| One of Repsol's refineries in Spain, where the company wants to produce more chemicals and increase blending of biofuels. |

The oil and gas sector is facing more pressure than ever to act on climate change. In the third of a three-part series, S&P Global Market Intelligence interviews Repsol CEO Josu Jon Imaz on the company's industry-leading commitment to become a net-zero carbon emitter by 2050.

Part one looks at how, despite publicly acknowledging the scale of the challenge, most integrated oil majors continue to pursue their traditional business at all cost. Part two analyzes the integrated oil majors' quarterly investor calls, showing how rhetoric has shifted since the Paris Agreement on climate change was adopted in 2015.

Repsol SA has become the poster child for climate action in the oil and gas industry after announcing a slew of new short- and long-term targets to cut its greenhouse gas emissions, meant to make the company carbon neutral by 2050 in line with the goals of the Paris Agreement on climate change.

Under its new plan, Repsol wants to reduce its carbon intensity in several stages, starting with a 10% cut by 2025, against a 2016 baseline, and further reductions by 2030 and 2040. Even though it only targets relative carbon intensity, rather than absolute emissions, the goal is by far the most ambitious among integrated oil and gas companies.

But the group's CEO says its strategy may be a tough one to copy, since Repsol's size and concentrated footprint will make it much easier to slash emissions compared with its larger peers in the sector.

"We are a company [that is] smaller than some others and we could be more flexible taking these kind of decisions," Josu Jon Imaz, who has led the Spanish oil major since 2014, said in an interview. Nevertheless, the rising awareness of risks tied to climate change, not least among large investors, is likely to spur faster action, he said.

While Repsol's strategy won't be appropriate for the whole sector, "I'm convinced that what we are doing now is going to be followed in coming years by some other companies," Imaz said.

|

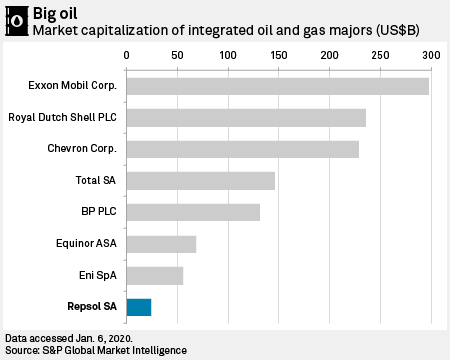

Repsol earned €2.34 billion in net income on €43.58 billion of revenue in 2018. Compared to the so-called supermajors, the company is small, however: Peers like Royal Dutch Shell PLC or Exxon Mobil Corp. have about 10 times the market capitalization of Repsol.

Although this means Repsol has relatively low overall emissions, its carbon intensity, measured in tonnes of CO2 by revenue, is higher than that of competitors like Shell and Total SA, according to Trucost, an offering of S&P Global Market Intelligence. That is even though Repsol already has a high share of gas in its energy mix, which emits less CO2 than oil when burned.

The company says that between 2016 and 2018, it reduced emissions from its own activity from 24.7 million tonnes to around 22 million tonnes, partly by cracking down on emissions at refineries. However, emissions from the use of Repsol's products, known as scope 3 emissions — which typically make up by far the largest share for oil companies — were unchanged, at 148 million tonnes.

Apart from Repsol, only Shell and Total have so far even set scope 3 reduction targets, and the rest of the industry is moving even more slowly on long-term decarbonization, even if targets are often hard to compare.

Although industry observers agree that its strategy is not directly transferable, Repsol's approach is now expected to further raise the pressure.

"More companies will follow," said Pavel Molchanov, an analyst Raymond James. "It's just a matter of the details and a matter of time."

Natasha Landell-Mills, partner and head of stewardship at U.K.-based asset manager Sarasin & Partners LLP, said it makes sense for smaller companies to move first. But, she added, "it doesn't take away the importance of everyone else following. We're not going to get to [the Paris Agreement's climate targets] without the majors moving."

|

Three-pronged approach

For Repsol, achieving the targets will mean a fundamental refocusing of its business, from upstream exploration through refining to retail sales. Imaz said this would set up the company for a future where climate change — and the policies driven by it — are sure to end in stranded assets for anyone not moving fast enough.

"We want to protect our portfolio to be resilient in a world that is going to be different and that is going to be less intensive in fuel emissions," he said.

Repsol anticipates a quarter of total capital expenditure in the 2020-2025 period will be dedicated to low-carbon activities. This will be mainly for new wind and solar power, as well as an expansion into retail electricity and gas, although it also includes green hydrogen investments or carbon capture in petrochemicals, for example.

The target also has implications for the company's traditional upstream business, which will pivot towards short-cycle production. Oil will be a key part of the energy mix until 2035 or 2040, Imaz said, but some exploration projects don't see first oil for a decade, which would lock Repsol into production until the 2050s.

At the same time, Repsol wants to retool its refineries to produce more chemicals and also blend more biofuels into its products. Last but not least, the company wants to increasingly build and operate renewable power plants to sell more and more green electricity alongside its traditional retail slate.

Double-digit returns

While Imaz said the more ambitious targets were partly driven by a change he is perceiving among Repsol's shareholders — the company says 15% of its shares are held by environmental, social and governance investors — he also acknowledged that there were legitimate concerns about the new strategy.

Repsol's share price dropped by less than 1% the day the new targets were unveiled, despite the fact that the company's new use of a Paris-compliant oil price scenario means it will write down €4.8 billion in the value of its current assets.

|

Imaz said that while he felt investors were generally appreciative of Repsol's ambition, many have lingering doubts about the company's ability to realize them. They also worry about the returns that can be achieved in some of the new sectors the company has set its sights on, especially when factoring in an oil company's high cost of capital.

"The concern is based on real fact," Imaz said. "I don't see Repsol being efficient in investing in the renewable sector everywhere without other kind of linkages that could increase the return of these projects."

That means pursuing projects as early as possible in the development cycle and later flipping minority stakes to financial investors — a strategy also employed by fellow oil majors such as Shell and Norway's Equinor ASA. This approach could end up yielding returns in "the double digits," Imaz said.

Repsol wants to install 7,500 MW of renewables and other low-carbon power by 2025, an increase from a previous target of 4,500 MW. It already has 2,952 MW in operation.

"We can't be an inorganic asset buyer in the renewable energy sector," Imaz said. "We have to take ... the risk of promotion, merchant development, operation, maintenance and so on."

No greenwashing

Imaz also pushed back against general criticism from many environmental activists that far-off carbon intensity targets are little more than public relations exercises in light of the urgent need to cut total emissions.

Repsol says it thinks it can achieve at least 70% of its net-zero goal with existing technology, including carbon capture, use and storage. If new opportunities to close the gap do not materialize, the company would offset the rest of its emissions through reforestation and other so-called climate sinks.

A spokesman for the company said Repsol's absolute emissions are also expected to start falling immediately along with the carbon intensity of its operations, although at a slower pace.

Imaz, who previously managed Repsol's new energies department and later the group's refining business, will have 40% of his variable pay linked to the targets, as will the rest of the management team. This, along with annual disclosures on all of the company's investments aligned to the Paris climate goals, will go a long way to guaranteeing that Repsol's targets are met, he argued.

"I'm not going to be in my office in 2050 ... 2050 is far away," he said. "But what is more important — and it's not greenwashing — is what we are doing now, day after day," he said.

CEO Josu Jon Imaz speaking at Repsol's sustainability day in 2019.

CEO Josu Jon Imaz speaking at Repsol's sustainability day in 2019.