Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 May, 2023

By Hassan Javed

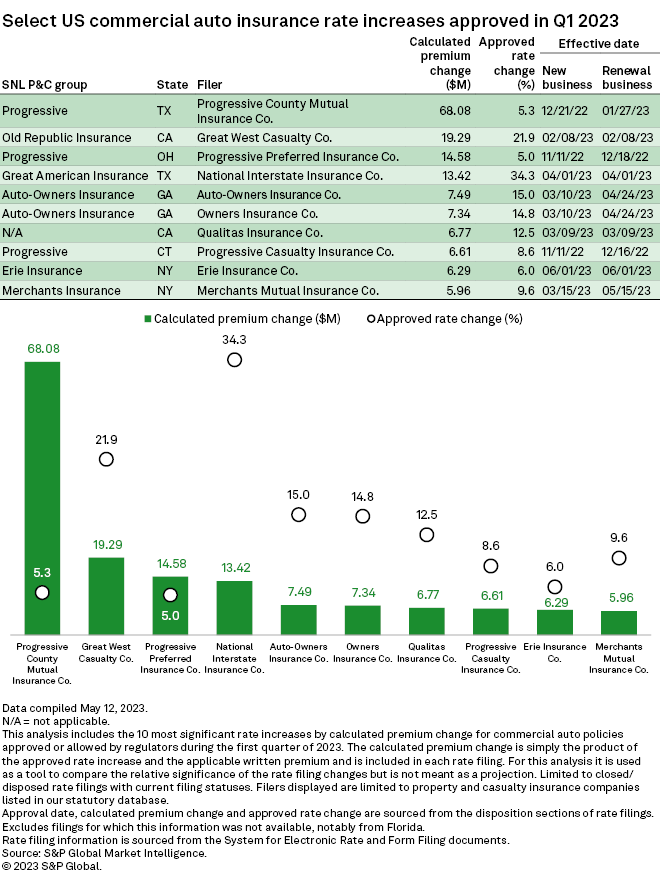

The Progressive Corp. continued to increase commercial auto insurance rates during the first quarter of 2023, according to an S&P Global Market Intelligence analysis.

Overall, Progressive and its subsidiaries received approvals for 17 rate hikes across 15 different states during the quarter. The aggregate of the calculated premium change for the filings is $102.5 million.

Progressive County Mutual Insurance Co. received the most significant increase during the quarter with a $68.1 million calculated premium change after a 5.3% bump in Texas. This rate increase went into effect Dec. 21, 2022, for new businesses and Jan. 27, 2023, for renewals and is expected to affect nearly 130,000 policyholders.

Texas regulators busy in Q1

Texas regulators were busy during the first quarter, with the Lone Star State approving 58 commercial auto rate hikes totaling $125.7 million in calculated premium change.

In addition to Progressive, American Financial Group Inc.'s units under the Great American umbrella benefited from rate change approvals in Texas. The group's subsidiaries received approval for six rate increases totaling $15.3 million in calculated premium change in the Lone Star State. About 88% of the calculated premium change will occur from a 34.3% rate increase for its National Interstate Insurance Co. subsidiary.

– Read more about the P&C industry's record statutory underwriting loss in the first quarter.

– Download a template to analyze rate changes for selected entities, state or type of insurance over a selected period.

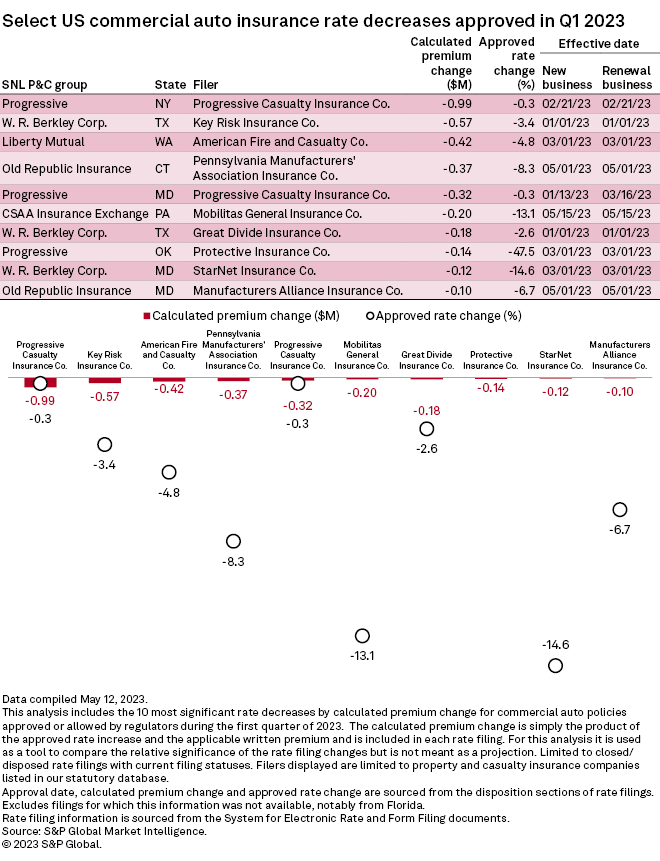

Progressive receives the most significant decrease

While the number of approved rate increases Progressive received in the first quarter outnumbered the number of decreases it received in the aggregate, the group did receive the most significant individual decrease in terms of calculated premium change during the first quarter of 2023. Progressive Casualty Insurance Co. received a 0.3% rate decrease in New York, with a calculated premium change of approximately $1 million.

All figures listed are based on as-reported numbers filed in the rate filings of each subsidiary in each state. The calculated premium change is not a final projection of the additional premium the insurer may receive in the upcoming year. The calculated premium change is reported by each insurer to reflect the most impactful premium changes based on the combined impact of the percentage change and the amount of business it affects. Changes to the insurer's policy mix or policies in force are not factored into the analysis.

US states employ a variety of rate regulation mechanisms, including prior approval, modified prior approval, file and use as well as use and file. Some states do not require explicit regulatory approval prior to insurers using new rates. This analysis is based on when rate filings are "disposed" by state regulators and does not take into account when those new rates became effective for new and renewal business. In some instances, a new rate may have been in effect prior to the month the filing was approved by the regulator.