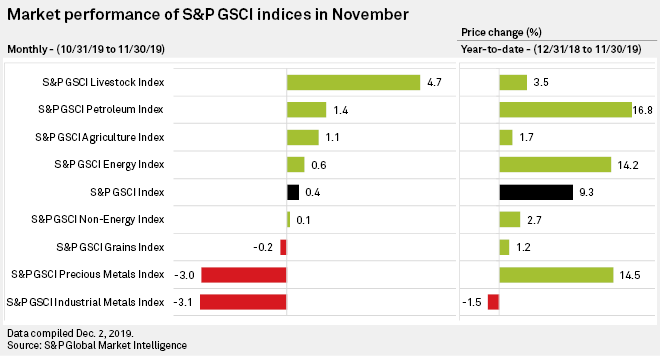

The S&P GSCI index of commodities was little changed in November as investors' renewed risk-on sentiment weighed on the appeal of gold while nickel experienced its worst drop in eight years.

Crude oil was lifted on expectations of longer output curbs before an OPEC meeting in early December.

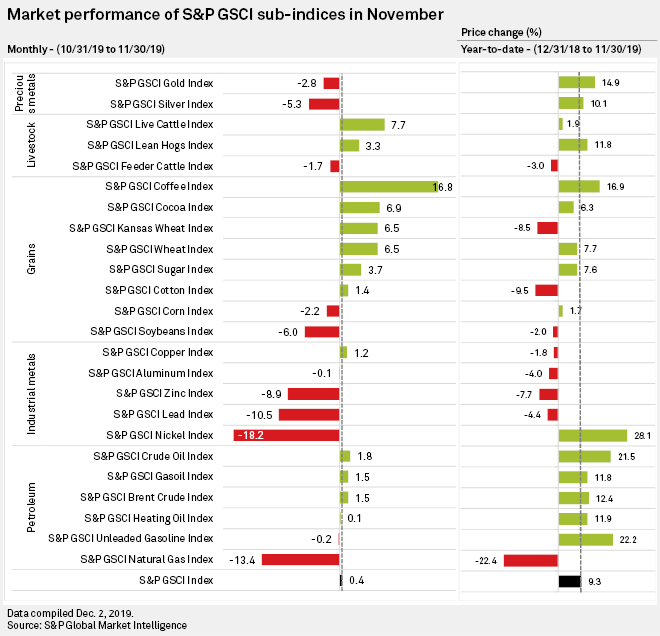

Gold lost its luster as investors sought riskier assets, with the yellow metal down 2.8% for the month, trimming its annual advance to 14.9%. Silver fell 5.3% in November for a 10.1% gain in the first 11 months of the year.

Investors returned to equities in November, pushing the S&P 500 index up by 3.6% during the period, as the U.S. and China edged toward a trade deal, even as key issues such as tariffs and agricultural purchases remained unresolved.

Nickel, an industrial metal in increasing demand because of its use in batteries, was the biggest loser in November with an 18.2% dive, the largest since September 2011. Despite that, it remains 28.1% higher this year, making it the biggest gainer among the 24 commodities in the S&P GSCI.

Nickel surged to a five-year high on Sept. 2 following Indonesia's announcement a ban on nickel ore exports, but has dropped precipitously since the government said Oct. 31 it planned to delay the move until next year.

The price of three-month nickel futures on the London Metals Exchange closed at $13,480 per tonne on the London Metals Exchange on Dec. 9.

"Expectations that next year’s Indonesian nickel ore export ban will lead to a tighter primary nickel market underpin our current forecasts for the average LME three-month nickel price to rise above the US$15,000/t level in 2020," Jason Sappor, a commodity analyst at S&P Global Market Intelligence, said by email.

The S&P GSCI Livestock Index outperformed other sub-indexes with a 4.7% increase, taking its year-to-date growth to 3.5%. Lean hogs prices are forecast to rise in the first half of 2020 on Chinese orders for the Lunar New Year and an expected decline in competing protein, according to Dutch lender Rabobank's.

The Petroleum Index rose 1.4% as OPEC and its allies weighed extending their agreement to cut output by 1.2 million barrels per day ahead of an expected market glut in the first half of 2020. The cartel of leading crude oil producers agreed on an extra 500,000 bbl/day of output cuts after the meeting on Dec. 5.

It was a mixed bag for the grains sector, which was little changed during the month. Soybeans futures reversed October's gains with a 6.0% monthly decline, while coffee climbed nearly 17%.

A global coffee supply/demand deficit of 3.2 million bags is projected in the 2019-20 crop year, Rabobank said. This is likely to be followed by a 2 million-bag surplus in 2020-21, with Brazilian farmers seen increasing their output to 66.7 million bags during the period.

S&P Dow Jones Indices and S&P Global Market Intelligence are owned by S&P Global Inc.