Banks in Poland, the Czech Republic and Hungary are forecast continued net interest income growth in the year ahead amid rapidly rising interest rates in each country.

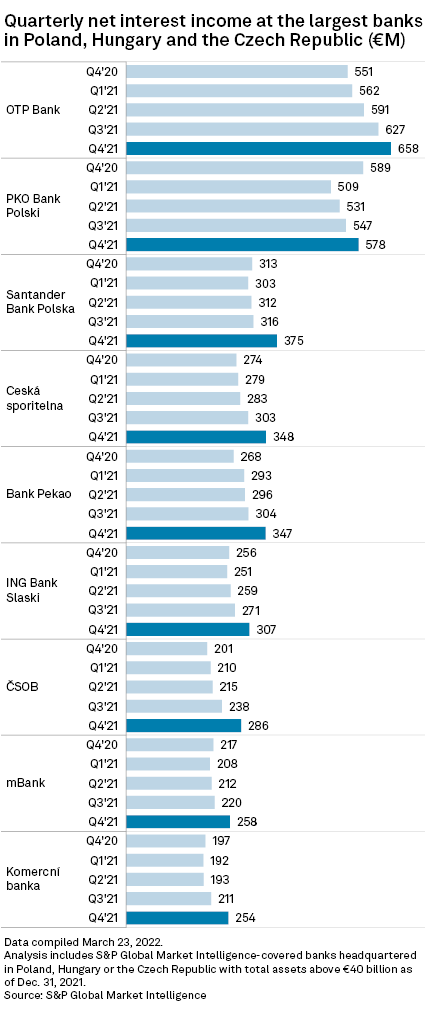

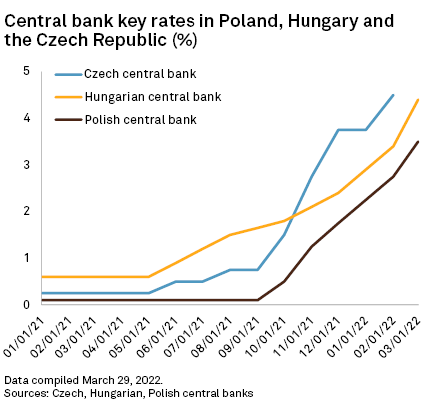

Among a sample of the three countries' largest banks, all reported quarter-over-quarter increases throughout 2021 in net interest income — a key revenue source for lenders that shows the difference between earnings on interest-bearing assets and expenses from interest-bearing liabilities — S&P Global Market Intelligence data shows. Those improvements were particularly visible in the final quarter of the year, when the Polish, Czech and Hungarian central banks stepped up key rate hikes amid accelerating inflation.

With rate increases continuing into the early part of 2022 and more anticipated in the coming months, analysts now expect this to be a bumper year for the net interest income of banks operating in the three countries.

"The target interest rate level prompts us to say that in terms of net interest income, 2022 will be a very good year, maybe even better than what we assumed just two months ago," analysts at Poland-based mBank's brokerage unit said in a March 16 note.

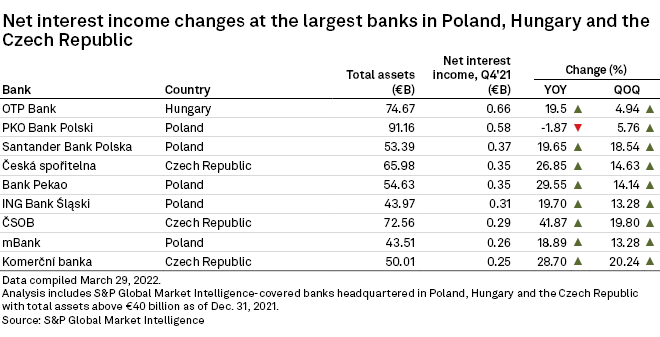

The fourth-quarter net interest income of KBC Group NV's Czech unit Ceskoslovenská obchodní banka a. s., or ČSOB, grew 41.9% to the equivalent of €286 million on a yearly basis, the steepest increase among the sample. Poland-based Bank Polska Kasa Opieki SA, or Bank Pekao, was next best with a 29.5% rise to €347 million.

ČSOB also demonstrated the second highest quarter-over-quarter increase in net interest income at 19.8%. It was surpassed only by Société Générale Société anonyme's Czech unit Komercní banka a.s., whose net interest income increased 20.2% to €254 million.

Poland's PKO Bank Polski SA and Hungary-based OTP Bank Nyrt., the biggest banks in the sample in terms of asset size, reported the highest total net interest incomes. However, they showed the smallest percentage improvements quarter over quarter, and PKO reported a 1.87% decline on an annual basis.

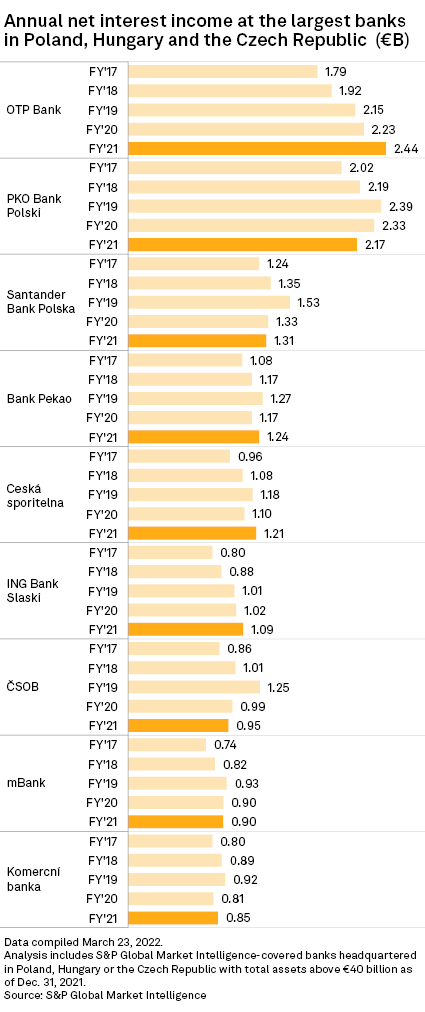

Five banks from the sample also showed year-over-year growth in their full-year net interest income, with OTP Bank and Erste Group Bank AG unit Ceská sporitelna a. s. posting the largest increases of roughly 10%. Meanwhile, the 2021 net interest income of Banco Santander SA unit Santander Bank Polska SA, ČSOB and PKO fell year over year by 1.45%, 3.95% and 7.04% to €1.31 billion, €948 million and €2.17 billion, respectively.

Only three of the sampled banks managed to recover full-year net interest income to pre-pandemic levels. OTP Bank showed the largest increase at almost 13.5% more than the 2019 result, while ING Groep NV unit ING Bank Slaski SA and Česká spořitelna demonstrated increases of 8.2% and 2.8%, respectively. The remaining six banks were still behind their 2019 figures as of the end of 2021.

Positive outlook

The central banks of the Czech Republic, Hungary and Poland have raised their key rates by 425 basis points, 380 basis points and 340 basis points, respectively, since the beginning of 2021. The rates in the respective countries stand at 4.5%, 4.4% and 3.5%.

Net interest income at lenders in the three countries will continue to be bolstered by further rate hikes as local central banks step up their efforts to combat inflation amid the Russia-Ukraine conflict. MBank analysts see the Polish central bank's key rate reaching roughly 5.5% by year-end.

In the Czech Republic, the base rate is likely to exceed 5% this year and boost the country's banking sector, even with the potential negative side-effects of reduced lending demand, increased nonperforming loans and higher financing costs, Patria Finance analyst Michal Křikava told Market Intelligence via email. "The year-on-year increase in net interest income against the backdrop of rising interest rates will be the main driver of higher profitability of domestic banks," said Křikava.

The key rate in Hungary could reach as high as 8.25%, according to ING Senior Economist Peter Virovacz. "This will have some downward impact on lending activity. … On the other hand, as the local banking sector is full of liquidity, the commercial banks are making money on their deposits with the central bank," Virovacz said in an email.

Ukraine factor

Hungary-based OTP Bank has the largest direct exposure to Russia and Ukraine among the lenders in the sample, with 15% of its 2021 adjusted profit coming from the two markets. Even so, the favorable conditions in its home market more than outweigh the risks posed further east.

"The Hungarian banking sector is in a really good shape despite the fact that some of the locally present banks have ties to the Russian market. I haven't identified any red flag which could jeopardize the sector's stability," Virovacz said.

PKO, which is present in Ukraine via JSC Kredobank, said in February that the conflict will have a relatively small impact on its financial results and capital levels, even under the most adverse scenarios.