| Raiffeisen Bank International's operations sprawl across most of central and Eastern Europe. |

Raiffeisen Bank International AG is under growing pressure to decide the future of its sizable Russian business as many of its peers leave the country.

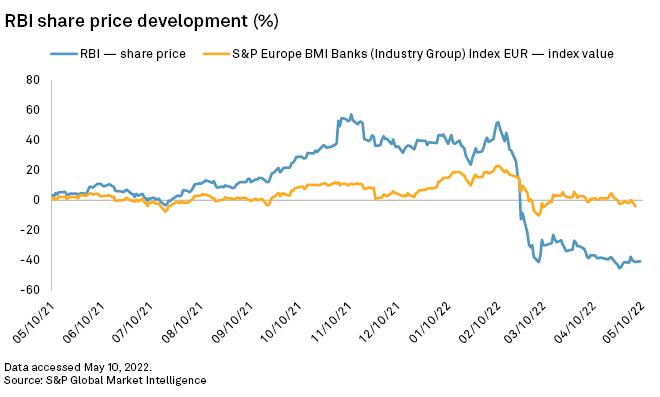

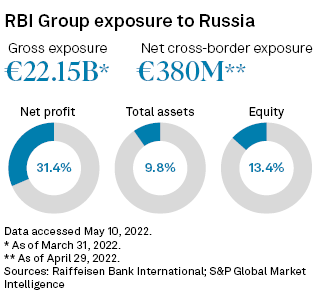

Banks and corporates alike have moved to shutter or sell their Russian operations following the country's invasion of Ukraine, as Russia faces increasing global sanctions. RBI, the European bank with the largest exposure to Russia, is yet to make a decision on its business in the country. Its share price has slumped to historic lows as the uncertainty persists.

RBI's dilemma is that it faces a major operational overhaul and losing a third of its profits if it sells its Russian business. If it holds on to the unit, it risks a prolonged valuation gap relative to its peers as well as investor pressure around the environmental, social and governance implications of operating there.

"There would be more operational risks involved in a premature and less thought-through exit, but reputational risk is definitely a problem," said Gábor Dániel Péntek, an equity analyst at Concorde Securities.

Share price drop

RBI's share has lost more than half its value since the invasion of Ukraine in late February. RBI's share price ended 2021 at €25.88 but had dropped to €10.20 by late April, its lowest level in more than 17 years. The stock remained depressed relative to its peers even after the bank reported that consolidated profit and return on equity for the first quarter had both more than doubled year over year.

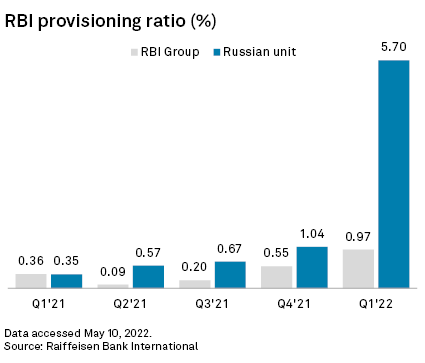

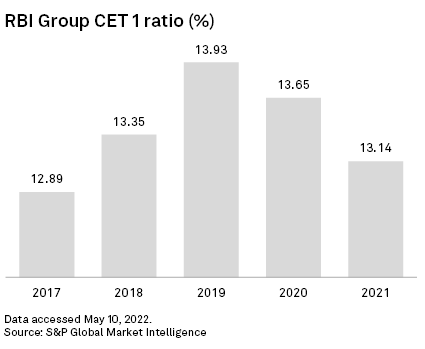

The sinking of the share price after a record-breaking 2021 shows investors' aversion to the uncertainty related to Russia, Péntek said. RBI's provisioning ratio for the quarter nearly tripled to 0.97% from 0.36%, and its common equity Tier 1 ratio dropped to 12.3% from 13.1% a year prior over increased risks and rating downgrades linked to its core Eastern European markets of Russia, Ukraine and Belarus.

The market "was unable to appreciate a relatively well-maneuvered first quarter," Péntek said.

The case to leave

RBI CEO Johann Strobl was quizzed by analysts for more clarity on the Russia situation at the bank's earnings call earlier this month. The bank received several "unsolicited indications of interest" for a potential acquisition of its Russian business, but no decisions have been made, Strobl said during the May 4 event.

The bank told S&P Global Market Intelligence May 19 that there were no updates on the situation and that Strobl's comments at the earnings call were "still valid."

RBI's current exposure to Russia may raise ESG concerns, and for some institutional investors the bank may become "uninvestable," said Mikołaj Lemańczyk, equity analyst at research firm Biuro maklerskie mBanku. While the majority of RBI's Russian portfolio is not yet exposed to sanction risk, "we cannot exclude that such risk will reappear in the future with the extension of sanction measures," Lemańczyk said.

At the end of March, RBI's exposure to Russia was €22.14 billion, including €19.84 billion in risk-weighted assets and €2.3 billion tied to equity and other capital.

A further risk of remaining is the prospect of Ukraine's government imposing a special tax on companies still operating in Russia, Lemańczyk said. The Austrian bank is already facing pressure from Ukraine because of its Russian business and is closely following the public discussion in the country, Strobl said during the earnings call.

Additionally, leaving Russia would reduce RBI's cost of risk and reduce its risk-weighted asset density — a measure of a bank's riskiness — which could improve the group's valuation and investor sentiment, Péntek said.

"RBI has had a longstanding discount in multiples compared to regional peers, which may also decrease after a Russian exit," Péntek said.

At 0.29 and 2.68, respectively, RBI's price-to-book ratio and EPS ratio for the last 12 months are less than half of the multiples of compatriot bank Erste Group Bank AG, which has negligible exposure to Russia. Erste's price-to-book ratio stands at 0.75, while its EPS ratio for the last 12 months is 6.33, according to S&P Global Market Intelligence data.

Profit pain

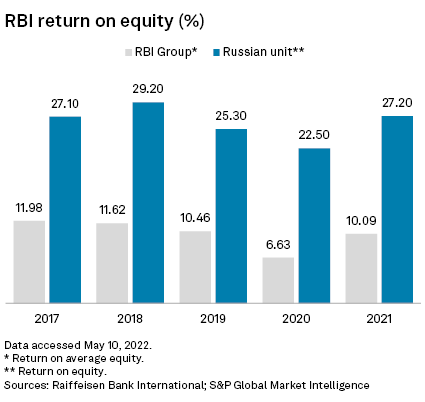

Though the pressure to exit Russia grows and future risks of staying put mount, parting with its local unit would be tough for RBI. The unit has historically accounted for roughly a third of the group's profits and one-tenth of total assets and equity. "From a profitability point of view, exiting Russia will have significant, negative effects on group results," Lemańczyk said.

The unit's strong performance in the past also increases the chances of a successful sale in the future should RBI decide to exit. "The bank could attract good offers given its ongoing profitability and historical resilience to economic slowdown," Lemańczyk said.

With the Russian unit's low problem loan ratio and the extensive risk provisioning undertaken by RBI, the unit "may turn out to be sufficiently attractive for local investors with access to offshore hard currency," Moody's analysts said in a May 6 research note.

Among RBI's peers, UniCredit SpA is in early-stage talks over a sale of its Russian operations, Bloomberg News reported earlier in May. The Italian lender has the third-largest exposure to Russia among European banks.

This as Société Générale SA, the European bank with the second-largest exposure to Russia, said in April that it will sell its local unit PJSC Rosbank to Interros Group. The deal will result in a write-off of about €2 billion and an exceptional noncash item of about €1.1 billion. SocGen's deal "suggests such an agreement is achievable for RBI with a better economic outcome than a full loss of its investment," the Moody's analysts said.