Ongoing supply chain issues may hamper consumers' ability to spend during the upcoming holiday shopping season after better-than-expected retail sales in September, economists said.

Retail and food services sales increased 0.7% month over month in September after a revised 0.9% increase in August, according to U.S. Census Bureau data released Oct. 15. That beat economists' expectations of a 0.1% drop for the month, according to a consensus of forecasts compiled by Econoday.

Consumers largely spent more on merchandise than services, reversing habits from earlier in the summer, according to economists. Spillover back-to-school shopping also boosted sales during the month. Rising inflation and supply chain backlogs, however, may eat into those gains in the upcoming months.

"Demand for products is at an all-time high, it's the supply that is dwindling," Jason Stuckey, general manager of e-commerce service Linnworks, said in an interview.

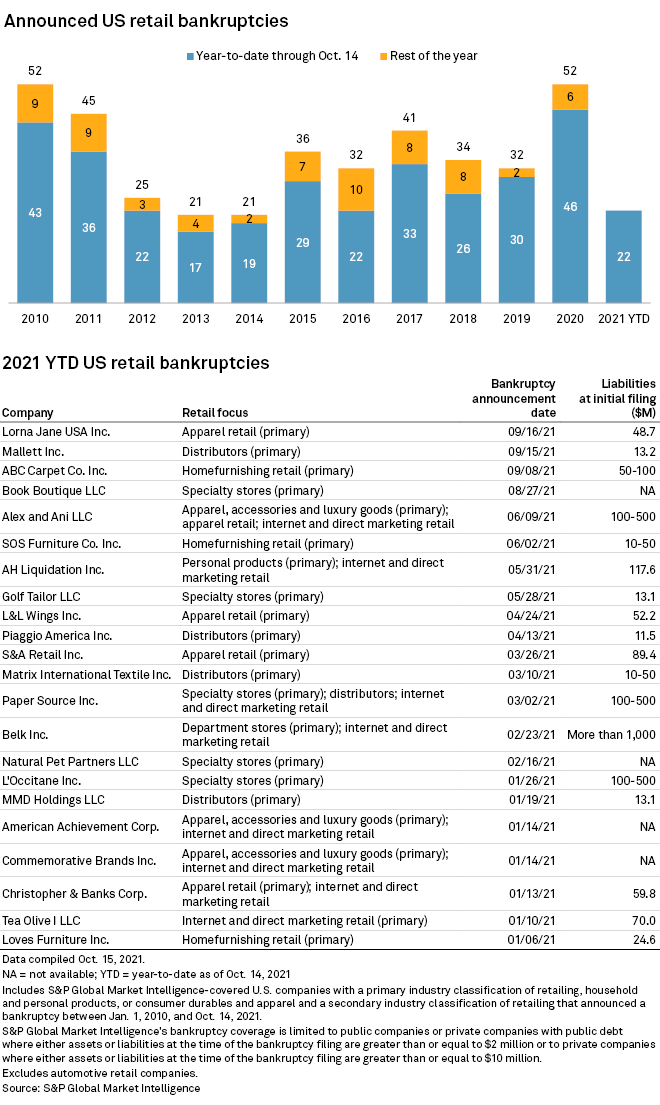

Meanwhile, no retail companies filed for bankruptcy in the period from late September through mid-October.

Retail sales

U.S. retail and food services sales increased to an advance estimate of $625.42 billion in September, up from a revised $620.85 billion in August, according to the Census Bureau. On a year-over-year basis, retail and food services sales rose 13.9% in September, with growth in all categories.

Sales in the retail trade, which excludes food services, rose 12.2% year over year and 0.8% from August. Clothing and clothing accessories sales were up 22.4% year over year, while gas station sales were up 38.2% year over year.

Sales at electronics and appliance stores fell 0.9% month over month in September, while sales at motor vehicles and parts dealers were up 0.5%. S&P Global Ratings on Oct. 14 lowered its expectations for U.S. light-vehicle sales to 15.8 million in 2021, from a previous forecast of 16.7 million sales. Still, that will represent an increase of 9% over 2020.

Ongoing backlogs in shipping consumer goods likely dampened sales as consumers faced shortages on some items, according to Jack Kleinhenz, chief economist at the National Retail Federation.

"Consumers remained active, but retail sales didn't reflect as much of a shift away from goods to services as expected," Kleinhenz said in an Oct. 15 statement.

Consumers are aware of dwindling supply, which means they are looking for immediate ways to get the products they want, according to Linnworks' Stuckey.

"Back to school combined with deeper awareness of the oncoming storm of product scarcity have contributed to the uptick that we are seeing in retail sales," Stuckey said.

To help clear a backlog of cargo ships waiting to unload, the White House on Oct. 13 announced plans to keep the Ports of Los Angeles and Long Beach open 24 hours a day.

Still, it will likely take two to three years to fully recover from the logjam in the supply chain, according to Stuckey.

The backup in supplies is likely to get worse as the holiday season approaches, said Joel Naroff, president and chief economist of Naroff Economics.

"With labor shortages abounding, it is hard to see how the ports will be cleared anytime soon," Naroff said in an Oct. 13 research note.

Consumer prices

Consumer prices rose 0.4% in September compared to the previous month, according to data from the U.S. Bureau of Labor Statistics. Prices jumped 5.4% over the same month a year ago before seasonal adjustment.

Prices for new vehicles rose 1.3% month over month in September and 8.7% on an annual basis. Used car prices fell 0.7% compared to August but were up 24.4% over September 2020.

Employment

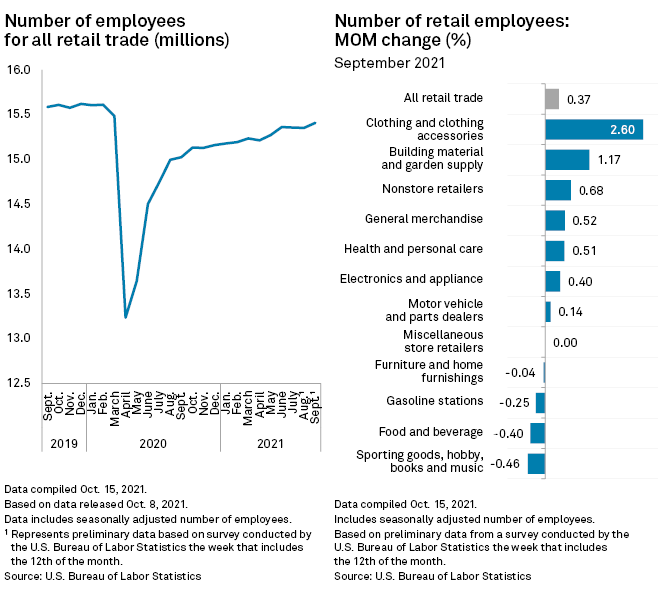

Employment in the retail sector was at 15.4 million jobs in September, an increase of 0.37%, or 56,100 jobs, from August, according to the Labor Department.

Jobs at clothing stores were up 2.6% in September from August, while building material and garden supply store jobs were up 1.17%. Employment at motor vehicle and parts dealers increased 0.14%. Food and beverage store jobs were down 0.4%.

Probability of default

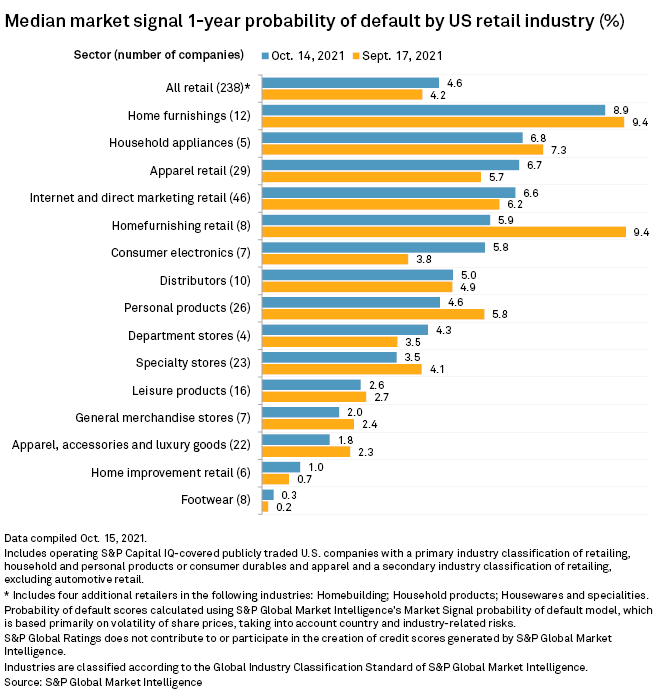

Home furnishings, a category that includes producers of furniture and flooring products, was the retail sector with the highest median market signal one-year probability of default at 8.9% as of Oct. 14, according to Market Intelligence data. The scores, which represent the odds of default within a year, are based primarily on the volatility of share prices for public companies in the sector and taking into account country and industry-related risks.

Default odds for the home furnishings category dropped from 9.4% in mid-September. The median probability of default score for all retailers as of Oct. 14 was 4.6%, up from 4.2% as of Sept. 17.

Bankruptcies

Retail bankruptcy filings returned to a standstill after a short burst of new filings in late August and the first half of September. As of Oct. 14, 22 retailers have entered bankruptcy proceedings in 2021, less than half the total for the same time period in 2020.

Corporate bankruptcies may pick up in 2022 after a period of slowness for the rest of this year, experts have said.