As First Citizens BancShares Inc. and CIT Group Inc. wait for the Federal Reserve to approve their merger of equals, deal advisers, equity analysts and industry observers are unsure what the holdup is.

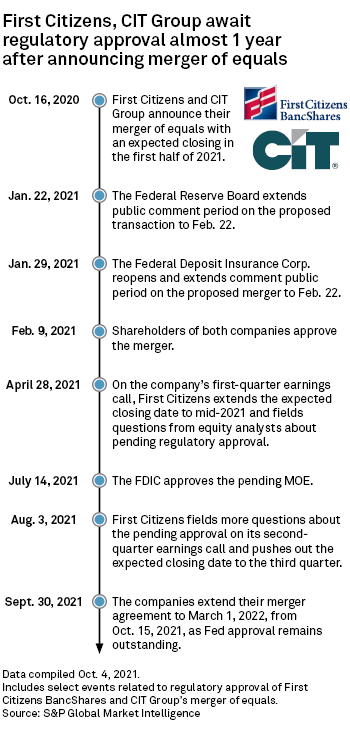

After pushing back the expected closing date of their MOE multiple times since announcing it in October 2020, First Citizens and CIT extended their merger agreement to March 1, 2022, from Oct. 15, 2021, as the parties await the Fed's sign-off. On its last two earnings calls and the press release announcing the amended merger agreement, the First Citizens management team has maintained that they are not aware of any problems that may be delaying approval.

According to S&P Global Market Intelligence data, the MOE is the only U.S. bank deal announced in 2020 that is still pending, aside from two deals involving private investors buying community banks. With no information from the Fed and limited details from First Citizens and CIT, industry experts are at a loss for what may be holding up the agency's approval, but they suspect the political climate is the most likely reason.

The Fed, First Citizens and CIT all declined to comment for this story.

|

Community protest

John Gorman, a partner at Luse Gorman PC, believes a community protest could potentially be holding up approval. A community protest can center around many concerns, including job cuts, branch closures and the pro forma company's ability to serve low- to moderate-income communities. When a community group objects to a transaction, it takes approval out of delegated authority, which in this case is the Richmond Fed, and boosts it to Fed Board of Governors, according to Gorman.

"D.C. can just be a black hole in terms of timing and trying to get something moved out in sort of an efficient manner," he said in an interview.

At least one group has expressed concern to the Fed over the merger — The Community Development Bankers Association, or CDBA — which flagged CIT's most recent subpar Community Reinvestment Act performance evaluation in a Feb. 3 letter to the regulator.

However, the CDBA clarified in a follow-up call with the agency that it was not opposing the merger, Brian Blake, CDBA's director of public policy, said in an interview.

"Our letters are pushing towards good behavior rather than trying to discourage banks from undertaking things that they've decided are in the interest of the shareholders," Blake said. "It was especially important to draw attention to the fact that CIT, as opposed to First Citizens, had been in the habit of setting out explicit goals for community development and then only getting halfway or three quarters of the way there."

On the day the FDIC and Fed's comment period closed, First Citizens announced a $16 billion community benefits plan that will support lending and investing in the areas of affordable housing, small business and community development over five years between 2021 and 2025, following the completion of the proposed merger with CIT, according to the press release.

That announcement may have been in response to community concerns about the pro forma company's CRA efforts, but those concerns are unlikely to hold up the Fed's approval, according to Matthew Lee, executive director of Inner City Press and Fair Finance Watch and someone who has lodged numerous objections to bank deals.

"My recent experience with the Fed under [Chair] Jay Powell is that CRA is not given the weight that it should be, so I don't think it's the reason here," he said. "As a protester, I would love to think that a single protest is delaying the deal, but I doubt that's the case."

Changing of the guard

Instead, the change in administration and President Joe Biden's recent executive order, which touched on increasing scrutiny of bank deals, could be playing into the Fed's hesitation, industry experts said.

"There's some of those political headwinds," Gorman said. "They're sensitive to the music sheets being distributed by the new sheriff in town."

The Fed could be taking its time reviewing the merger to "dot their Is and cross their Ts to address the issues they think can be raised from a political standpoint and make sure they cover the bases" in light of Biden's stance on increased scrutiny of M&A, Gorman said.

D.A. Davidson analyst Kevin Fitzsimmons agreed that it "does not seem unreasonable" that the Fed is likely just taking its time.

"It's undeniable that we're in more of an administration and a Democratic majority that is not carrying the banner for deregulation and making things faster and easier," he said in an interview. "There's going to be more scrutiny and potential criticism about a bank getting larger and more complex."

The delay may also be an attempt by Powell to "seem more serious on merger review" as his term expiration nears and to send a message about the regulator's stance going forward on large bank M&A, Lee said.

"The Fed never denies applications. They pretty much send a message if they want to send one by delaying. But what's the point of a message if nobody knows? … The ball is in their court to say why," Lee said. "Absent finding out that there's some unknown major compliance issue, I think the politics of the future chair is definitely an issue here."

Despite a potential protest or increased political scrutiny, Gorman, Lee and Fitzsimmons all agree it is a matter of when, not if, First Citizens and CIT's MOE will get Fed approval.

"Odds are it is on its way to approval," Gorman said. "It'd be a rare exception where the FDIC would approve something where they think there are issues at the Fed, not to say that can't happen."