Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Oct, 2021

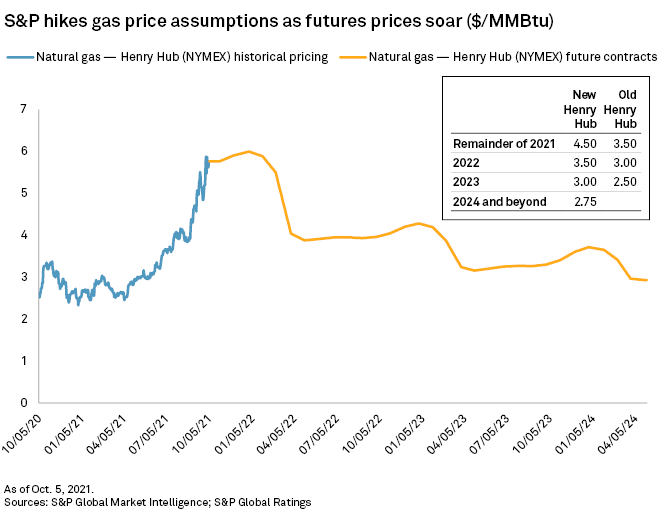

More and more economies across the globe will use natural gas as a transition fuel on the way to lower-carbon renewable energy sources, putting upward pressure on Henry Hub gas prices for the next three years, S&P Global Ratings said late on Oct. 4, as it hiked the assumed gas price it will use for credit decisions by 29% to $4.50/MMBtu for the rest of 2021.

Soaring prices will continue to ease credit pressures on exploration and production companies over the next two years, Ratings said. It raised the benchmark Henry Hub gas price assumptions it uses for corporate credit ratings $1/MMBtu for the remainder of 2021.

The price of the NYMEX futures contract for November delivery was up another 10% to $6.335/MMBtu at midday Oct. 5, with the rest of the winter 2022 contracts also above $6/MMBtu.

The higher and more volatile gas prices are a sharp contrast to 2020, when drillers suffered through months of $2/MMBtu gas prices.

"Natural gas prices have been on a tear," Ratings said. "The price of Henry Hub natural gas has surged more than 230% year over year due to a warmer than expected summer, strong industrial demand and a robust LNG export market."

The credit rating agency added $0.50/MMBtu to its price deck for 2022 and 2023, moving these assumptions up to $3.50/MMBtu and $3.00/MMBtu, respectively. Ratings made its first call on 2024 prices with a $2.75/MMBtu assumption.

Ratings cautioned that the move up in its commodity price assumption will not result in the rerating of many companies' debt. "The revisions likely won't result in wholesale upgrades, though we could raise some speculative-grade ratings," Ratings said. "We remain focused on issuers' financial policies and commitment to improving their balance sheets through debt reduction, particularly for investment-grade companies."

A warm summer in Europe coupled with a lack of wind power has sucked down gas supplies and increased the continent's reliance on LNG, while U.S. shale gas exploration and production companies have stuck to low-growth drilling plans designed to generate positive cash flows, the rating agency said.

From a wider perspective, Ratings said long-term fundamentals are a tailwind for global and U.S. natural gas. "New long-term natural gas price assumptions are higher than previously published prices largely because of our belief that natural gas has favorable fundamentals as a bridge fuel in the energy transition story," the agency said. "We believe many economies worldwide will continue to utilize natural gas to meet greenhouse gas and carbon regulatory standards while continuing to transition and adopt other sources of energy such as renewables."

Rob Thummel, a managing director and senior portfolio manager with energy investment firm Tortoise Capital Advisors LLC, did not expect the high prices to lead to new behavior among producers. "U.S. producers [are] not going to return to a focus on production growth, as the current market is rewarding capital discipline and returning cash to shareholders," Thummel said Oct. 1.