S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Macroeconomic turbulence slowed global private equity exit activity in the first half of the year, but it may create more attractive conditions for entries in the months ahead.

TPG Inc. CEO Jon Winkelried gave his outlook on the "increasingly favorable investment environment" when the firm reported second quarter earnings Aug. 9. Exits well outpaced entries for TPG over the previous year, the CEO said, but with volatile markets taking a toll on valuations, the firm is likely to flip its focus from selling to buying.

"We expect to see more attractive investment opportunities across our core sectors and themes as sellers adapt to reset valuations and markets stabilize in the coming quarters," Winkelried said.

With $39.4 billion in dry powder as of June 30, its largest-ever amount of investable capital, TPG is positioned to act on those investment opportunities as they arise. In fact, dry powder remains near record levels across the industry.

Winkelried's view on upcoming investment opportunities echoed comments Apollo Global Management Inc. co-President James Zelter made on his firm's Aug. 4 earnings call.

"Our pipeline of investment opportunities is strong, and we expect to deploy a meaningful amount of capital from our flagship private equity funds in the coming months," Zelter said.

Click here to read more about TPG's second-quarter earnings.

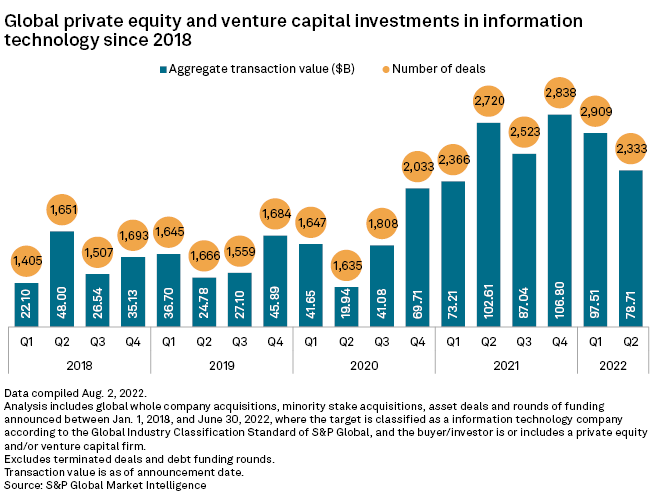

CHART OF THE WEEK: Despite Q2 drop, PE infotech investment remains historically high

⮞ Global private equity and venture capital investments in the information technology quarter declined for a second straight quarter in the second quarter.

⮞ Investments totaled $78.71 billion globally in the second quarter, down 19.3% from the first quarter's $97.51 billion total.

⮞ Despite the decline, private equity infotech investment remained well above pre-2021 levels.

FUNDRAISING AND DEALS

* Apollo closed its first fund dedicated to large corporate direct lending, Apollo Origination Partnership Fund I, with commitments totaling roughly $2.35 billion, Dow Jones Newswire reported. Also, Apollo agreed to sell its Mexican restaurant chain Qdoba to Butterfly Enterprises LLC.

* The global infrastructure platform of The Carlyle Group Inc. agreed to invest up to $1 billion in Tillman Global Holdings LLC's cell tower platform Tillman Infrastructure LLC. Greenberg Traurig LLP advised Carlyle. Sullivan & Cromwell and TAP Advisors served Tillman Global.

* Blackstone Inc. agreed to buy a majority stake in commercial sourcing agency CoreTrust from HealthTrust Inc., Bloomberg News reported, citing sources.

* Nielsen Holdings PLC reached a tentative agreement with its largest shareholder, WindAcre Partnership LLC, to back its planned $10 billion buyout by a group of private equity firms, Dow Jones reported, citing The Wall Street Journal. WindAcre previously opposed the TV ratings company's acquisition by a consortium led by Elliott Management Corp.'s private equity arm and Brookfield Asset Management Inc.

ELSEWHERE IN THE INDUSTRY

* Sannova Analytical Inc., a provider of testing services to pharmaceutical and biotech firms, received a capital injection from SFW Capital Partners LP.

* Mubadala Capital will purchase short-haul trucking and logistics company Canada Cartage System Ltd.

* Inflexion Pvt. Equity Partners LLP sold its stake in Pharmaspectra LLC, a medical science information provider.

FOCUS ON: ENERGY

* OMERS Private Equity bought a minority stake in NovaSource Power Services for $100 million. The company provides solar operations and maintenance services to utility, commercial, industrial and residential customers.

* OEP Capital Advisors LP is selling the power generation division of BRUSH Group, an electrical equipment manufacturer, to Baker Hughes Co.

* Scout Clean Energy LLC, a portfolio company of Quinbrook Infrastructure Partners Ltd., and Elawan Energy agreed to sell the 199-MW Persimmon Creek Wind Farm in Oklahoma to Evergy Inc. for about $250 million.