S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Macroeconomic conditions have put private credit in the spotlight. Banks have become more reluctant to lend, and private capital funds are moving in, providing easier access to credit. The funds also offer a potential safe harbor for investors during a risk-off environment.

Those trends help to explain a cluster of private credit deals announced by alternative asset managers in recent weeks. Private credit has also been a hot topic on end-of-quarter earnings calls for the large, publicly traded alternative asset managers.

When The Carlyle Group Inc. reported third-quarter earnings on Nov. 8, Mark Jenkins, the firm's head of global credit, said the firm was "quite bullish" on the prospects of the asset class over the next 12 to 24 months. That outlook could pertain not just to deployment opportunities but fundraising as well. Carlyle reported $3.3 billion in inflows to its global credit business in the third quarter, more than the $2.5 billion investors committed to the firm's private equity strategies.

"There is a sense of opportunity when we talk to our investors about what's going on in the credit markets, in particular, as they've seen a repricing of risk. And we're taking advantage of that," Jenkins said.

For another take on private credit, check out the Nov. 10 webinar featuring experts from Preqin and S&P Global Market Intelligence. The topic was Preqin's recent Future of Alternatives 2027 report, and panelists discussed the five-year outlook for a variety of alternative assets, including private credit.

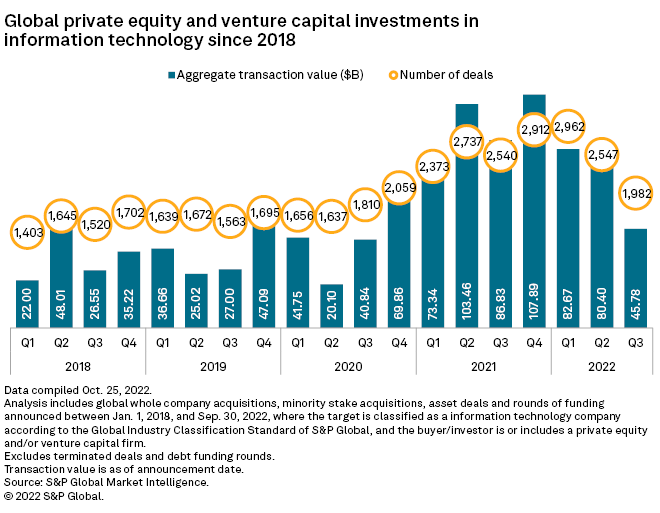

CHART OF THE WEEK: Fading infotech investments

⮞ Information technology maintained its status as the top target for private equity and venture capital in the third quarter, but investments in the sector dropped over 47% year over year to $45.78 billion.

⮞ It was the third consecutive quarter of declining deal values since the fourth quarter of 2021, when private equity completed 2,912 infotech sector deals with a total announced value of $107.89 billion.

⮞ Of the deals completed in the third quarter, the greatest number involved application software businesses — 1,167 transactions in total, or nearly six out of every 10 private equity-involved infotech deals.

DEALS AND FUNDRAISING

* TPG Capital LP agreed to divest Immucor Inc., a transfusion and transplant diagnostics company, via a sale to Werfen SA for about $2 billion. The Spanish buyer manufactures and distributes specialized diagnostic instruments.

* KKR & Co. Inc. is injecting $400 million of capital into Indian industrial decarbonization solutions provider Serentica Renewables India Pvt. Ltd.

* A consortium led by Global Infrastructure Partners Inc. and KKR entered into a strategic co-control partnership with Vodafone Group PLC to buy up to half of Vodafone's 81.7% stake in European telecommunications tower company Vantage Towers AG. The new joint venture, known as Oak BidCo, will offer to buy all outstanding Vantage shares at €32 per share.

* An investor group led by Brookfield Asset Management Inc. proposed to buy Australian energy company Origin Energy Ltd. for about A$15.51 billion or A$9 per share, Dow Jones Newswires reported.

* Ardian pulled in €5 billion for its fifth-generation private credit platform, which seeks to provide alternative, flexible financing to middle-market European businesses.

* EQT AB (publ) raised a total of €1.1 billion for EQT Ventures III at final close. The venture capital fund will back early-stage technology startups in Europe and North America.

* HighBrook Investment Management LP collected $632 million for HighBrook Property Fund IV. The oversubscribed fund will target industrial, residential and creative office assets across select markets in Western Europe and the U.S.

* Quona Capital LLC pulled in $332 million for its Fund III, TechCrunch reported. The venture capital firm backs financial technology companies across Latin America, India, Southeast Asia, Africa and the Middle East.

ELSEWHERE IN THE INDUSTRY

* Certara Inc. shareholder Arsenal Capital Partners has committed to invest an additional $449 million in the biosimulation software maker, buying out EQT Private Equity-controlled funds. Arsenal will buy about 30 million shares, or about 22% of Certara's diluted shares outstanding.

* KPS Capital Partners LP signed a deal to sell Howden Group Ltd., a specialist in air and gas handling equipment, to Chart Industries Inc. for $4.4 billion.

* Milan-based private equity firm Ambienta SGR SpA acquired a majority stake in Lässig GmbH, a German producer of sustainable products for babies and children.

FOCUS ON: AGRICULTURE

* Cooperative Ventures, a venture capital fund formed by North American agricultural cooperatives, injected capital into tractor automation solutions provider Sabanto Inc. via a venture funding round.

* French e-commerce platform for agricultural supplies Agriconomie secured €60 million in a series B financing round. Investors included Eurazeo SE, Aliment Capital and Temasek Holdings (Pvt.) Ltd.

* Mutares SE & Co. KGaA is selling Royal De Boer Stalinrichtingen BV, a Netherlands-based barn equipment manufacturer serving the dairy industry, to Turntide Technologies Inc.