Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2024

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

The reelection of President-elect Donald Trump featured prominently in conversations among private equity fund managers, investors and advisors gathered in New York City for SuperReturn North America.

While Trump's campaign promises were analyzed — particularly those related to trade tariffs, immigration, and the US tax and regulatory framework — many conference attendees advocated for a wait-and-see approach regarding the incoming administration.

"Our view was it didn't matter who was elected. Private equity was going to go on and will still be a very attractive asset class," said Kenneth Binick, managing director and co-head of direct equity investments for Hamilton Lane Inc. and a SuperReturn panelist.

The life cycle of the typical private equity fund is longer than the four-year term of a US president. Allen Waldrop, deputy chief investment officer of the Alaska Permanent Fund, said his focus remains on selecting the best managers who can guide a fund through fluctuations both economic and political.

"It's not like we’re planning for higher rates or lower rates or who's going to control the Senate and the White House. You can't plan for that," Waldrop said.

Read more of S&P Global Market Intelligence's conversation with Allen Waldrop.

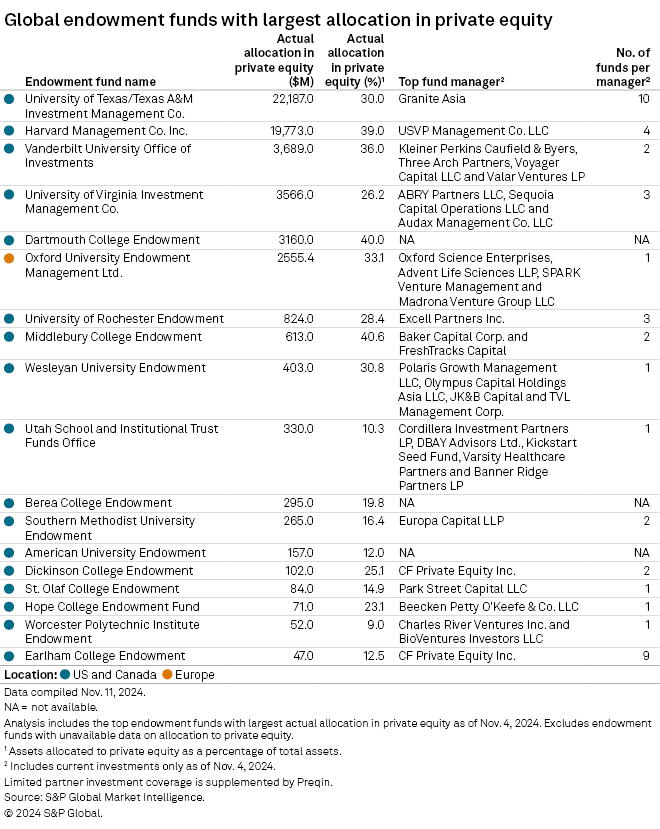

CHART OF THE WEEK: The top private equity allocators among endowments

⮞ The University of Texas/Texas A&M Investment Management Co. and Harvard Management Co. Inc. topped a ranking of endowments by the size of their allocations to private equity, with capital commitments totaling $22.19 billion and $19.77 billion, respectively, as of Nov. 4, according to S&P Global Market Intelligence data.

⮞ The University of Texas' allocation amounts to 30% of its investment portfolio while Harvard is at 39%.

⮞ Compared to other investors, endowments tend to invest more heavily in alternative assets such as private equity, Paul Sinthunont, Preqin's head of asset allocation research, told Market Intelligence.

TOP DEALS AND FUNDRAISING

– KKR & Co. Inc. and Dragoneer Investment Group LLC acquired Instructure Holdings Inc. in an all-cash transaction valuing the learning management solutions provider at about $4.8 billion. As part of the deal, Instructure shareholders received $23.60 per share.

– Court Square Capital Management LP exited diabetic medical supplies distributor Advanced Diabetes Supply Group in a sale to Cardinal Health Inc., which agreed to buy the company for about $1.1 billion in cash.

– Altas Partners LP made a $1 billion minority investment in claims management company Sedgwick Claims Management Services Inc. Current investors including The Carlyle Group Inc. and Stone Point Capital LLC will remain investors.

– Transom Capital Group LLC raised $675 million in capital commitments at the final close of Transom Capital Fund IV LP. The firm also secured $79.5 million in co-investor capital.

– Godspeed Capital Management LP raised $675 million at the final close of Godspeed Capital Fund III LP. The fund will invest in the defense and government sectors.

MIDDLE-MARKET HIGHLIGHTS

– Kingswood Capital Management LLC acquired frozen and refrigerated ground meat company Branding Iron Holdings Inc.

– The Halifax Group invested in after-market heating, ventilation and air conditioning equipment company Universal Air Conditioner Inc. Terms of the investment were not disclosed.

– Wynnchurch Capital LP acquired LED components company Principal Industries LLC. Terms of the deal were not disclosed.

FOCUS ON: ADVERTISING & MARKETING

– Highpost Capital LLC and Charlesbank Capital Partners LLC invested in marketplace management services provider Front Row. Terms of the investment were not disclosed.

– Go Capital LLC and Station Partners invested in digital marketing and public relations agency DemandG LLC, or Arketi Group. Terms of the investment were not disclosed.

– Inverness Graham Investments Inc. acquired marketing data and analytics company Alliant Cooperative Data Solutions LLC. Terms of the deal were not disclosed.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter