Retail sales growth in February missed expectations as the price of goods increased and consumers spent more on services.

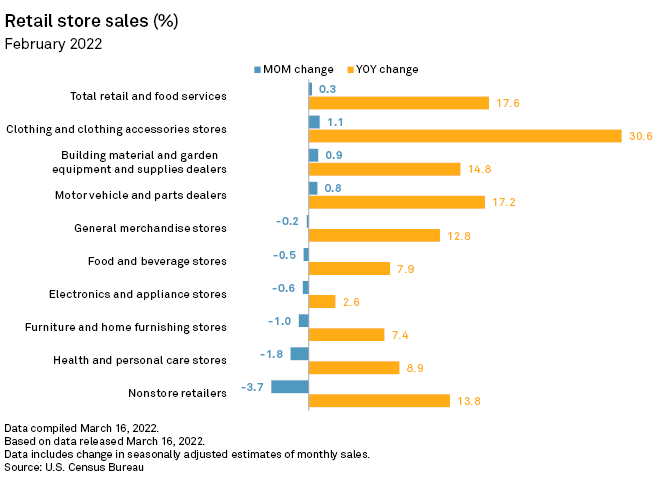

Retail and food services sales increased 0.3% month over month in February, according to U.S. Census Bureau data released March 16. Economists expected 0.4% growth, according to consensus estimates compiled by Econoday. The latest growth followed an increase in January's sales after a decline in December 2021.

Soaring inflation and rising gas prices are impacting consumer spending, according to experts. The national average price of gas per gallon as of March 16 was $4.31, according to AAA.

"Households pared back their online shopping and spent more at restaurants and bars amid a better health situation, while gas stations' sales surged reflecting higher prices at the pump," Lydia Boussour, lead U.S. economist at Oxford Economics, said in a March 16 note.

Retail sales

U.S. retail and food services sales increased to an advance estimate of $658.13 billion in February from a revised $656.12 billion in January, according to seasonally adjusted Census Bureau data. Year over year, retail and food services sales rose 17.6% in February, with growth in all categories.

"Spending for discretionary items like furniture, electronics and non-store spending all saw sales fall in February compared to January, despite Presidents' Day taking place, which usually boosts sales," said Dave Cesaro, a retail and consumer behavior expert at marketing solutions company Vericast.

Consumers saved during the coronavirus pandemic but are earmarking that money for paying down debt, a rainy-day fund or other non-discretionary spending, Cesaro said.

The National Retail Federation expects retail sales minus auto dealers, gas stations and restaurants to grow up to 8% in 2022, according to organization Chief Economist Jack Kleinhenz. This is above pre-pandemic rates of 3.7%.

"Our outlook for retail sales reflects a lot of moving parts the economy is balancing: growth, inflation, geopolitical uncertainty and policy variability," Kleinhenz said during the organization's March 15 State of Retail and the Consumer event.

Vulnerability

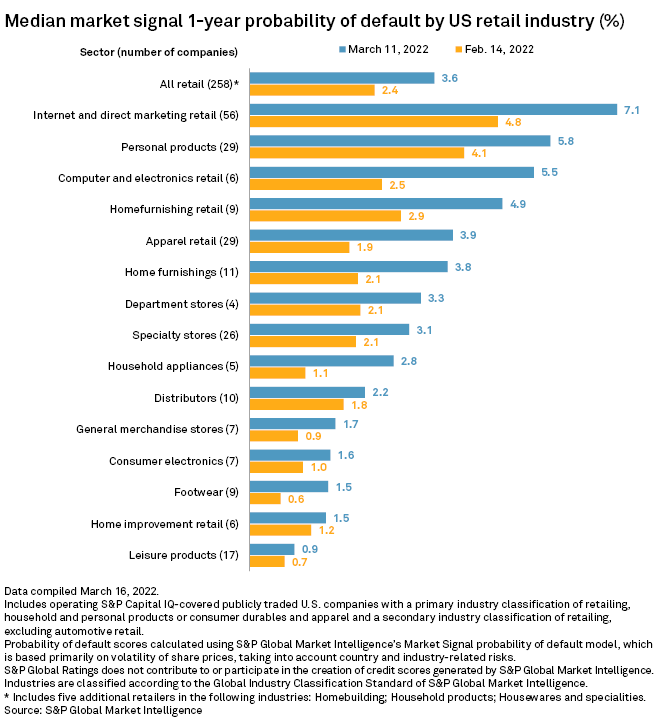

Internet and direct marketing was the retail sector with the highest median market signal one-year probability of default at 7.1%

Vulnerability scores across all retail sectors are up since Feb. 14, with computer and electronics retailers logging the highest increase.

The median probability of default score for all publicly traded retailers as of March 11 was 3.6%.

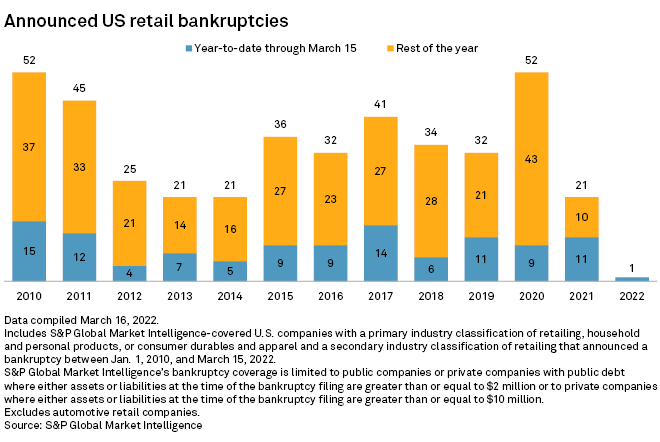

Bankruptcies

Ecommerce retailer Vey's Bandit LLC's Chapter 7 filing on Feb. 7 marked the sole retail bankruptcy filing tracked by Market Intelligence year-to-date, and the only filing since mid-September 2021.