Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Dec, 2024

By Allison Good

Datacenter customers' demand for electricity will not provide enough upside for US utility companies to outperform on Wall Street in 2025, analysts at Scotiabank said.

While unprecedented load growth across the country drives "strong fundamentals" for the sector, "sentiment toward defensive sectors has been apathetic as investors are in risk-on mode" following former President Donald Trump's reelection, they wrote in a Dec. 12 note to clients.

Despite increased uncertainty over the impacts of potential tariffs, investors are focusing on expectations of deregulation, tax cuts and a more business-friendly attitude at the federal level when Trump and incoming Republican majorities in both the US Senate and House take power in the coming year, Scotiabank analysts wrote.

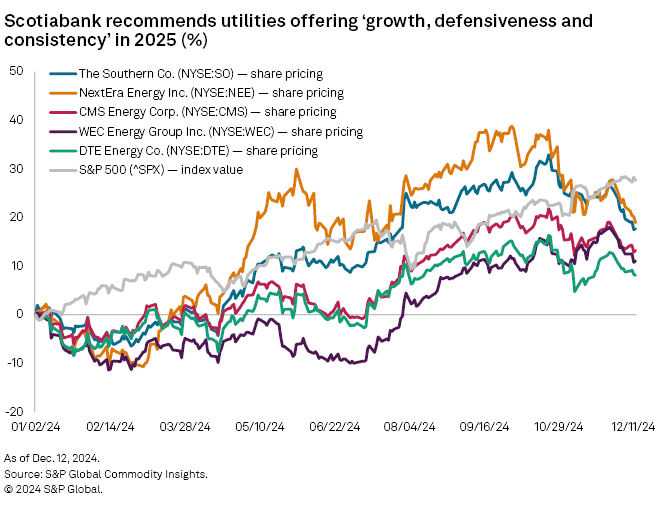

Since the election, the S&P 500 Utilities index has underperformed the S&P 500, declining just over 1% as of the Dec. 11 close compared to the S&P 500's 5% gain. Year to date up until the election, the utilities index had risen 24%, more than the S&P 500's 21% increase.

"The past few weeks suggest that the next few quarters might not be kind to utility stocks," Scotiabank said, recommending that investors focus on companies offering "better growth, defensiveness and consistency." Its suggestions included CMS Energy Corp., DTE Energy Co., NextEra Energy Inc., Southern Co. and WEC Energy Group Inc.

WEC Energy is investing $335 million to support a planned Microsoft Corp. datacenter in Racine County, Wisconsin, through its We Energies unit, which includes subsidiaries Wisconsin Electric Power Co. and Wisconsin Gas LLC. Most of the spending is allocated toward substations and other grid infrastructure.

Meanwhile, CenterPoint Energy Inc., Consolidated Edison Inc. and FirstEnergy Corp. are undervalued due to greater regulatory risk but have also indicated better growth projections, the report added.

FirstEnergy and CenterPoint must avoid "a punitive outcome" in upcoming rate cases to create value for shareholders, according to Scotiabank.

Following the election, Jefferies analysts wrote Nov. 6 that they expected FirstEnergy, Southern, Duke Energy Corp., Evergy Inc. and OGE Energy Corp. to benefit from the results.

Still, the generalist investors that have flooded the broader power sector over the last year to capitalize on energy's role in serving hyperscalers may exit the industry, given lackluster earnings projections for 2025 compared to what utilities will likely see starting in 2027, according to Scotiabank analysts.

"We're skeptical that datacenter growth will translate to meaningful upside to EPS for most utilities," they said. "The notion of de-risking the long-term outlook is certainly appealing to dedicated utility investors (stronger for longer), but generalists and tech investors will likely lose patience soon, if they haven't already."

Entergy Corp. could be an exception, Scotiabank noted.

Subsidiary Entergy Louisiana LLC filed an application in November for two new gas-fired power plants at a northern Louisiana site planned for a $10 billion Meta Platforms Inc. datacenter.

What attracted Meta to Entergy was its "one-stop shop" as an integrated utility company, Entergy Chairman and CEO Drew Marsh said in a Dec. 4 interview.

"Everybody thinks that a rate-regulated environment is going to be inherently slow because of the approval process. But it turns out, if you can have the integrated conversation, that can help things move along incredibly fast. That is an advantage for us with these hyperscalers," Marsh said.

American Electric Power Co. Inc. is another of the "biggest winners" when it comes to demand, but "EPS estimate revisions have been negative over the past three months, not positive," according to Scotiabank.

In October, subsidiary Ohio Power Co. and parties including Microsoft, Meta, Google LLC and Amazon.com Inc. filed a landmark settlement agreement with state regulators that will implement a new tariff structure for datacenters with a "load ramp period" and minimum demand charge.