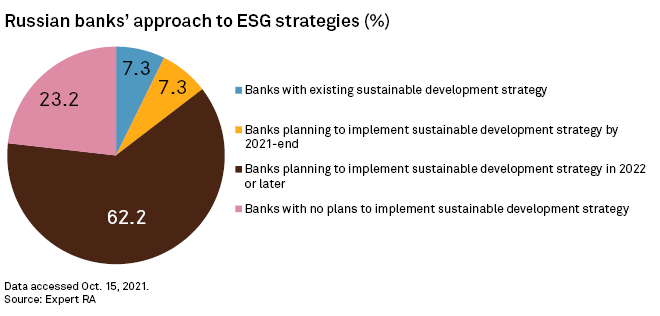

Just 15% of Russian banks have introduced environmental, social and governance strategies, or will do so by the end of 2021, as insufficient regulatory support and the issue's perceived lack of importance hold back adoption, according to a survey by local credit rating agency Expert RA.

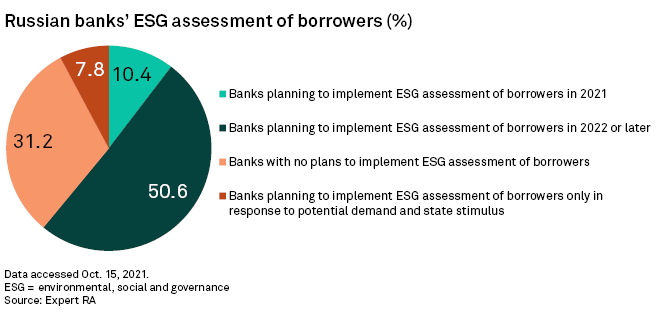

The survey of more than 100 banks found that only 4% of respondents intend to have key performance indicators, or KPIs, for sustainable investments in place by the end of 2021, while 31% have no plans to introduce ESG-related borrower assessments.

Russia's largest banks are more advanced in this area, with 40% of the country's 20 biggest lenders planning to have sustainable investment KPIs by the end of 2021. Over one-third have implemented ESG-related borrower assessments and a further 20% are planning to do so by year-end.

The results indicate that Russian banks do not yet see ESG policies as a prerequisite for further business development, Expert RA said. It added that the lack of take-up from the country's small and medium-sized banks also stems from the fact that they rarely operate in international markets.

Banks have been drivers of ESG transformation in other countries, but in Russia the trend has been led mainly by large companies focused on exports, Sberbank of Russia ESG Senior Vice President Tatiana Zavyalova recently told Russian analytical company Frank RG. Zavyalova added that Sberbank, Russia's largest lender by assets, prepared its first ESG strategy only at the end of 2020.

VTB Bank PJSC, Russia's second-largest bank, plans to put in place an ESG strategy by the end of 2021, although some ESG factors are already included in its current business strategy.

ESG financing

Sberbank's green loan portfolio amounted to 75 billion rubles as of the end of June, while loans with a rate linked to ESG metrics exceeded 50 billion rubles. The bank plans to increase its green lending exposure to 100 billion rubles by the end of 2021, Zavyalova told Frank RG. Sberbank's first deputy head, Alexander Vedyakhin, recently estimated the potential value of the Russian green financing market at roughly 3 trillion rubles by the end of 2023.

VTB Bank recently launched a climate finance and carbon trading business through which it wants to raise funding for Russian companies planning to implement ESG projects. It also launched a platform that will offer individuals, companies and local government entities access to financial products and services meeting ESG standards.

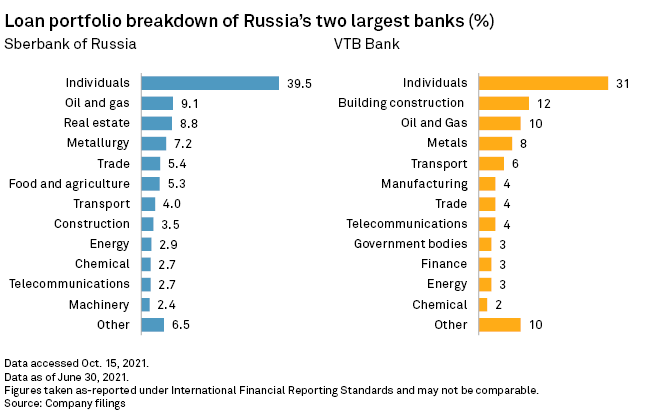

Sberbank's total loan portfolio stood at 26.2 trillion rubles as of June 30, while VTB Bank's total loan portfolio amounted to almost 13.8 trillion rubles. Loans to companies operating in the oil and gas industry constituted 9.1% of the total portfolio at Sberbank and 10% at VTB, while loans for the energy sector accounted for roughly 3% of the banks' respective portfolios.

Calls for state support

The majority of the survey respondents said Russian authorities need to offer more support for the ESG transformation of the banking sector. Some 57% would like regulatory incentives regarding loan loss provisioning and risk weighting for ESG loans, while 30% want tax incentives for projects that meet ESG criteria.

Banking regulation related to ESG factors will evolve in the next few years in Russia and neighboring countries, S&P Global Ratings said in a recent report. The most immediate impact will be in governance factors, but the relevance of environmental factors will gradually increase, reflecting the growing regulatory requirements and potential asset quality issues that could arise from the high exposure of the Russian and neighboring economies to carbon-intensive sectors, the rating agency noted.

As of Oct. 22, US$1 was equivalent to 70.02 Russian rubles.