Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Mar, 2022

By Eric Oak

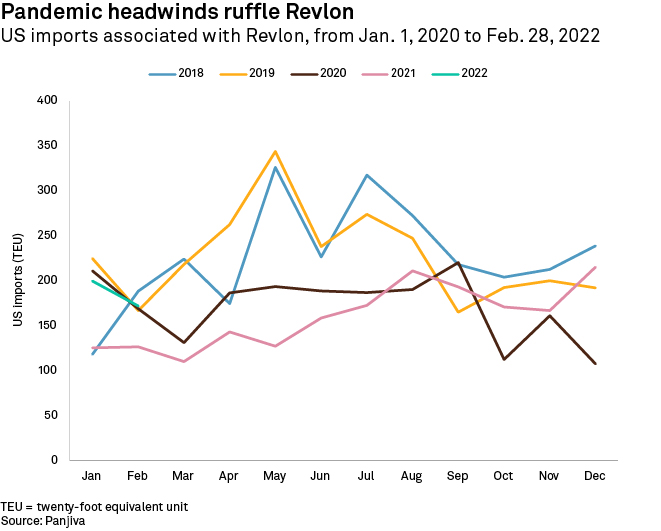

Revlon Inc., a maker of cosmetics and personal products, reported a 1.8% fall in fourth-quarter 2021 revenue that fell short of analyst expectations by 4.7%, according to S&P Capital IQ. Gross profit increased and inventories fell, however, indicating that the company may be operating more efficiently. Panjiva data shows that imports linked to the firm increased 44.9% year over year in the three months to Dec. 31, 2021.

On Revlon's March 3 earnings call, President and CEO Debra Perelman said the decline in sales was driven by issues such as "pricing pressure and shortages with key ingredients and components, logistics challenges across all modes of transportation and persistent labor shortages," which impacted the company's ability to manufacture and deliver products. CFO Victoria Dolan added that "over the last two weeks, the uncertainty and volatility in the world [have] definitely increased, impacting what was already a very volatile supply chain situation," likely referring to the Russian invasion of Ukraine. These events may have affected the company's imports, which were already lower on average in 2021 and 2020 than in previous years.

The company strove to combat the logistical challenges, however, with the CEO noting that from an external supply chain perspective, Revlon has "rerouted freight and sourced additional vendors for key materials and components." Panjiva data may shed some light on these changes. In the fourth quarter, imports from China and other Asian countries were up 68.0% and 52.5% year over year, respectively, following months of decline. Imports from China have sustained this momentum, increasing 41.0% in January and February combined, while imports from Europe rose 81.7% year over year. Looking ahead, Perelman said, "[W]e believe the current supply chain headwinds, while challenging, are temporary and that our brands have tremendous strength and opportunity for growth in the market."

Eric Oak is a researcher at Panjiva, the supply chain research unit of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.

The S&P Capital IQ Pro and S&P Capital IQ platforms are owned by S&P Global Market Intelligence.