The European leveraged loan market sell-off in March, due to the COVID-19 pandemic, was the first test of the asset class’s resilience since the global financial crisis in 2008/2009.

As the fourth quarter gets underway, demand for leveraged loans remains strong, though this supportive backdrop has resulted in rising leverage on credits now being shopped to investors. According to pricing data from LCD, however, investors are being compensated for this risk.

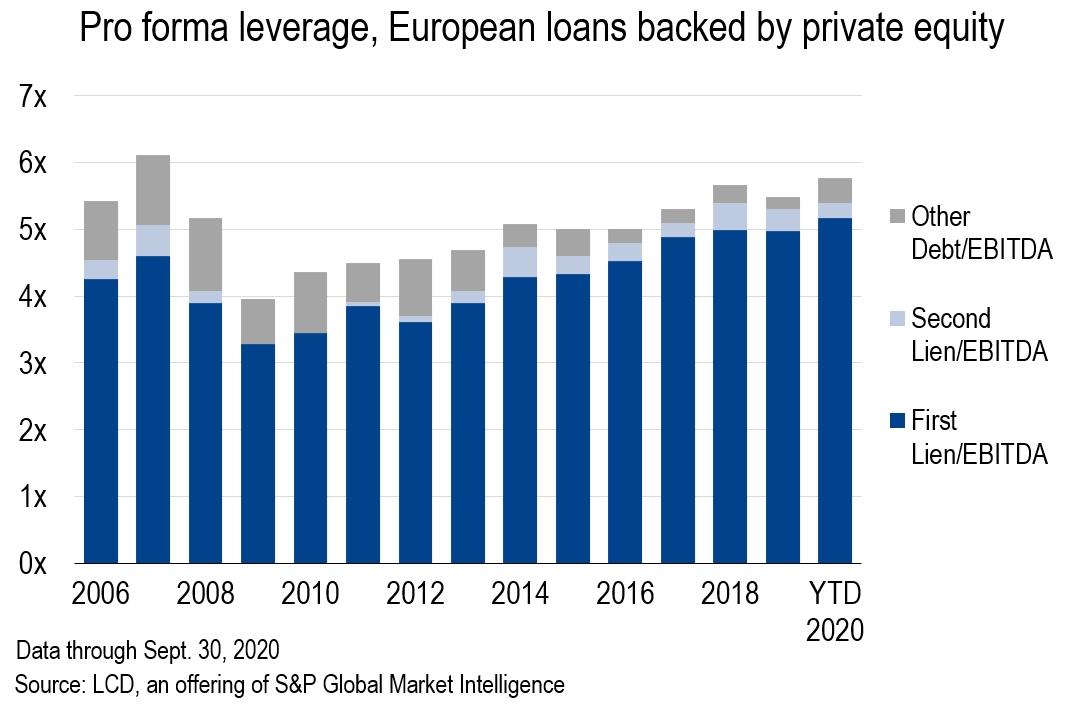

Indeed, total pro forma debt to EBITDA for all leveraged loan deals year-to-date (to Sept. 30) in Europe has risen to 5.5x, which is the highest level since 2007. First-lien debt has stayed on par with 2019's level, at 4.8x debt to EBITDA, remaining at a high point since LCD began tracking this data in Europe.

|

For transactions involving private equity sponsors, total pro forma debt to EBITDA has risen to 5.8x year-to-date — the highest this measure has been since 2007, when it topped out at 6.1x. And, just as with the all-transactions measure, first-lien leverage on sponsored deals has also reached its highest level since LCD has been tracking this data, at 5.2x.

The average leverage figure has been impacted by the number of entities completing add-on credits, however, as opposed to loans backing new leveraged buyouts. Market participants say there haven't yet been enough new LBOs structured since the pandemic to see where genuine leverage levels lie in the current market.

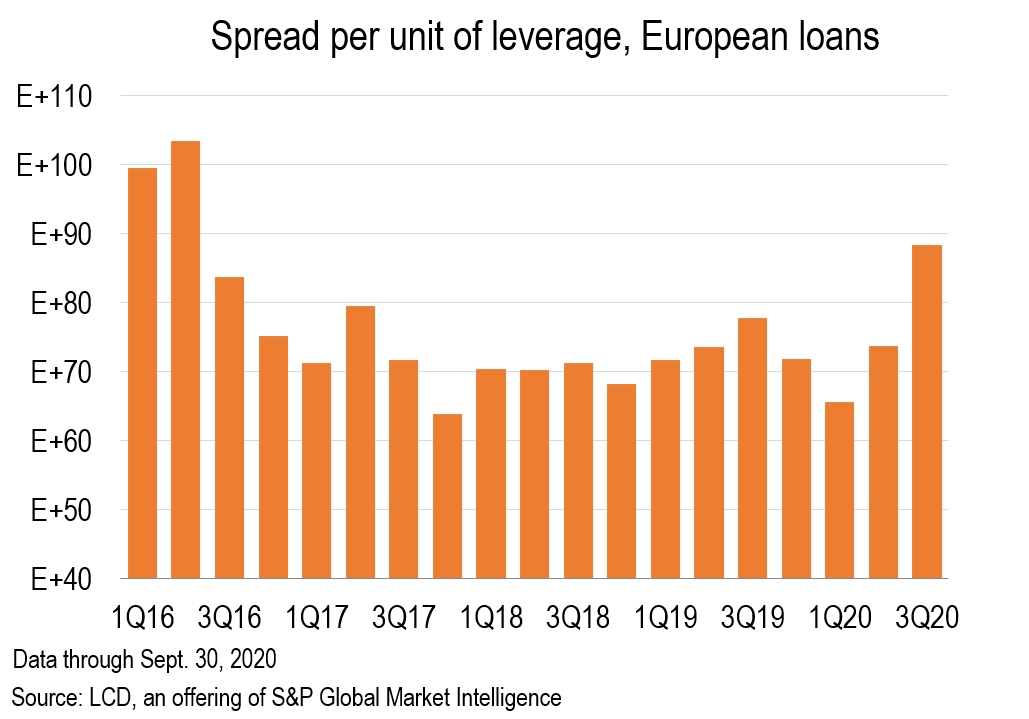

But on deals where leverage is high, loan investors are being compensated. The spread per unit of leverage rose to 88 bps at the end of the third quarter — up from 74 bps at the end of the second quarter, and from 66 bps at the end of the first quarter. This is the highest this measure has been since the second quarter of 2016.

|

To calculate spread per unit of leverage, LCD divides the discounted spread of a loan, according to the S&P/LSTA Leveraged Loan Index, by the pro forma debt/EBITDA ratio at closing of each loan.

|

Spreads widen

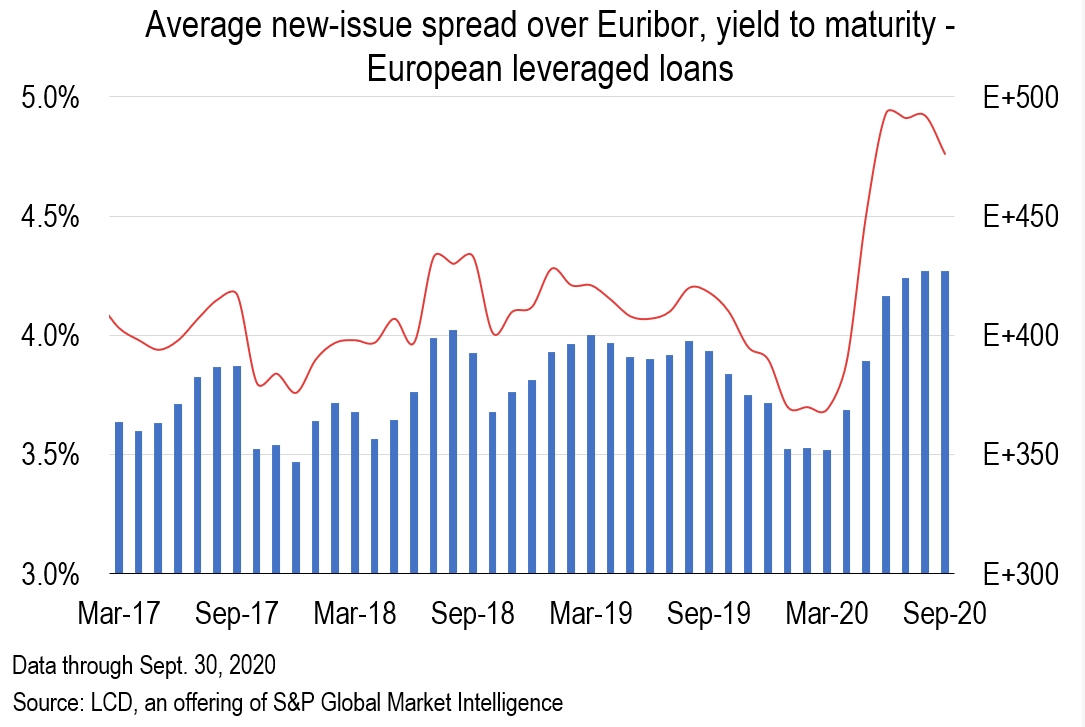

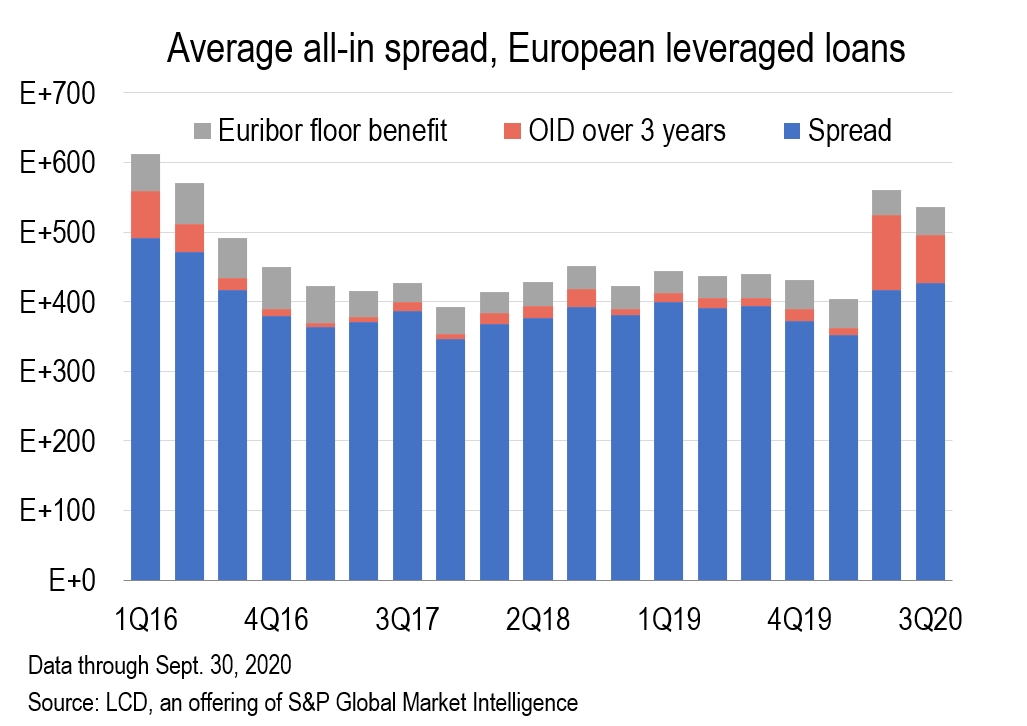

This increase in SPL has come about because, though yields have declined, spreads over Libor on European loans have widened. For all new loans on offer in the European market at the end of the third quarter, average spreads have increased to 426.9 bps, from 416.7 bps at the end of the second quarter, according to LCD. These numbers entail institutional loans, the kind bought by collateralized loan obligation vehicles.

|

Meanwhile, average yields to maturity, or YTM, fell to 4.76% in the third quarter, from 4.93% at the end of the second quarter, due to shrinking original issue discounts, or OIDs, on loans offered to investors. OIDs had ballooned after the market sell-off, to end the second quarter at 107.2 bps on average (fees here are amortized over a three-year period), the highest they had been since the fourth quarter of 2011. The measure had declined to 68.8 bps by the end of the third quarter but was only 10.7 bps at the end of the first quarter.

|

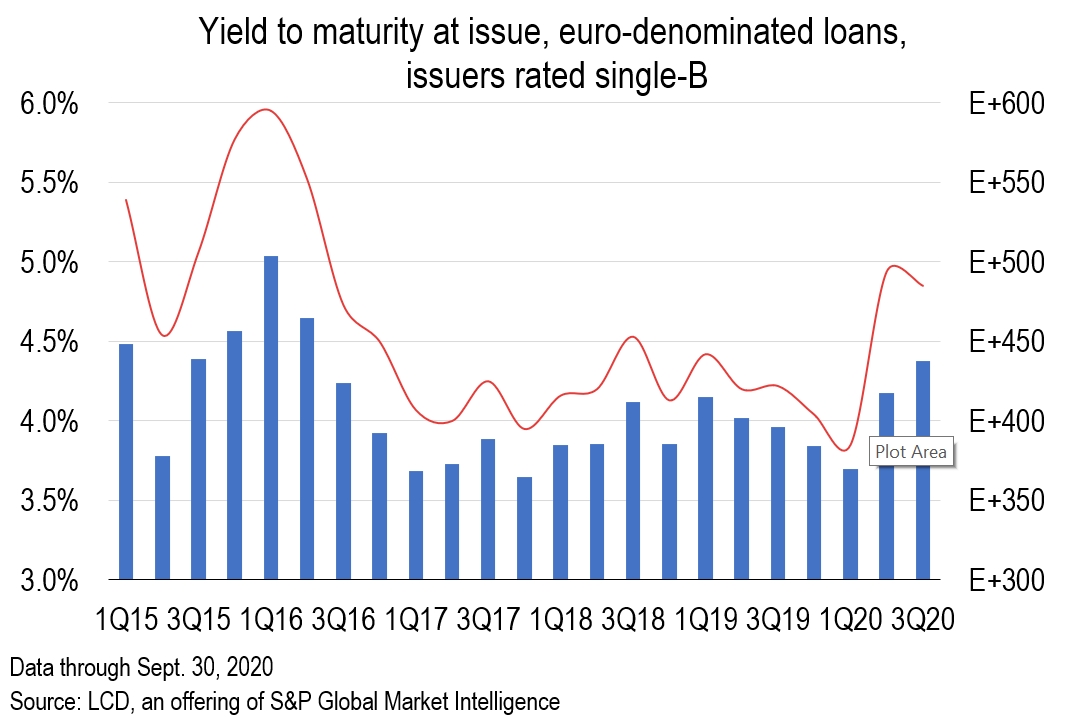

Spreads on euro-denominated loans to issuers rated single-B also increased over the third quarter, rising to an average of 437.5 bps, from 417.3 bps at the end of the second quarter. YTMs fell to 4.85% at the end of the third quarter, from 4.94% at the end of the second quarter, also due to shrinking OIDs.

|

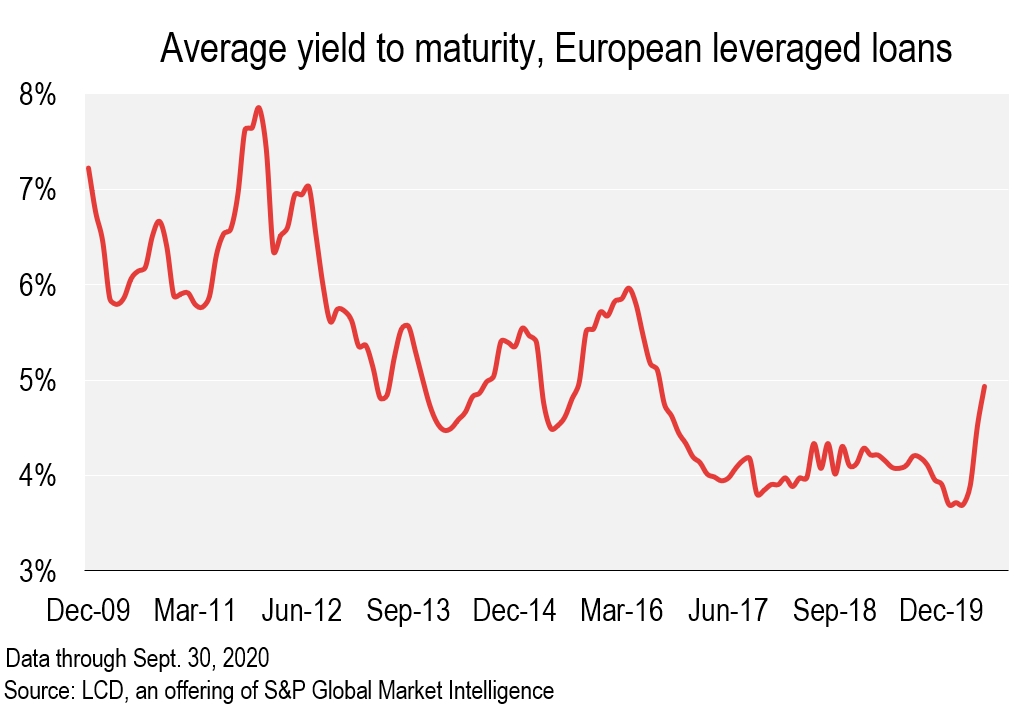

Yields have been declining in the European leveraged loan market consistently since the Great Financial Crisis, and from when LCD first began calculating YTMs in 2009. It was after the financial crisis that the European loan market first saw OIDs regularly in primary pricing, as prior to that period loan transactions generally priced at par. In December 2009 the rolling three-month average YTM for all institutional loans was 7.22%. This climbed to 7.85% in December 2011, but since that time has been declining, hitting an average of 3.69% in January 2020 (again, on a rolling three-month basis). However, Euribor was much higher during that time period, contributing to higher yields for investors, as spreads on these credits are based off the Euro interbank offered rate.

|

Early-year repricing splurge

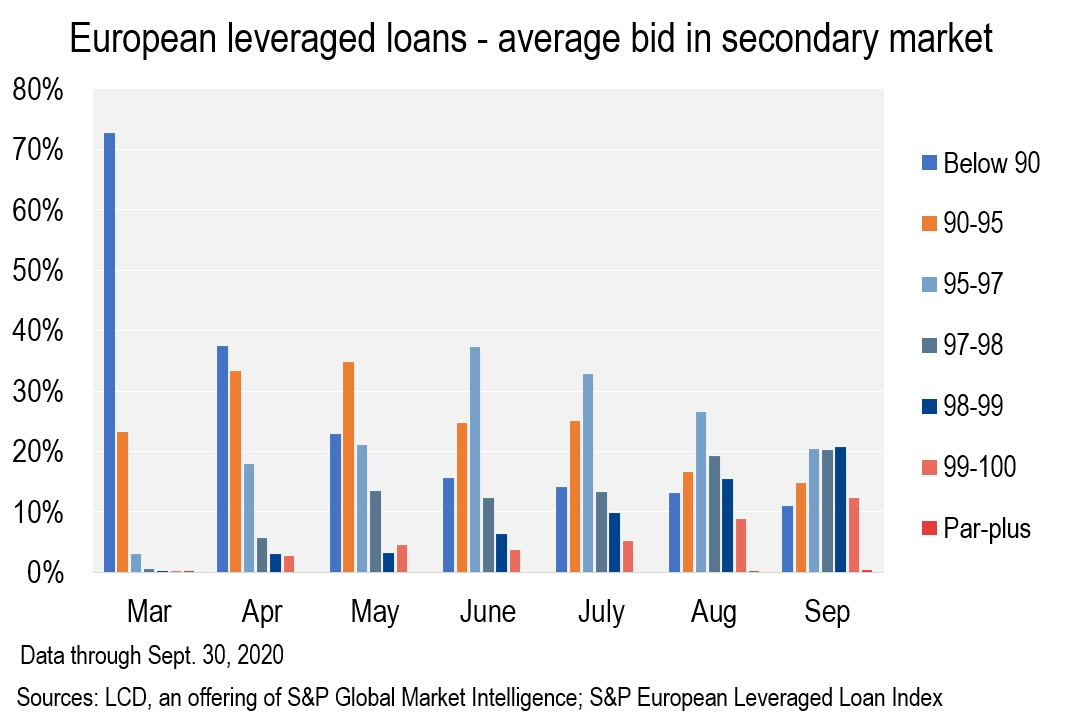

It is almost difficult to remember now but the first quarter of 2020 contained European leveraged loan repricings totaling nearly €16 billion, as debt issuers rushed to take advantage of low cost of funds in the loan market. This activity cut overall borrowing costs by an average of 61 bps. Then, during the market shock in March, secondary loan prices fell off a cliff, with the S&P European Leveraged Loan Index, or ELLI, reaching its pandemic low of 78.92 on March 24. Since then secondary loan prices have recovered, with the ELLI reaching a weighted average bid of 94.79 on Sept. 30, only some 4 points away from its 2020 peak of 98.66 in January, and up nearly 16 points from its March low. Meanwhile, the share of loans priced at par or higher increased again in September, to 0.42%, from 0.24% in August, which was the first time this measure has been above zero at month-end since March's reading.

|

“It will be a while before we get back to equilibrium,” said one CLO investor, taking stock of the market's recent trajectory. “We swung too far one way, and then swung too far back. There has been a lack of supply and residual demand from [CLO] warehouses — a particularly significant technical, which has meant things are unbalanced.”

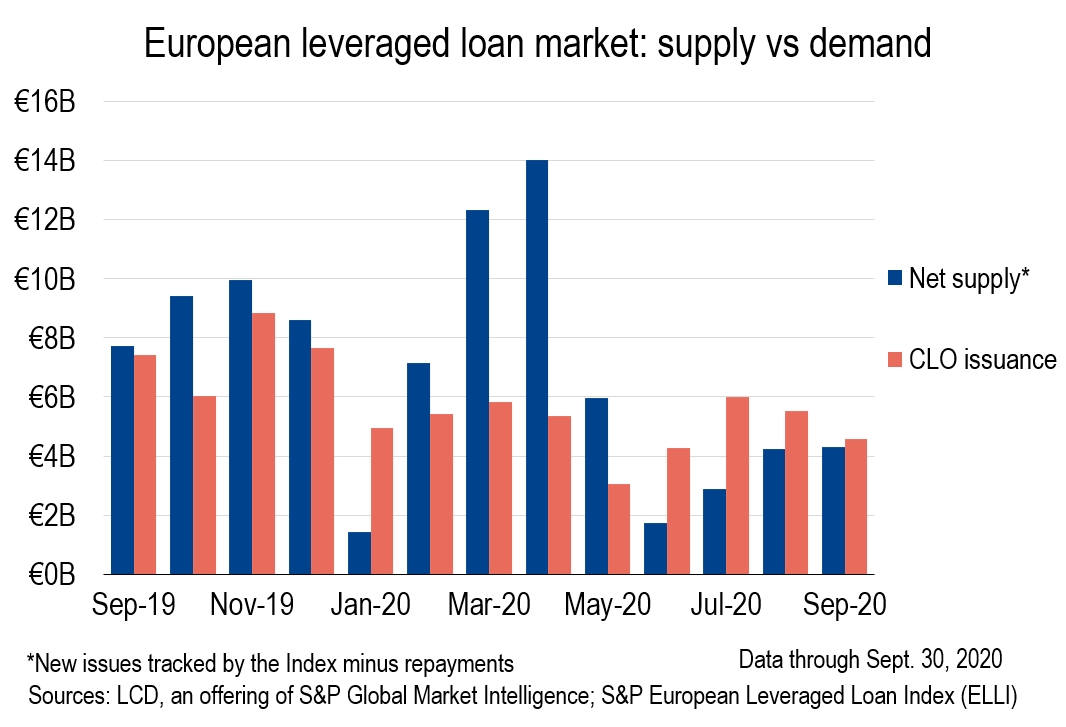

When the COVID-19 crisis hit the leveraged finance markets European institutional loan volume fell from €22.9 billion in the first quarter, to just €10.1 billion in the second quarter, while the third-quarter tally has come in at only €9.8 billion. CLO issuance improved slightly, to €4.59 billion in the third quarter, from €4.28 billion in the second quarter. This activity leaves the rolling three-month supply shortage (loan new issues, as tracked by the ELLI, minus repayments, minus CLO issuance) at roughly €0.3 billion.

|

In addition to CLO demand, investors have said they are still seeing cash inflows, mainly from existing investors, into their non-CLO funds — including managed accounts and other vehicles. Demand for the loan asset class is keeping the leverage available to borrowers high, and sources say documentation is still borrower-friendly.

One investor said during a recent industry panel: “I've been impressed by disclosure around COVID-19, which is over and above the information covenant. But we still have a way to go on documentation. The hope for me is that new deals being underwritten now will have better documentation.”

“The only restraint we are seeing is on some documentation where the EBITDA add-backs are capped,” said a rating agency analyst. “Even on new buyout transactions we are seeing the same levels of leverage as we were before the pandemic.”

A tale of two crises

The European leveraged finance market has functioned well in the wake of the coronavirus pandemic, with deal flow continuing and pricing adjusting — particularly when contrasted with 2008/09. “The GFC was a banking crisis, but now the banks are in better shape, and not rationing credit. The financial system is in better shape,” explained one investor.

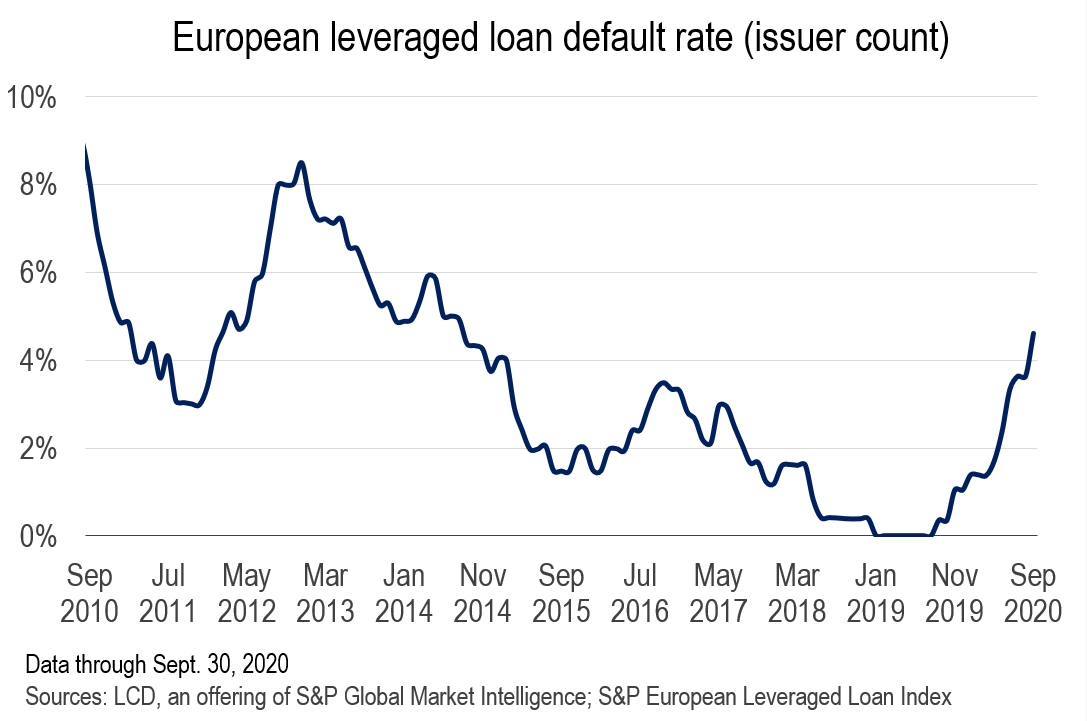

But there is uncertainty ahead, and fears of a recession, while the long-term impact of the pandemic on businesses in Europe is still not entirely clear. Meanwhile, the trailing 12-month default rate in the ELLI has hit its highest point since August 2014, at 4.61%.

“Traditional cyclical companies are performing well, but the biggest risk is a broader economic downturn and fiscal stimulus ending,” one market participant said.

|