State Farm Mutual Automobile Insurance Co. and Berkshire Hathaway Inc.'s Geico Corp. both posted personal auto loss ratios above 80% in the first quarter as the average first-quarter losses for the business line across the U.S. climbed past 70%.

Losses on the rise

The loss ratio for the business line increased to 72.4% in the first quarter from 58.4% a year earlier, almost 10 percentage points worse than the second-highest loss ratio recorded in the first quarter over the past five years.

Combined first-quarter direct premiums written dropped year over year to $68.80 billion from $69.50 billion, though the latest figure is the second highest over the five-year period.

Starting in 2022, personal auto physical damage is directly reported on a quarterly basis. Therefore, all figures for 2022 and subsequent are entirely personal auto.

Keefe Bruyette & Woods analyst Meyer Shields wrote in a research note that he believes "modest" personal auto rate increases are not large enough to absorb still-heightened, though decelerating, used vehicle price increases and still-rising labor and auto part costs.

Shields added that this implies near-term personal auto core loss ratio pressure, particularly for insurers with more physical damage exposure.

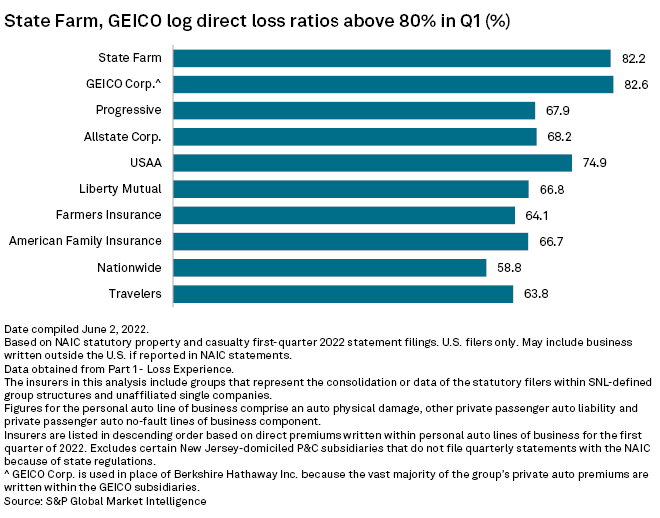

Largest underwriters have highest loss ratios

State Farm and Geico, the two biggest players in the space by premiums, recorded two of the highest loss ratios in the first quarter of 82.2% and 82.6%, respectively.

The Progressive Corp. CEO Susan Griffith, whose third-ranked company had a loss ratio of 67.9%, said in the company's most recent earnings call that the insurer believes it is ahead of competitors in taking rate actions.

"We have not slowed our pursuit of segmentation superiority," the CEO said. "Our U.S. personal auto product model is now available in over half the states and is showing early promising results, especially among more preferred segments."

State Farm in pole position

State Farm grew its first-quarter private auto liability direct premiums written by 6.5% year over year. The company wrote $11.15 billion in private auto line as it continues to hold the most market share.

Geico was the second-biggest writer of personal auto insurance with $10.03 billion of direct premiums written, while Progressive was third with $9.36 billion, although its private auto liability direct premiums written dropped 0.7% year over year.

Griffith said she is optimistic that as more states reach rate adequacy, Progressive expects to increase marketing spend and "reengage the growth engine."

"Because of the advantages we believe we have in the way we buy media, we can adjust marketing spend at the local and segment level and in such a way to ensure the new business we write meets our economic goals," Griffith added.

* Download an Excel template to generate P&C market share reports based on data from annual or quarterly exhibits.

* Read an in-depth look into State Farm's first-quarter underwriting losses.