S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 May, 2023

By Alex Graf, Syed Muhammad Ghaznavi, and Zuhaib Gull

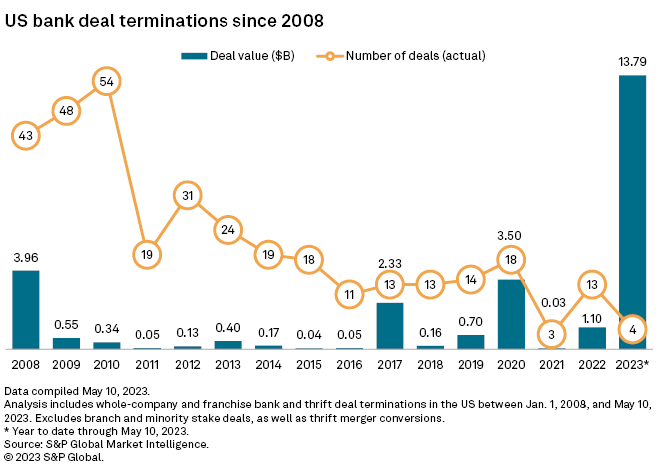

Industry uncertainty, regulatory pressures and depressed stock prices have scuttled some US bank deals recently.

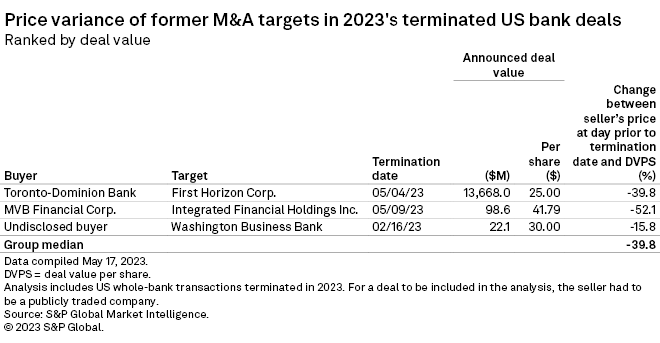

Unknown regulatory issues led to the largest US bank deal termination ever, between The Toronto-Dominion Bank and First Horizon Corp., in early May after TD was unable to assure First Horizon that it could secure regulatory approval through 2024. Also citing regulatory delays, MVB Financial Corp. terminated its acquisition of Integrated Financial Holdings Inc. The companies pointed to stock price pressure as another reason.

The current environment is tumultuous for US banks as they work through uncertainty over a potential recession and what the operating environment will look like after recent bank failures. The industry's stock prices have additionally come under pressure, and regulators' scrutiny of mergers is only expected to intensify. This culmination of factors led to the recent breakups — but most other pending deals will likely power through the circumstances.

"A lot of these companies want to get married," Christopher Marinac, director of research at Janney Montgomery Scott, said in an interview. "They find a way to make it work."

Stock price pressure

One obstacle pending deals will have to overcome is depressed stock prices. Following recent difficulties in the wake of three bank failures and industry liquidity concerns, bank stock prices have fallen, leading to a large difference between the announced per-share deal price and sellers' current prices.

Among the 10 largest pending US bank deals, all but one have large negative differences between the announced deal value per share and the seller's current stock price. The median difference for those 10 deals is negative 26.9%.

For some banks, the stock price changes were too much.

In the case of MVB Financial and Integrated Financial, the difference between the announced deal value per share and the seller's stock price on the day before termination was negative 52.1%. The companies cited "changing market conditions that have pressured bank industry stock prices" in the press release announcing the termination.

Industry experts believe pricing also played a role in the TD-First Horizon termination. The deal was announced at a $25.00-per-share price, but First Horizon's stock price stood at $15.05 the day before the termination was announced.

While the companies cited regulatory delays as the reason for the breakup, Marinac believes the deal's pricing was the most likely cause for the termination.

"It was going to be a painful, if not impossible, conversation to get First Horizon to do a deal at the haircut that they wanted," Marinac said.

TD and First Horizon reportedly went back to the negotiating table in March as the deal pended, making price renegotiation an increasingly likely prospect, equity analysts told S&P Global Market Intelligence at the time.

Other factors

The regulatory environment and ongoing uncertainty are other hurdles that could trip up currently pending bank deals before they cross the finish line.

Among the four terminations announced so far this year, three cited regulatory delays. In addition to TD-First Horizon and MVB Financial-Integrated Financial, Washington Business Bank terminated its agreement to sell to an investor after the regulatory approval process took longer than expected.

Since an executive order from President Biden in mid-2021 calling for regulators to take a harder look at M&A, many US bank deals have faced prolonged closing periods as they awaited regulatory sign-off. While some have chosen not to wait in regulatory purgatory, most others will wait however long it takes.

"There are going to be one-offs ... I'm just not sure that's going to be the norm. The norm is going to be these deals take longer to close, but they still close," Marinac said.

Growing uncertainty related to the recent bank failures, rising interest rates, deposit competition and liquidity issues could also weigh on pending deals.

However, most banks will push through all these obstacles and get their pending deals done.

"To give up is not in the DNA of most of these banks," Marinac said.