Spain's vaccination program to prevent the spread of COVID-19 and its variants will be crucial to determining the success of Sabadell's 2023 strategy.

"Two and a half years from now, this bank will be in a completely different position," said CEO César González-Bueno during Banco de Sabadell SA's 2023 Investor Day. "It will be transformed. It will be a bank that will have regained the respect of the market."

To get there the Spanish lender is restructuring and refocusing much of its business in Spain and the U.K. The overhaul, which was announced May 28, aims to deliver a return on tangible equity of more than 6% to investors by 2023.

Much of that target hinges on the continued success of Sabadell's strongest source of profit, its business banking division in Spain, which González-Bueno described as "outstanding." Lending to corporates and SMEs made up the largest portion of Sabadell's loanbook as of Dec. 31, 2020, at 28%, or €43 billion, with that share projected to increase to 30% by 2023 under the new strategy.

While analysts describe the strategy as realistic, some see the uncertainty around the long-term impacts of the COVID-19 pandemic on businesses in Spain as a major threat to the plan's success. "The largest issue is the challenge within the estimate of return on tangible equity because it is entirely dependent on the improvement of the small and medium enterprise environment in Spain," Daniel Lacalle, chief investment officer at Spanish asset manager Tressis Gestion, said in an interview. "And that is hugely questionable."

The number of insolvencies in Spain in the first five months of 2021 almost doubled to 2,636 compared to the same period in 2020, according to an Iberinform analysis of bankruptcy processes published by the Bank of Spain. Insolvencies in May reached 550, up from 141 a year earlier.

The Spanish government set up an €11 billion program in March to help companies threatened by insolvency and extended a moratorium on bankruptcy proceedings from March until the end of 2021. Prior to the extension, Spain's General Council of Economists had warned that the insolvency rate could hit 40% if bankruptcy proceedings resumed in March.

Sabadell believes the additional help offered to businesses by the Spanish government will have a positive impact on nonperforming loans in the Spanish banking sector in the coming quarters. The bank's latest forecast made in March, based on projections obtained from research analysts' estimates, predicts NPLs peaking at 5.9% in 2022 before falling to 5.3% in 2023. Its previous forecast in June 2020 had NPLs peaking at 6.4% in 2021 before easing to 6.0% in 2022.

Pablo Manzano, vice president, European financial institutions, at credit rating agency DBRS Morningstar, said that Sabadell's 2023 targets are achievable if the projected economic recovery from the COVID-19 pandemic continues. The main threat to the bank's plan, Manzano said, is a return of COVID-19 restrictions because of new more transmissible variants of the disease or problems with the vaccination program. "All of this depends on COVID," said Manzano.

Sabadell's plan to hold on to its troublesome U.K. lender TSB Banking Group PLC also raises doubts about the path to profitability. Sabadell has struggled to make the bank profitable since its acquisition in 2015, with TSB recording its first profit in two years in the fourth quarter of 2020.

The Spanish lender said in November 2020 that it was considering selling TSB following failed merger negotiations with Banco Bilbao Vizcaya Argentaria SA. However, González-Bueno has committed to keeping the bank.

The CEO was bullish on TSB's prospects during the 2023 Investor Day, projecting it to deliver improved profitability with a return on tangible equity above 6% in 2023.

"We believe that focusing on mortgages growth is the right move for TSB," said González-Bueno. "The market in the U.K. is expanding. We have operational capacity to meet additional demand, and we have a low 2% market share, meaning that we have significant headroom to grow without affecting market dynamics."

Lacalle is less optimistic. "It's a long-term bet and a risky one," he said. "It is something that people would certainly not perceive as positive, considering it's a negative contributor to earnings. And it's a huge burden in terms of cost of capital."

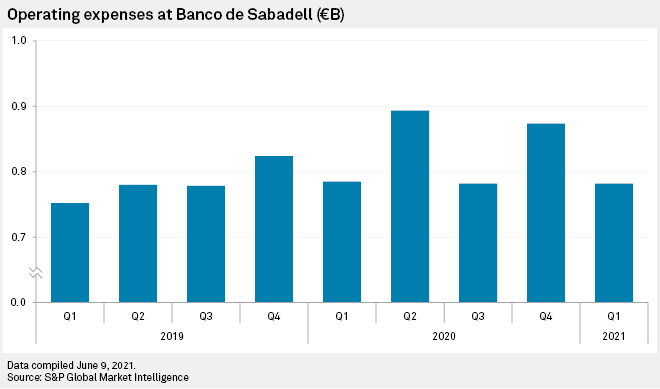

Sabadell's plans for further cost savings are of less concern. González-Bueno announced a further €100 million gross savings per year before the end of the first quarter of 2022 that follows a program completed in March that is saving the bank €140 million in gross costs and another set to finish in the fourth quarter of 2021 with a net cost reduction of €70 million.

The cost reduction efforts will specifically target retail banking, said González-Bueno, where the bank aims to reduce its number of branches and increase its digital banking operation.

"What is very much manageable, and quite positive from the perspective of bondholders and investors, is the planned reduction in costs," said Lacalle. "That is entirely something at the discretion of the management and definitely feasible."

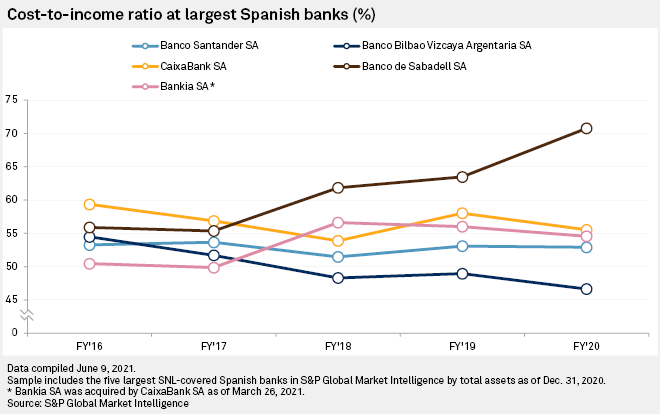

Still, Sabadell could still run into some difficulty in achieving its savings target as unions push back against the slew of job cuts underway in the Spanish banking sector. Both CaixaBank SA and BBVA have faced resistance to planned redundancies in recent negotiations with unions.

"It's inevitable that you will see union backlash," said Lacalle. "But perhaps the difference relative to a case such as BBVA, is that the unions are aware of the level of excess in terms of personnel that Sabadell has."