Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Mar, 2022

|

A wind turbine behind a compressor station at the Jagal gas pipeline, the German section of the Yamal-Europe pipeline that transports Russian natural gas to Europe. |

The EU could end its reliance on imported Russian natural gas by 2025 — two years sooner than the European Commission is targeting — if it accelerates the deployment of renewables and energy efficiency measures, according to a new study that rejects the need for new gas import infrastructure in Europe.

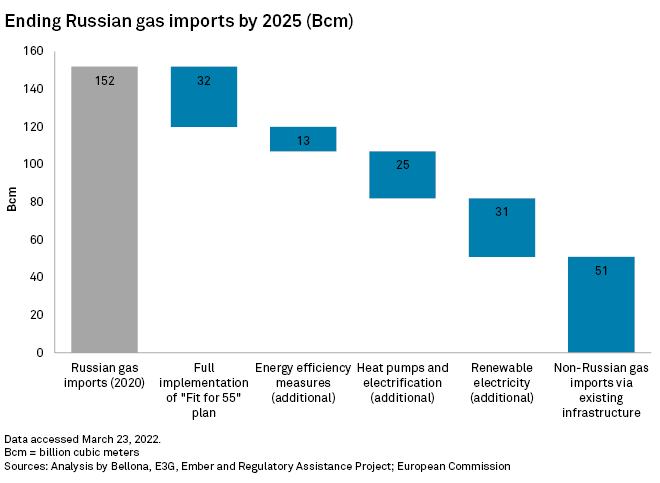

The bloc can replace two-thirds of the 152 billion cubic meters of Russian gas it imported in 2020 by ramping up delivery of its "Fit for 55" energy and climate package —under which it aims to reduce greenhouse gas emissions by 55% by 2030 — according to a March 23 report by think tanks Ember and E3G and nongovernmental organizations Bellona and the Regulatory Assistance Project. The remainder could come from alternatively sourced gas imports channeled via existing pipelines.

The EC laid out a plan March 8 to slash the EU's Russian gas reliance by two-thirds by 2022-end as a consequence of the country's invasion of Ukraine. EC President Ursula von der Leyen aims for the bloc to be energy independent from Russia by 2027.

It will do so chiefly through higher LNG purchases and finding new sources of imports as well as increasing the production of biomethane and renewable hydrogen, though some analysts think the EC's assumptions are unrealistic given infrastructure bottlenecks in Europe and international competition for LNG.

The researchers behind the alternative plan acknowledged that an "urgent uplift" in policy is needed to sufficiently ramp up renewables and energy efficiency, but they insisted this is achievable.

"Homegrown renewables offer an escape route out of Europe's Russian fossil gas addiction," Sarah Brown, senior energy and climate analyst at Ember, said in a statement. "There must be immediate action and huge EU-wide commitment to achieve both the current Fit for 55 renewable targets and the required acceleration of wind and solar deployment."

Plan eschews new import infrastructure

Through the EU's Fit for 55 package, net imports of fossil gas are predicted to decrease by 32 Bcm by 2025 from 2020 levels. Under the alternative plan, imports would fall by an additional 69 Bcm.

The researchers said the bloc can find 51 Bcm of non-Russian gas imports via existing channels, negating the need for new import infrastructure such as LNG terminals. That is less than the EC's plan, which assumes raising LNG imports to 50 Bcm and diversifying pipeline sources for an additional 10 Bcm.

Wind and solar capacity targets could increase by 158 GW to 691 GW by 2025, the researchers said, equating to 31 Bcm of reduced gas demand. The EC's plan envisages an additional 80 GW of renewables by 2030. Both scenarios require more streamlined permitting procedures for new capacity, which the EC is expected to provide guidance on in May.

Energy efficiency measures and heat pumps can deliver an additional 13 Bcm and 19 Bcm, respectively, of gas savings by 2025, the researchers said. The alternative plan does not include hydrogen or biomass, since "both come with significant risks, and hydrogen cannot deliver impact in the short term."

If the EU pursued the alternative plan, it would reduce fossil gas demand without slowing the decline of coal-fired power generation, the researchers added.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.