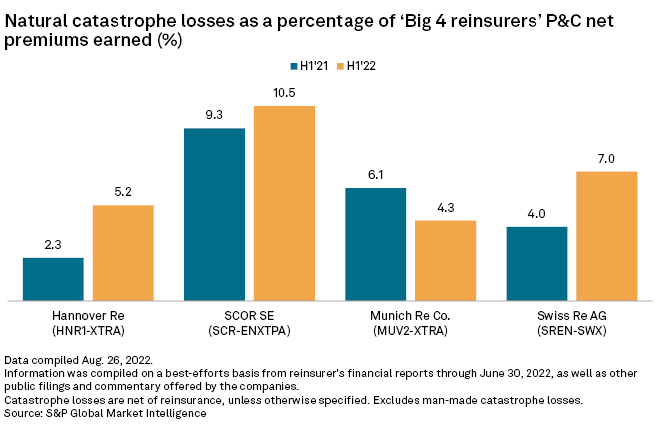

Scor's P&C reinsurance division was hit harder than its peers by natural catastrophe losses, which accounted for 10.5 points of its combined ratio. That compares to 4.3 points for Munich Re, 5.2 points for Hannover Re and 7 points for Swiss Re. A severe drought in the southern part of Brazil accounted for 5.2 percentage points of Scor's natural catastrophe loss ratio.

Dividend uncertainty

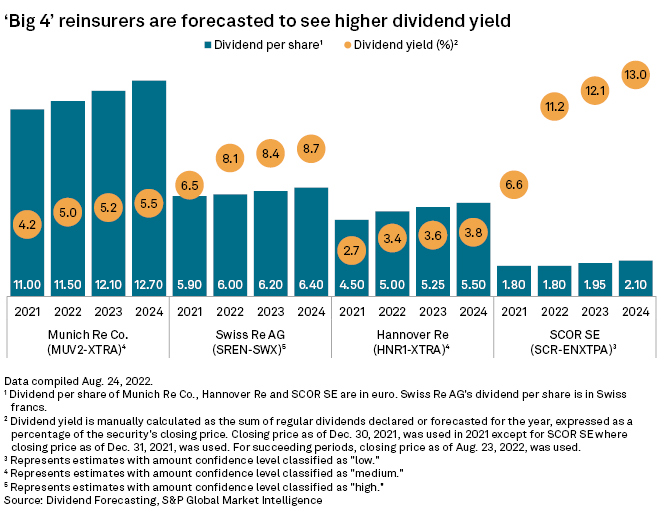

Scor's first-half performance may have dashed any hopes for dividend-per-share growth in 2022. Analysts at S&P Global Market Intelligence expect the reinsurer to maintain its dividend at €1.80 per share this year, amid expectations of a "strong fall" in full-year earnings and uncertainty on how the Ukraine war and natural catastrophes will affect performance, according to an Aug. 12 research note. There is "a high downside risk" on the projected dividend, the analysts added. Dividend growth for the other three big European reinsurers is expected this year, however.

Munich Re, Swiss Re and Scor declined to comment on the prospects for dividend increases. A Hannover Re spokesperson pointed to the company's policy of paying an ordinary dividend of at least the same amount as the previous year, and a special dividend if the company achieves its profit target and capital exceeds that required for future growth. The company paid a special dividend of €1.25 a share in 2021 on top of its ordinary dividend of €4.50. S&P Global Market Intelligence analysts expect Hannover Re to pay a special dividend of €1.25 a share again in 2022.

There were some positive signs in Scor's earnings. While describing Scor's second-quarter results as "messy," Berenberg analyst Kathryn Fear said in a research note that the company's Solvency II ratio of 240% was "robust." While the second-quarter net loss of €159 million was "materially worse" than expected, the life and health reinsurance second-quarter operating profit of €108 million beat analyst expectations, UBS analysts said in a research note.

The corrective action Scor has taken, which includes a 21% year-on-year cut in natural catastrophe exposure so far in 2022, also provides hope of better results in the future. S&P Global Ratings said in a research update that the remediation should result in a performance turnaround by the first half of 2023.

Scor's share price is down 37.4% year-to-date as of Sept. 6. Munich Re's share price has fallen 4.8% over the same period, while Swiss Re's is down 11.7% and Hannover Re's is off by 9.18%.

Even as the other three big European reinsurers aside from Scor remained profitable in the first half, their fortunes differed widely. Swiss Re's profit fell 83.4% year over year, while the profits of Hannover Re and Munich Re dropped by a more modest 3.3% and 18.8%, respectively.

One differentiator was P&C reinsurance underwriting performance. Munich Re's P&C reinsurance combined ratio improved by 3.8 percentage points to 90.5%, while its peers' ratios all deteriorated. The life and health reinsurance businesses also set the peers apart as operating results improved at Swiss Re and Hannover Re but worsened at Munich Re and Scor.

Also, Hannover Re was the only company in the group to see net investment income rise.

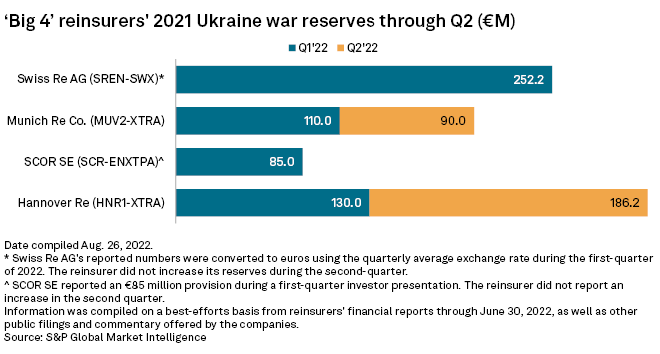

The companies have taken differing approaches to reserving for possible losses from the war in Ukraine. Like Scor, Swiss Re left its reserving unchanged at the level set in the first quarter. Munich Re, on the other hand, added €90 million to its war reserve in the second quarter, taking the year-to-date total to €200 million, and Hannover Re set aside a further €186.2 million, taking its total to €316.2 million.

The great divide

As with the first half, natural catastrophe activity and related strategy in the second half of the year is likely to have a big bearing on the reinsurers' performances. For instance, Scor has been busy cutting its natural catastrophe exposure, but Swiss Re has grown its natural catastrophe gross premium volume by 23% at renewals so far this year.

The top 21 global reinsurers are fairly split between increasing or reducing their exposures to natural catastrophes, S&P Global Ratings said in an Aug. 29 report. While there have been some doubts about cutting back on exposure when prices are high, S&P Global Ratings in its report said high catastrophe activity in the second half, along with high inflation, "would call into question the strategy of those reinsurers that have maintained or increased exposure to natural catastrophes."

The waning influence of COVID-19 claims on life and health performance should offer the Big Four reinsurers a helping hand. Claims and reserving activity in the second quarter were down sharply from the first quarter, though the pandemic's book may not yet be totally closed. Munich Re CFO Christoph Jurecka told journalists on an earnings call that although it was "reassuring" that the claims were lower in the second quarter, "it remains to be seen how the development will be going forward."