Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Mar, 2024

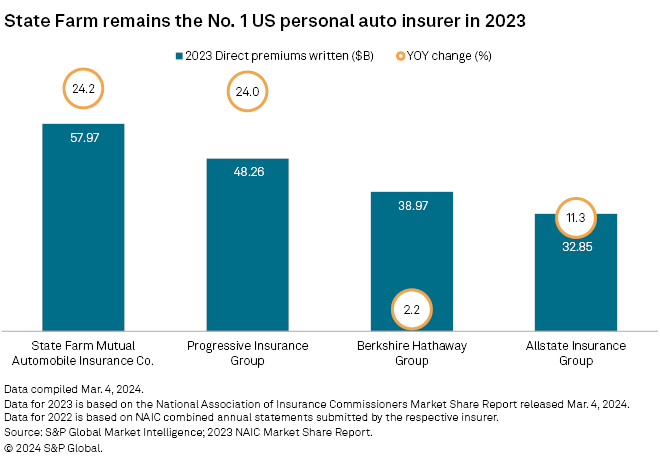

A tumultuous 2023 for the US personal auto business accelerated key changes at the top of the business line's market-share rankings that have been playing out over the past two years, according to preliminary data released by the National Association of Insurance Commissioners.

State Farm Mutual Automobile Insurance Co., which has long held the mantle of the No. 1 US personal auto insurer, solidified its leadership with its most rapid growth in direct personal auto premiums written in at least the last 25 years.

One year after The Progressive Corp. overtook GEICO Corp. parent Berkshire Hathaway Inc. to become the second-largest US personal auto insurance underwriter, the Ohio-based insurer significantly expanded what had been a narrow lead.

The National Association of Insurance Commissioners (NAIC) data, which is based on filings from 95.75% of expected individual property and casualty filers, shows Progressive with $48.26 billion in direct personal auto premiums written in 2023 as compared with $38.97 billion for the Berkshire Hathaway's US subsidiaries. Government Employees Insurance Co. and its GEICO affiliates accounted for 99.9% of Berkshire's direct personal auto premiums written during the first three quarters of 2023.

|

– Read about rate increases taken in 2023 by the largest personal auto writers |

The resulting market shares for State Farm, Progressive and Berkshire, according to the preliminary NAIC data, were 18.4%, 15.3% and 12.4%, respectively. These percentages will change based on the NAIC's incorporation of data from additional filers, and S&P Global Market Intelligence has not independently verified the results. Also, market-share percentages for 2023 in the NAIC data are not necessarily comparable to S&P Global Market Intelligence's values for prior years due to potential methodology differences and the lack of full availability of 2023 results from all expected filers as of this article's date of publication. Historical results cited in this article reference S&P Global Market Intelligence's consolidation of combined annual statement data, which presents results based on point-in-time group composition to exclude the effects of subsequent acquisitions or divestitures.

The preliminary NAIC data implies that direct personal auto premiums written for State Farm and Progressive soared by 24.2% and 24.0% while Berkshire's rose by only 2.2%. The results for Progressive and GEICO are consistent from a directional standpoint with disclosures in SEC filings, which showed that the former's personal lines net premiums written spiked by 24% while the latter's increased by 1.9% for a second consecutive year.

State Farm posted its largest overall market-share gains in at least 25 years, and its margin over Progressive widened by 31 basis points. By State Farm's gaining ground on Berkshire in each of the last two years, the gap between the two rivals stands at its widest point since 2016. Further, State Farm's overall share of the personal auto market grew to its highest point since 2014, the last year that incorporated the company's subsequently divested Canadian business.

Rate increases drive premium growth

Carriers across the personal auto business significantly raised rates in 2023 in response to the effects of loss-cost inflation. With losses continuing to mount through the first half of 2023, both Progressive and GEICO pulled back in 2023 on advertising spending, a key driver of new business growth in the direct personal auto business. Progressive also took various non-rate-related actions intended to curtail its expansion. Despite this, Progressive still showed growth in personal auto policies-in-force on a year-over-year basis; GEICO, meanwhile, posted a 9.8% decline in policies in force, contributing to its significantly lesser rate of written premium growth.

Looking ahead to 2024, Progressive has signaled its intent to ramp up its growth initiatives as personal lines combined ratios in recent months have been well below management's 96% target. GEICO's rate of premiums written growth began to show signs of acceleration during the second half of 2023. We estimate that its expansion of 6.7% in the fourth quarter of 2023 marked its most rapid growth in any quarter in five years after adjusting for the effects of its 15% COVID-19 discount on 2021 comparisons.

Personal auto writers continued to post direct incurred loss ratios in the business line at levels above historical norms but lower than 2022's historically elevated results, the NAIC data suggests. The 2023 personal auto direct incurred loss and defense-and-cost-containment-expense ratios calculated by the NAIC for State Farm and Berkshire were 87.6% and 75.6%, which represented improvements in excess of 10 percentage points, apiece, from 2022. Progressive's ratio was incrementally higher but at 70.8% well below that of its two rivals. Particularly poor 2022 results reflected high costs to repair and replace damaged vehicles due to pressures on automotive supply chains and the availability of skilled labor.

Carriers across the sector, including Progressive, have continued to pursue rate adequacy in 2024 as they seek to ensure business across market segments and geographies generates acceptable profit margins.