Cloud-based software company salesforce.com inc. on Dec. 1 agreed to buy Slack Technologies Inc. in a stock-and-cash transaction valuing the business communications platform at roughly $27.7 billion, representing Salesforce's largest acquisition to date.

Under the terms of the agreement, Slack shareholders will receive $26.79 in cash and 0.0776 share of Salesforce common stock for each Slack share. Salesforce shares were trading down close to 3% in after-market trading Dec. 1 following the announcement, while those in Slack were down just under 1%. Slack's stock had soared in recent days following a Nov. 25 report in The Wall Street Journal about the potential deal.

The transaction is expected to close in the second quarter of Salesforce's fiscal year 2022, which ends in July 2021. The closing is subject to approval by Slack stockholders, as well as required regulatory approvals and other customary conditions. Upon the close of the transaction, Slack will become an operating unit of Salesforce and will continue to be led by CEO Stewart Butterfield.

Salesforce said it expects to fund the cash portion of the transaction with a combination of new debt and cash on Salesforce's balance sheet.

Wall Street analysts were bullish on the potential tie-up ahead of the official announcement, saying the Salesforce/Slack deal could bolster both companies' competitive stance and spur a wave of consolidation in the workforce collaboration space.

Wedbush Securities analyst Daniel Ives in a report this week said the deal specifically represents a "major shot across the bow" toward Microsoft Corp. and its Teams business collaboration platform and could also pressure other tech companies to pursue similar acquisitions in the future.

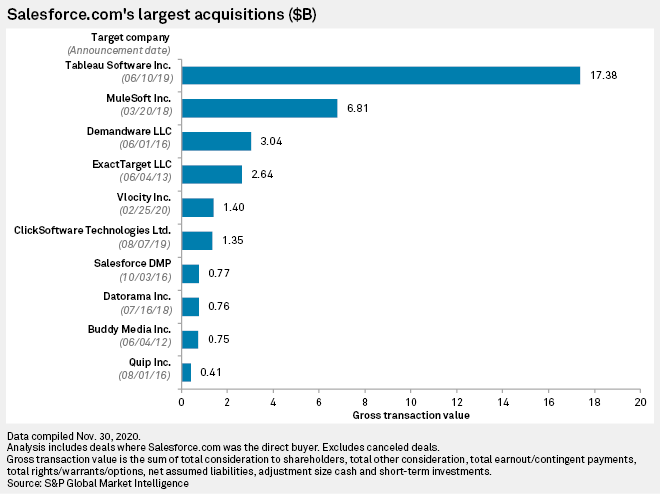

Salesforce has made several other large acquisitions in recent years — including its $17.38 billion deal with data-visualization platform Tableau Software Inc. in 2019 and its $6.81 billion buy of open-source firm MuleSoft Inc. in 2018.

Salesforce's expected acquisition of Slack indicates that both companies are betting that many pandemic-induced trends are here to stay, said Chris Marsh, a principal research analyst with 451 Research, a division of S&P Global Market Intelligence, in an interview before the official deal announcement. Marsh said the Slack deal will be a crucial next step for Salesforce to meet the growing demand among businesses for easy-to-use collaboration and messaging tools.

Still, some analysts were cautious about the deal's long-term potential.

Evercore ISI analyst Kirk Materne said that while the combination possesses some "strategic rationale," including providing Salesforce with a "more robust" collaboration toolkit and equipping Slack with Salesforce's enterprise sales knowledge and customer base, it still might not be enough to compete against the likes of Microsoft and other more-established players.

Confirmation of the deal came in conjunction with Salesforce's fiscal third-quarter 2021 results, in which the cloud-based software company beat analysts' estimates on the top and bottom lines.