2022 is shaping up to be another record-breaking year for credit union acquisitions of banks.

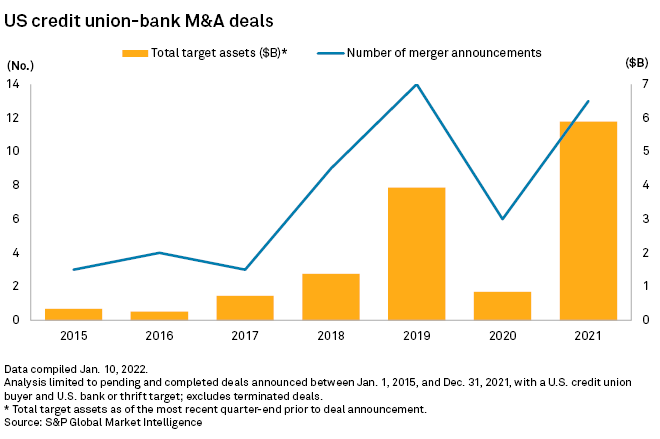

The total assets of banks sold to credit unions reached a high of $5.89 billion in 2021, up from $3.93 billion in 2019, while the deal count of 13 fell just short of the all-time high of 14 in 2019. Charles McQueen, president and CEO of McQueen Financial Advisors, said he expects between 15 and 20 such deals this year.

Michael Bell, partner and co-leader of the financial institutions practice group at law firm Honigman LLP who has worked on more than 40 credit union acquisitions of banks, said in an interview that he expects at least 20 announcements in 2022.

"I see this year most likely being the most we've ever had," Bell said. "I'm in the middle of an exceptional amount of transactions."

The rise in credit unions' bank acquisitions has overcome longstanding opposition by banking industry groups, which argue that credit unions, facing fewer regulations than banks, have unfair advantages as buyers. Opponents of the deals have gained traction with some state regulators, with Colorado and Iowa barring state-chartered banks from selling to credit unions and officials in Tennessee and Nebraska raising objections.

State skirmishes

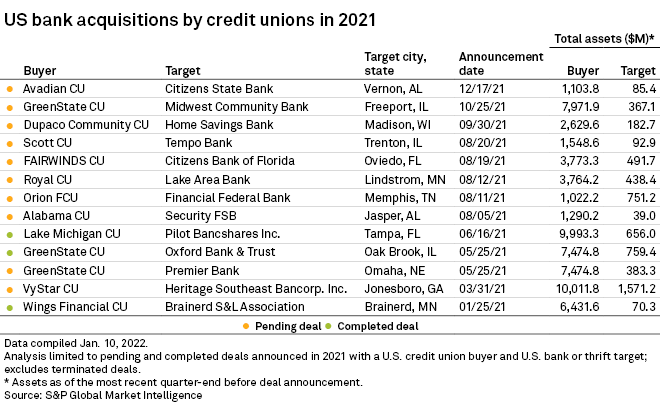

Notable 2021 credit union-bank transactions included VyStar CU striking the largest such deal yet with Heritage Southeast Bancorp. Inc., and GreenState CU announcing two bank purchases at once for a total of three during the year.

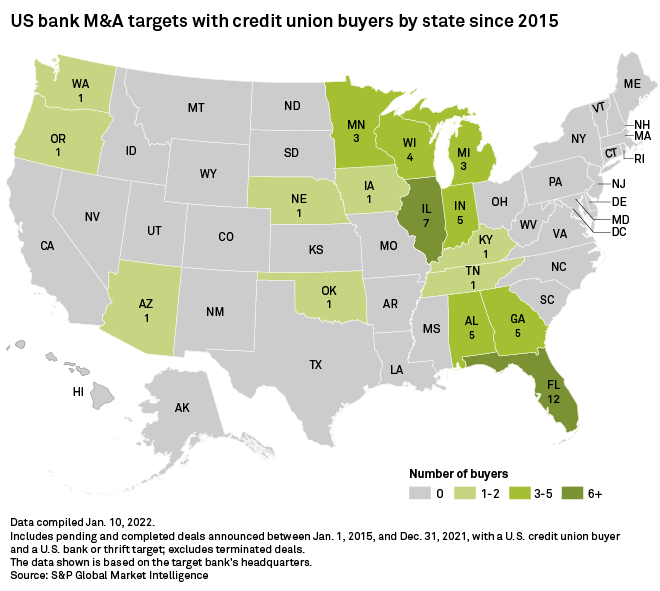

The majority of such deals have been concentrated in the Midwest and Southeast, with Florida leading the way with 12 announcements in the state since 2015, and Illinois coming in second with seven announcements since 2015. Advisers expect activity to remain concentrated in the Midwest and Southeast, but McQueen said he is working on transactions in the Western part of the country in states where no credit union-bank deals have been announced.

Nebraska and Tennessee both had bank deal announcements involving credit union buyers for the first time ever in 2021, and both transactions have come under fire.

The Nebraska Department of Banking and Finance denied Premier Bank's proposed sale to GreenState CU. Premier Bank is appealing the decision and GreenState CU expects the transaction to go through, the credit union wrote in a statement to S&P Global Market Intelligence.

In Tennessee, a judge passed a temporary injunction to block Orion FCU's proposed purchase of Financial Federal Bank following a request from Greg Gonzales, commissioner of the Tennessee Department of Financial Institutions. A hearing is set to be held regarding the matter.

"We commend the court's decision to prevent this from being forced through quickly without serious deliberations," Tennessee Bankers Association President and CEO Colin Barrett wrote in an email. Orion FCU declined to comment, citing the pending litigation.

Speed bumps

Neither Bell nor McQueen believes Nebraska and Tennessee will follow Colorado and Iowa in banning credit union bank acquisitions.

"I believe you will see the setbacks, actually perhaps be only speed bumps and ultimately be resolved in favor of the selling bank and the credit union," Bell said of the pending deals in Nebraska and Tennessee.

Further, neither adviser believes the states' regulatory pushback will dampen credit unions' interest in bank M&A. As credit unions look to scale and enter new markets, they will continue to opt for acquisitions — either of banks or of other credit unions — instead of de novo expansions, McQueen said.

The impact of states potentially barring these types of transactions could cause unintended effects, such as forcing credit unions to expand beyond their home-state borders, Bell said.

"You saw the thing happen in Iowa, and what happened? GreenState continued on the path, but they're buying banks in Illinois now, and trying to in Nebraska," Bell said. "So these local political rulings have an effect in many ways."

Secondary capital

A final rule from the National Credit Union Administration expanding the number of credit unions that can access secondary capital came into effect on Jan. 1 and could also help drive more bank acquisitions in 2022, McQueen said.

The adviser said he has seen an increase in credit unions considering taking on subordinated debt so they have cash on hand when they find a bank or other entity they want to buy.

"The secondary capital thing is a bit of a game changer," he said. "That's going to be really interesting for this landscape."