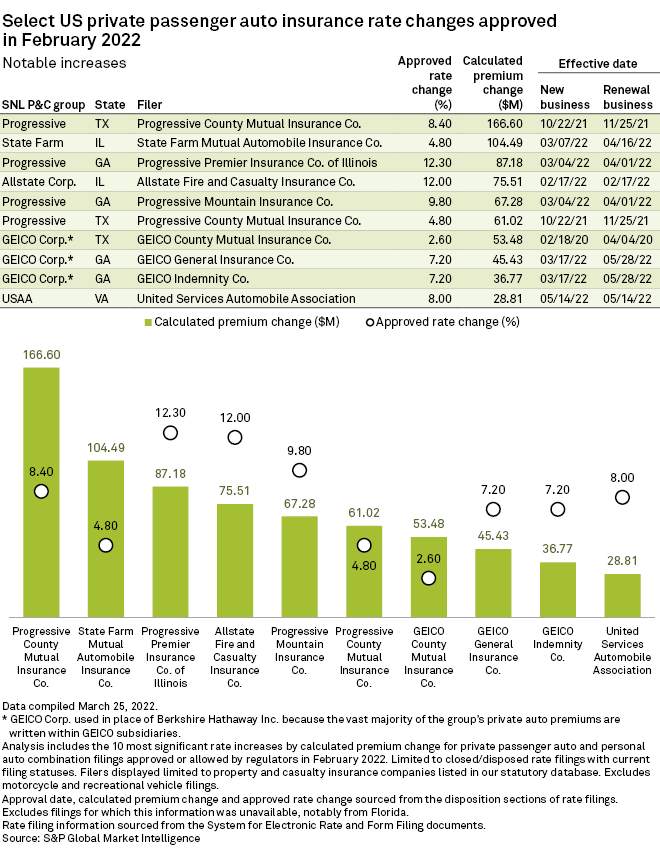

The Progressive Corp. subsidiaries received approval for what looks to have been the most-impactful private auto insurance rate increases during February.

Progressive received 47 rate-hike approvals across 11 states in the month. Those hikes stand to boost Progressive's premiums by an aggregate $627.9 million, an S&P Global Market Intelligence analysis shows.

Two outsized rate increases approved by Texas regulators alone are expected to raise the company's premiums by $227.6 million.

GEICO sees second-largest premium increase

The second-largest aggregate premium increase is expected to come from 21 rate increases approved for GEICO Corp. Those rate hikes stand to bolster GEICO's auto premiums by $210.7 million. The approved rate increases range between 1.4% and 9.6% across 11 states. Roughly three-quarters of the calculated premium increase is expected to stem from two Southern states: Georgia and Texas.

Four rate increases approved for Progressive featured on the month's most notable list, while rate hikes for GEICO appeared three times.

Few rate cuts in February

Private auto insurers were approved for just 34 rate reductions in February, compared to 377 rate increases. A pair of rate decreases for Progressive units disposed by Oregon regulators on Feb. 14 were the most-impactful rate reductions for the month.