Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Mar, 2021

By Cathal McElroy and Rehan Ahmad

|

Banco de Sabadell has increased self-servicing at its branches in recent months as part of its drive to improve efficiency. |

It has been a busy few months for Banco de Sabadell SA.

The Spanish lender has undertaken a sweeping cost-cutting program, entered and then walked away from merger talks with domestic rival Banco Bilbao Vizcaya Argentaria SA, and announced a new CEO and CFO, all in less than five months.

With Jaime Guardiola having bid farewell as CEO at the company's full-year 2020 earnings presentation, investors are now looking ahead to Sabadell's new strategy, set to be delivered in May by its revamped executive team led by César González-Bueno. The bank's cost-cutting efforts in recent months have gone some way to improving efficiency and profitability, but analysts say more will be required if it is to compete with its peers.

"Sabadell has tremendous challenges," said Daniel Lacalle, chief economist at Spanish asset manager Tressis. "If they want to present a credible message [in May] about the firm's potential as an independent entity and a driver of, not just top-line growth, but return on tangible equity, they have to undertake a very significant reduction of costs and streamline their operations."

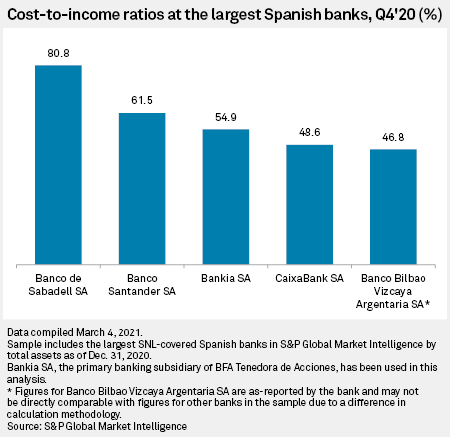

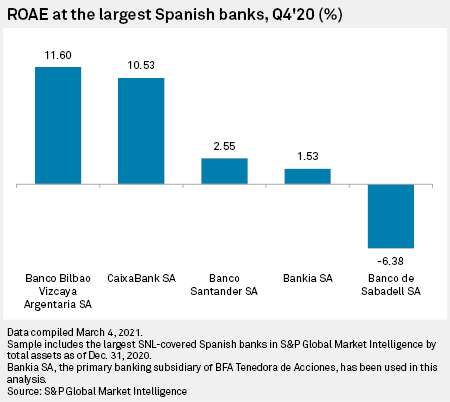

Sabadell is by far the least efficient of Spain's five largest banks, S&P Global Market Intelligence data shows, with a cost-to-income ratio for the fourth quarter of 2020 of 80.8%. It was also the only one of the five to report a negative return on average equity.

The bank's weaker fourth-quarter performance came despite its introduction of a significant efficiency drive in October. Under the plan, Sabadell is increasing self-service banking in branches and centralizing modeling, controls and reporting in its corporate unit, which it said would allow it to reduce the use of outsourcing.

Sabadell also cut 1,800 jobs in Spain in the final quarter of 2020 as part of the restructuring program. The efficiency push will deliver the bank €141 million in annual gross savings, it said in a presentation, though the €314 million cost of restructuring means it will be some time before the bank sees a payback from the changes.

Further measures have been taken to improve efficiency at its U.K. subsidiary, TSB Banking Group PLC, which contributed a €220 million net loss to the overall group in 2020. Sabadell shuttered 93 TSB branches in 2020, with another 153 closures announced for 2021. Sabadell is expected to off-load TSB in the coming months as part of its new strategy.

Homeward bound

"We will focus on our domestic market where we have a solid franchise," said Guardiola as he outlined the bank's three main priorities during its fourth-quarter earnings presentation. "We will transform our retail banking business and generate efficiencies using the group's capital and resources. And thirdly, we will boost our leadership in Spain's [small and medium-sized enterprise] segment, consolidating our solid position in a highly profitable segment of the business."

Still, the sale of TSB and a renewed focus on its home market may not be enough to significantly boost Sabadell's performance in the near term, Miriam Fernandez, associate, European financial institutions at S&P Global Ratings, said during a recent webinar discussing the agency's recent outlook reviews on European banks.

"Even in a scenario where Sabadell retrenches its business back to Spain mostly, we think that its efficiency levels would still probably lag those of the Spanish system, at least in the next couple of years," Fernandez said. "That's probably the biggest challenge for the bank."

Sabadell must focus on two key areas if is to achieve the required efficiency savings that would put it on a competitive footing against its Spanish peers, said Lacalle. "They have way too many people, and they have way too many offices," Lacalle said. "It's a very, very convoluted organization."

Sabadell was reported in December 2020 to be considering further job cuts beyond the 1,800 previously agreed with unions, according to Reuters.

The COVID-19 pandemic's shifting of the balance between office and remote working could provide an opening for Sabadell to reassess its organizational structure and real estate footprint, Lacalle added. "It's a perfect opportunity for them to have a thorough analysis of what the long-term business is going to be and what the headcount needs to be for that new business, and to put the measures in place to make it more profitable."

Uncertain future

Sabadell's future as a stand-alone entity remains uncertain even after the collapse of merger talks with BBVA in November. The Bank of Spain has encouraged further consolidation in the sector despite recent mergers between Unicaja Banco SA and Liberbank SA, and CaixaBank SA and Bankia SA. Analysts have also warned that Spanish banks may have to recognize higher provisions in 2021 than they currently anticipate due to continuing COVID-19 uncertainties, adding further pressure to Sabadell and its peers.

For the bank's new leadership team, improving efficiency is just one of several areas in need of addressing if it wishes to remain an independent entity over the longer term, said Lacalle. Its geographical exposure and loan book composition are of concern too, he said.

"The problem is that when the economy grows fast, [Sabadell's] profitability is simply substandard," Lacalle said. "And when the economy weakens, it is overly exposed to the cycle because it's very domestic-driven and very SME-driven."

Products & Offerings

Segment