Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Sep, 2021

An aerial view of the Six Flags Great America amusement park in Gurnee, Ill.

An aerial view of the Six Flags Great America amusement park in Gurnee, Ill.

COVID-19 put regional U.S. theme park operators on a financial roller coaster, but improvements made during pandemic-mandated closures could lead to a more profitable industry as parks reopen.

During the downtime, companies identified efficiencies, updated rides and improved experiences — changes executives say will drive bigger returns. While the data for late summer, when the more transmissible delta variant took hold in the U.S., has yet to be disclosed, early indications support the theme park operators' upside argument. Investors appear ready to buy in, with shares in SeaWorld Entertainment Inc. and Six Flags Entertainment Corp. notching big gains year to date through the end of the summer park season.

Only SeaWorld has exceeded its pre-pandemic valuation so far, but analysts believe Six Flags and Cedar Fair LP are poised to follow. The strength of the park operators' recovery to date shows consumers' willingness to pay more for tickets and in-park amenities, which operators attribute to both pent-up demand and recent park improvements.

"If you can come out of this in a stronger position to where you were, which it seems all these operators are positioned to do, it makes sense valuations can exceed pre-pandemic levels," B. Riley Securities analyst Eric Wold said in an interview.

Some improvements focus on attraction upgrades, but operators implemented others for pandemic-era health and safety precautions. Many now offer touchless payment systems for in-park purchases, including tickets. Digital queues help keep customers from standing in long lines, and self-pay systems for food orders reduce contacts between customers and staff.

In addition to easing health and safety concerns related to crowded venues, the upgrades also created financial efficiencies for operators and in some cases allowed for upselling opportunities.

"Many operators that dealt with capacity restrictions discovered that the volume is not the only way to increase revenue," Mike Konzen, CEO of experience design firm PGAV Destinations, said in an interview. "Embracing the new methods ... and not have it appear as a temporary pandemic solution, but one that creates a greater sense of safety and convenience for the guest, should be welcomed and enhanced."

The outlook for theme parks at this stage of the pandemic is "cautiously optimistic," Konzen said, with much of the potential upside dependent on park operators' ability to continue to adapt to customer-preference trends.

Pricing power

Equity analysts are largely bullish on the changes, predicting some pricing increases will be lasting. While some of the operators' enhanced pricing power may soften in the intermediate future, Macquarie Research analyst Paul Golding told S&P Global Market Intelligence he is modeling for increased attendance and pricing power over the long term.

"We see the resilience of the business model and the backdrop of demand continuing to benefit the regional theme park operators, and it will allow them to capitalize the margin opportunity they've set up," Golding said. "We see continuing margin expansion over time, especially as some of these variable costs efficiencies get the opportunity to start shining through."

Market Intelligence data shows the majority of analysts covering SeaWorld and Six Flags rate them "outperform." Cedar Fair is mostly rated a "buy."

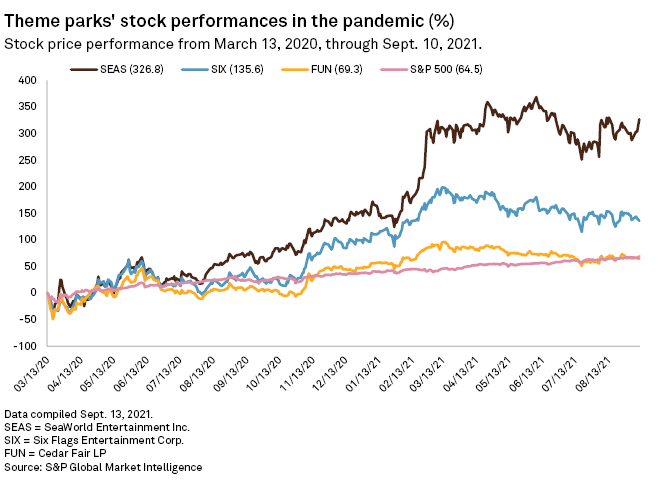

Through Sept. 10, the week following Labor Day, Cedar Fair's stock had risen 69.3% from March 13, 2020, when then-U.S. President Donald Trump declared a national emergency related to the pandemic. Meanwhile, Six Flags and SeaWorld gained 135.6% and 326.8%, respectively. In comparison, the S&P 500 overall rose 64.5%.

Back to the new normal

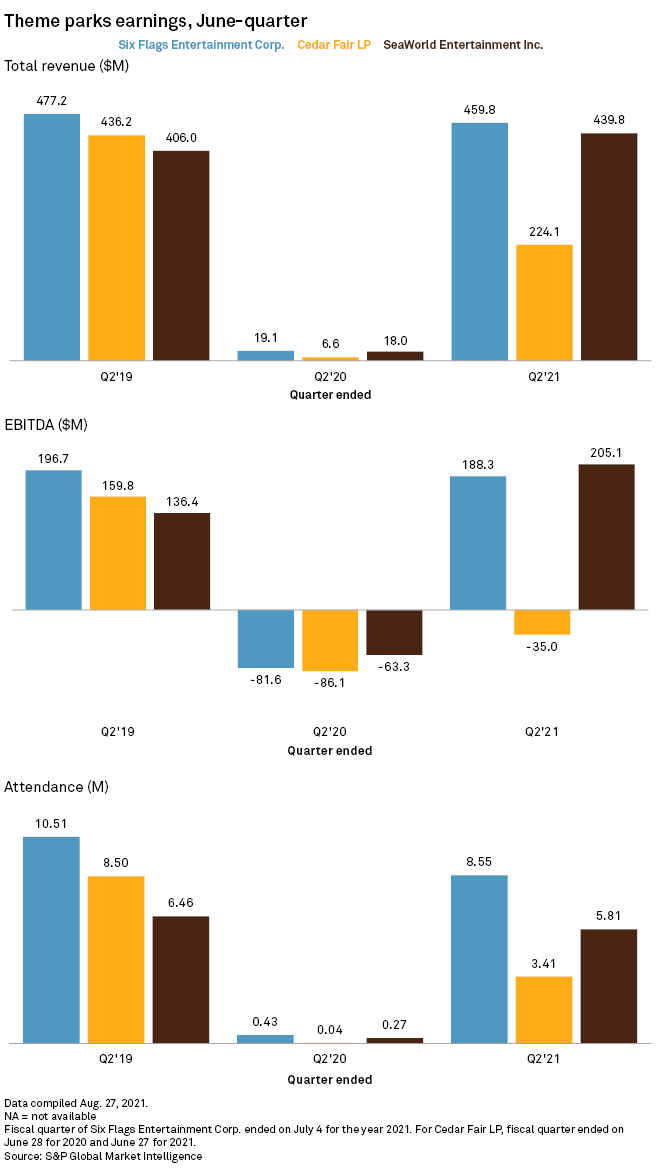

SeaWorld and Six Flags in their most recent reporting periods saw park attendance approach levels comparable to the same quarter of 2019, well before the pandemic. SeaWorld also beat its EBITDA and revenue performance from the comparable 2019 period, reporting EBITDA of $205.1 million for the June 2021 quarter, up from $136.4 million two years earlier. Revenue for the most recent quarter came to $439.8 million, up from $406.0 million in the June 2019 period.

While July attendance fell 7% for SeaWorld, revenue grew 13%, which CEO Marc Swanson attributed to new park efficiencies and pricing power gains.

"Management has provided a roadmap to margin expansion that is well above that of its peers ... and has already outperformed those expectations," said B. Riley Securities' Wold. "Note that [SeaWorld] had lagged the group for years ... but has clearly moved well beyond those issues."

Where Cedar Fair offers a diverse range of attractions, and Six Flags has some of the most highly trafficked roller coasters in the country, SeaWorld's differentiator has been educational, zoological and experience-based attractions.

"The big push for SeaWorld pre-COVID was always, 'Can they grow attendance and pricing simultaneously, and can they grow attendance without sacrificing price?'" said Macquarie Research's Golding. "Recent years have proven that, so that was a bit boost to investor confidence."

Cedar Fair's struggles

Cedar Fair is a "house of brands" compared to Six Flags and SeaWorld, Golding said, with various Cedar Fair parks operating under different names. That creates a kind of cult demand among its customers who might love Carrowinds in North Carolina or Kings Dominion in Virginia or Valleyfair in Minnesota. But it also makes synergizing across its portfolio more difficult as there is no singular Cedar Fair brand that consumers know. Cedar Fair's second-quarter earnings results showed the company's operations lagging in recovery compared to peers, though a recent financial update showed some improvement in late summer.

For the 10 weeks ended Sept. 5, Cedar Fair reported net revenue of $645 million, up $3 million from $642 million reported in the same period of 2019. While attendance was still down from 2019, year-over-year revenue growth was driven by a 25% increase in in-park per capita spending.

"The strength and resilience of our business model has quickly propelled operations back to near-historical levels over the last 10 weeks," CEO Richard Zimmerman said in a statement with the earnings update.

Cedar Fair, Six Flags and SeaWorld did not return requests for comment.