Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Feb, 2023

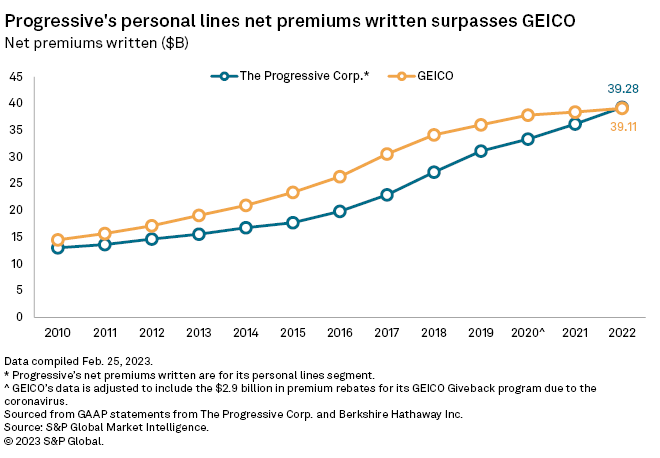

For the first time since 2006, The Progressive Corp. recorded more personal lines net premiums written than GEICO Corp. in a full year, according to an analysis by S&P Global Market Intelligence.

The Ohio-based insurer's personal lines net premiums written, which encompasses both private auto and recreational vehicles, was $39.28 billion in 2022, an 8.6% increase year over year. Progressive's yearly total was about $170 million more than GEICO's reported figure net premiums written of $39.11 billion. GEICO's net written premiums were up 1.9% over the 2021 total.

The premium figures discussed for both insurers are on a net basis, prior to reinsurance, and include small amounts of business that are not considered personal auto, such as watercraft or boat insurance. For GEICO, its GAAP statement figures include homeowners, renters and commercial fleet insurance.

At this time, it is still uncertain which of the two companies wrote more direct personal auto premiums in 2022. The upcoming release of year-end regulatory data will show which company was the second-largest personal auto underwriter in the U.S. in 2022.

GEICO sheds auto policyholders; Progressive notches gains

While both insurers reported year-over-year premium growth, the two went in opposite directions when it comes to total private auto policyholders. GEICO's voluntary auto in-force policies declined by 8.9%, while Progressive's auto policies-in-force total increased 2.6% from 2021.

Progressive ended 2022 with 17.9 million policies between its direct and agency auto businesses. The momentum has continued into this year, as the insurer reported 18.3 million in-force private auto policies at the end of January, up about 435,000 in just a month.

Worst combined ratio since '96

GEICO's combined ratio climbed to 104.8% in 2022, its worst annual figure since it was taken private by Berkshire Hathaway Inc. in 1996. Since that time, the only other years in which GEICO reported a combined ratio in the triple digits were 2000 and 2017. The company reported combined ratios of 104.0% and 101.1%, respectively, in those two years.

|

* Read about Progressive's and GEICO's personal auto rate changes |

GEICO's performance suffered as a result of higher losses from increases in claims severity and frequency across all policy coverages. When compared to the prior year, the insurer's average claim severity for property damage was up between 21% and 22%. For collision, the average claim severity was up by 14% to 16%, while bodily injury was up 9% to 11%.

On the claims frequency side, personal injury was 3% to 4% higher, collision and bodily injury were both up between 4% and 5% and property damage was up 1% to 2%.

The insurer's loss and loss adjustment expense ratio was 93.1% in 2022, by far its worst since going private. Its previous highest loss and loss adjustment expense ratio for a full year was 86.6% in 2017.

GEICO was able to lower its underwriting expense ratio in 2022, which came in at 11.7%. The insurer decreased underwriting expenses by $881 million year over year, primarily through a reduction in advertising expenses and lower employee-related expenses.

Progressive's combined ratio within its personal lines segment deteriorated to 96.0% from 95.4% in 2021. The insurer's overall incurred frequency within its personal auto business decreased by 6% year over year, while severity increased about 13%.