Banco de Sabadell SA may not be the ideal partner for a merger due to weak profits and low capital but remaining a stand-alone bank could be problematic too, analysts said.

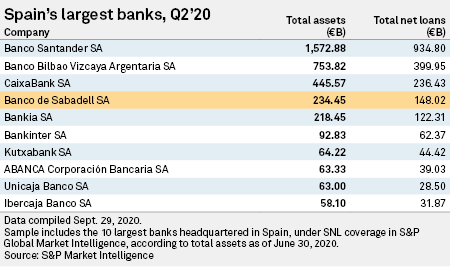

As merger fever grows in Spain with CaixaBank SA set to take over Bankia SA and Unicaja Banco SA resuming tie-up talks with Liberbank SA, midsize Sabadell could find itself falling behind larger, better-capitalized peers. It currently ranks as Spain's fourth-largest bank in terms of assets and net loans, according to S&P Global Market Intelligence data, behind CaixaBank, and the latter's acquisition of Bankia will leave Sabadell in a much weaker position. Its assets stand at €234.45 billion, compared to €664.03 billion for a combined CaixaBank-Bankia entity.

European banks have suffered from weak profits amid low interest rates, tougher regulation and fierce competition for some time. The Spanish market is no exception. Its fragmented nature means too many players are chasing too little market share in one of Europe's most overbanked markets. As of 2018, the country had 55 banks per 100,000 adults, as opposed to 35 banks per 100,000 adults in France, according to World Bank data. Its banks also have among the lowest capital levels in Europe.

Sabadell has contacted Spain's second-largest lender Banco Bilbao Vizcaya Argentaria SA and smaller peer Kutxabank SA as it assesses options, Cinco Dias reported Oct. 5. The bank has held exploratory talks with BBVA and Banco Santander SA, according to Reuters, while Bloomberg said the lender was working with Goldman Sachs to determine a sale or sell assets.

Although Sabadell declined to comment, a source close to the bank said its priority was to generate value for shareholders as a stand-alone entity, but it would bear in mind any "strategic alternative" should it provide greater value. BBVA declined to comment.

Vulnerable

Tom Kinmonth, fixed-income strategist at ABN Amro, said the bank's weak profits and capital position make it more vulnerable as rivals become larger.

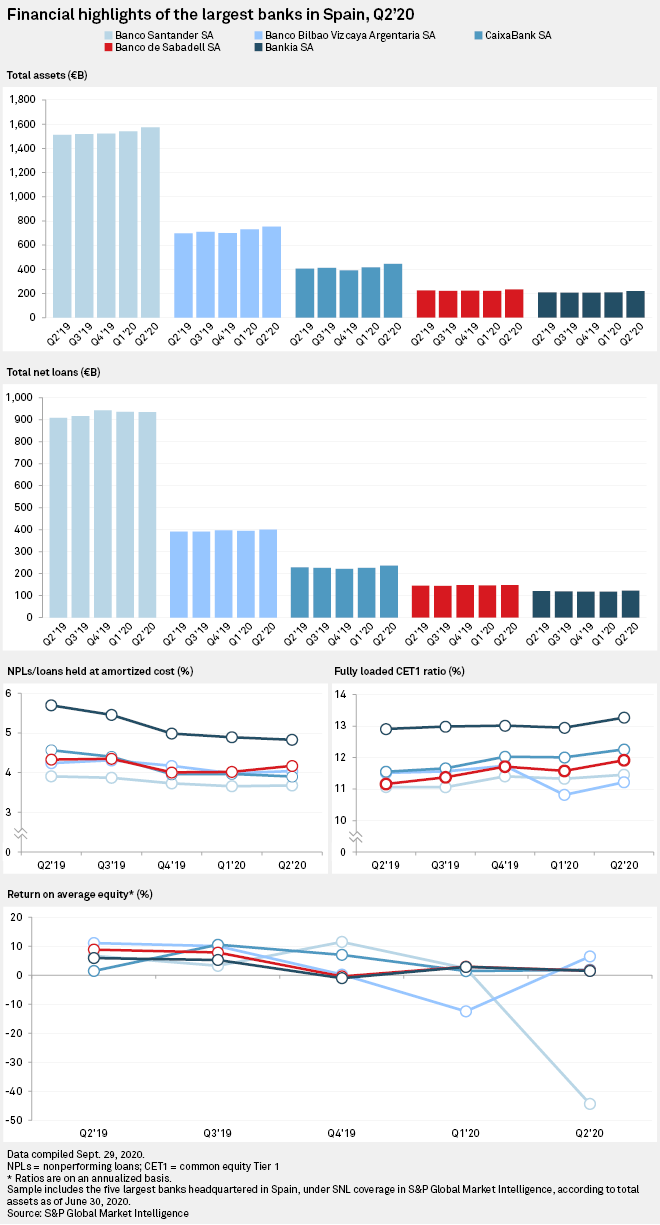

"It's probably thinking if these bigger names are going to come together, they are going to be able to lower their rates to attract customers, where does that leave a bank that can't?" he said.

Sabadell's return on average equity — a key measure of profitability — was 1.57% at the end of the second quarter, the second-lowest of the five largest Spanish banks, S&P Global Market Intelligence data showed. Its common equity Tier 1 ratio stood at 11.92% at the end of second quarter, the third lowest among its peers. At the end of the second quarter of 2019, the ratio was the fourth lowest at 11.16%, just ahead of Santander's ratio of 11.06%.

Sabadell has been shedding assets to shore up capital, but there are limitations to that strategy, Kinmonth said.

"They haven't got the kind of funky lending in some place that gives a big return but a high risk that they could cut or take the return."

It has not ruled out selling U.K. unit TSB Banking Group PLC, which undertook a restructuring following a bungled IT migration in 2018. Kinmonth said it was unlikely that Sabadell, which paid a 30% premium for TSB in 2015, would sell the bank at a good price.

"They are not the biggest player in Spain, they are not the biggest player in the U.K so if you start selling assets, it is quite a short-term gain," he said.

One potential scenario could be for a Spanish lender to buy Sabadell's domestic assets, and a U.K. buyer to purchase TSB, but it could be challenging given the low valuations of European banks at the moment, Kinmonth said.

Tough position

"Our view is that Sabadell is in a slightly tough position; we've looked at different scenarios from the M&A front," said Jefferies analyst Benjie Creelan-Sandford.

"There is obviously an argument that two banks does give you the scope to extract cost savings and deliver profit uplift ... but on the flipside you have to remember that it costs money to do that."

Headcount reductions involve large restructuring charges, which then eat into capital, Creelan-Sandford said. A potential deal with a bank such as BBVA, which itself has low solvency levels, could require a capital increase, reducing the value for shareholders, he said.

Bankia's strong capital ratio of 13.27%, the highest of Spanish banks, is a positive for its deal with CaixaBank, Creelan-Sandford said.

However, by itself, Sabadell faces continued pressure on its preprovision profits and revenues, he said. A large proportion of the bank's lending goes to small and medium-sized enterprises and corporates, a potential risk for asset quality as concerns about rising bad loans grow, he said.

Corporates and SMEs accounted for 42% of the group's performing loans, according to the bank's second-quarter earnings presentation. Mortgages make up 45% of its performing loan book and the rest is consumer and public lending.