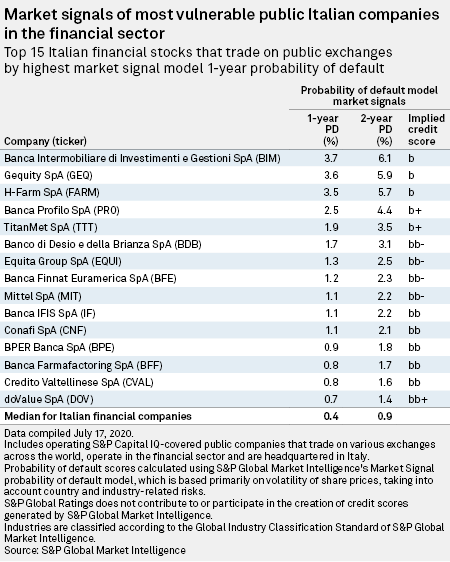

The one-year median probability of default for Italian companies in the financial sector fell in July, according to S&P Global Market Intelligence's Probability of Default Model Market Signals framework.

The probability of default among Italian financials stood at 0.4% over a one-hear horizon, and 0.9% over two years, according to data compiled July 17. This compares with 1.0% and 2.1% as of June 12, according to the model, which helps to identify companies that are less certain to meet previously agreed-upon commitments.

The model is primarily based on volatility of share prices but also assesses country- and industry-related risks. It also takes into account the fact that different levels of operating leverage are considered acceptable for different types of financial institutions, and is adjusted accordingly for commercial banks, investment banks, insurers and nonbank financial companies.

Low risk for big banks

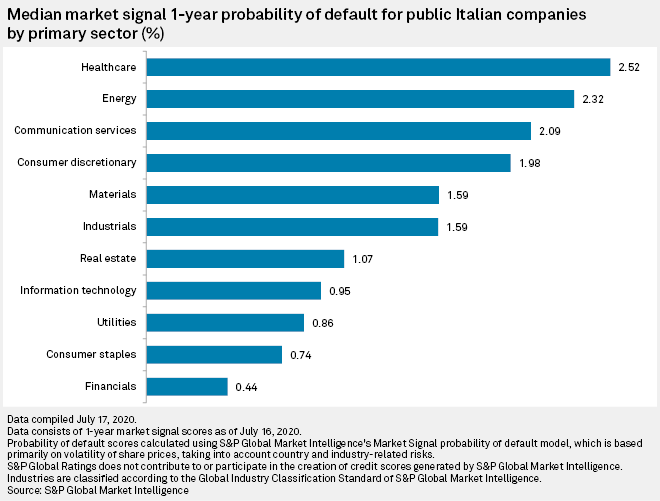

Although Italy is among the European countries worst hit by the coronavirus pandemic, most financial companies have so far proved resilient. On average, probability of default for financial services companies is below the average for Italian companies in all sectors, which stands at 1.4% and 2.6% over one and two years, respectively.

|

Italy has recorded 35,073 confirmed COVID-19 fatalities to July 22, according to Johns Hopkins University's Coronavirus Resource Center. The economic impact of the crisis has been severe, with the Italian central bank forecasting a 9.2% contraction in GDP growth for this year. Unemployment is expected to cross the 10% mark next year, according to both ING and Fitch Ratings.

But banks have benefited from emergency stimulus measures. The Italian government announced plans in April to extend a state guarantee on up to €750 billion of commercial bank loans granted to struggling businesses, a move that was broadly welcomed by the banking community. This move puts banks at the heart of the country's response to the economic fallout of the pandemic and gives them a degree of insulation from defaults on new loans.

The companies that top the list of Italian financials most likely to default are not mainstream banks but a mixture of investment companies, wealth managers and specialized financial services companies. In first place is Turin-based Banca Intermobiliare, which has a 3.7% risk of default in the next year, and a 6.1% probability of default over the next two years. Gequity S.p.A., an investment firm focused on small and medium-sized companies, follows with a probability of default of 3.6% and 5.9% over the next one and two years, respectively. Next up is H-Farm S.p.A., a platform that supports the digitalization of corporates, with a 3.5% and 5.7% probability of default. The only large bank to feature in the top 10 Italian financials most likely to default is BPER Banca SpA, with a probability of default of 0.9% and 1.8% over one and two years, respectively.

doValue, Banca IFIS back in stable territory

Two companies that are instrumental in Italy's bad debt management market, doValue SpA and Banca IFIS SpA, feature in the top 10. Special servicer doValue has a probability of default of 0.7% and 1.4% over a one-year and two-year horizon, and Banca IFIS, which provides loans for the purchase and management of nonperforming loans, among other activities, had a probability of default of 1.1% and 2.2%.

This is an improvement on just a month previously, when the pair were the Italian financials at the highest risk of default. DoValue had a 7.3% probability of default in the next year, and a 10.8% over a two-year horizon, according to data compiled June 12. Banca IFIS is also in more stable territory compared to where it was in June, when it had a 4.3% probability of default over the next year and a 7.0% risk in the next two years.

DoValue, which collects fees for managing bad loan portfolios on behalf of clients — and does not hold loans on balance sheet — helps some of the biggest names in Southern European banking to work through their large piles of bad debt. The company has forward-flow agreements with lenders including Unicredit and Banco Santander, for example. It is also one of the leading managers of the debt portfolios underlying securitizations in Italy’s GACS scheme, an Italian government initiative that has helped banks to offload some €62.00 billion of toxic loans.

|

While doValue's services are in demand, the pandemic brought some specific problems. DoValue generates much of its revenue from debt collections, and these usually involve a court decision. With courts in Italy and Spain closed for long periods from mid-March onward, doValue's ability to collect revenues has been severely affected, according to one investment bank analyst, speaking on condition of anonymity.

The company's debts have also increased considerably over the past year, Fitch Ratings said in a July 9 note, going from "negligible" as of the end of 2018 to roughly €644 million at the end of June this year.

This is due to two acquisitions. DoValue took a majority stake in Eurobank Ergasias Services and Holdings SA's loan servicing unit in June 2020, and purchased Altamira Asset Management in June 2019. The pandemic could both slow doValue's pace of deleveraging and depress EBITDA, according to Fitch.

The anonymous analyst said that there were concerns that doValue's debt-to-EBITDA ratio would increase from 1.4x EBITDA to more than 3x EBITDA during the second half of 2020 due to a mixture of high debt and depressed revenues, a level that could cause it to breach the covenant with its lenders.

A spokesperson for doValue said that the company's net-debt-to-EBITDA ratio is expected to be around 2x as of the end of June. In addition, the company has cash-on-hand of around €190 million and committed credit lines of €75 million.

"[D]oValue does not expect to have financial covenants constraints over the medium term and there is no default risk for the group," doValue said in an emailed statement.

The 3x figure is "an analyst estimate and might not reflect the company's base case scenario," it added.

Even in a hypothetical situation in which doValue breached a contract with its lenders, it is likely banks would treat them with leniency because of the important role it plays in Italy's bad debt management ecosystem, according to Barbara Casu Lukac, director of the Centre for Banking Research at Cass Business School.

"I don't think it's in anyone's interests for doValue to go under at this particular point in time," she said in an email.