Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 May, 2022

By Beata Fojcik

Polish banks face higher costs and lower profits as a result of a new government program that will shake up the country's mortgage market.

The borrowers' support program will help consumers for whom mortgage repayments have increased sharply in conjunction with rising central bank rates. Banks' profits, which are also increasing, could be crimped by a requirement to directly fund the initiative. The plan also proposes to change how mortgage repayments are calculated in a way that will mean thinner margins for lenders in the future.

"[The program] will have a significant impact on the results of the banking sector, estimated at 5 billion zlotys to 6 billion zlotys ($1.1 billion to $1.4 billion) this year alone," DM BOŚ analyst Michał Sobolewski told S&P Global Market Intelligence.

Pressure on households, pressure on banks

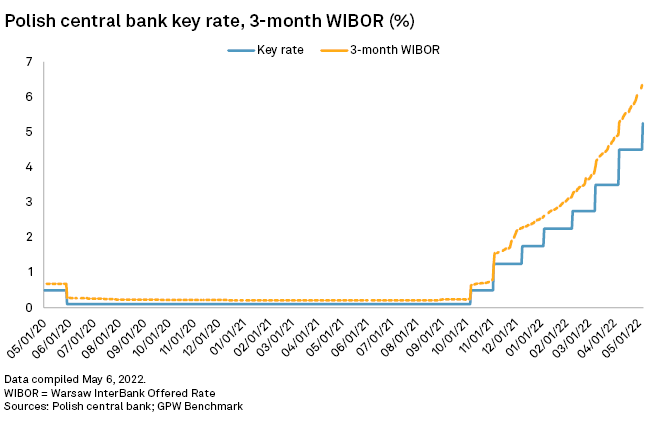

Inflation, fueled by higher energy and food costs and exacerbated by Russia's invasion of Ukraine, reached 12.3% in April and has put pressure on Polish household incomes. The central bank has hiked rates to 5.25% from 0.1% in the last eight months and mortgage repayments have grown in parallel — a monthly mortgage payment has increased by about 70% since the start of the monetary policy tightening cycle in October 2021, according to Poland-based real estate developer HRE Investments.

Under the program, lenders will need to contribute to an existing support fund for borrowers as well as a separate new fund designed to bolster the banking sector's resilience. Poland's banks include subsidiaries of Banco Santander SA, ING Groep NV, BNP Paribas SA and Commerzbank AG.

The government is also proposing to replace the Warsaw interbank offered rate, or Wibor, which is used to calculate mortgage interest rates, with a lower rate from 2023. This could reduce monthly mortgage repayments by a total of about 1 billion zlotys annually and cut bank margins on mortgages by an average of 0.3 or 0.4 percentage point through the lifecycle of a loan, according to government estimates.

Borrowers will also be able to delay some mortgage payments from July under the program, which was announced by Poland's prime minister, Mateusz Morawiecki, in late April. Some elements such as the Wibor replacement have yet to be finalized but Morawiecki said a "political decision" has been taken to implement the program. A consultation is set to be launched May 10.

Banks should be able to absorb the associated "big cost" as they have benefited from rising central bank rates, the prime minister said. As rates rise, banks can generate more net interest income — revenue from loans minus expenses on deposits — as they pass on higher rates to borrowers.

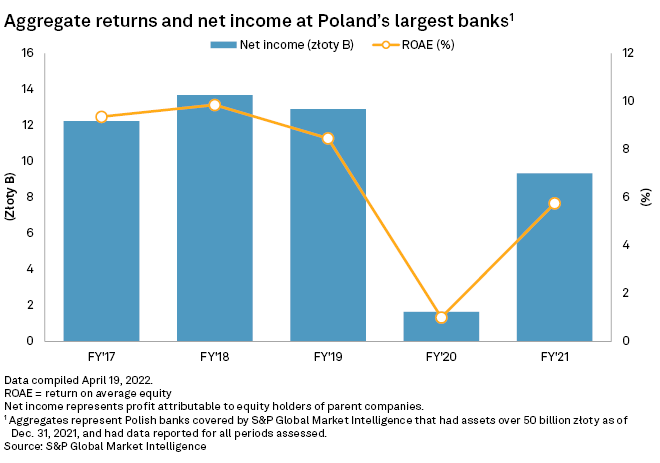

Indeed, the aggregate net profit and returns on equity of Polish banks grew in both January and February, according to data from the Polish financial regulator, and could reach record levels this year amid a positive rate environment, Sobiesław Kozłowski, who heads the analysis department at Polish broker Noble Securities, told Market Intelligence. In 2021, the sector saw a profit rebound amid a post-pandemic recovery.

Still, the program will negatively impact banks' future profits and increase political risk for the banking sector as investors worry about possible similar proposals in the future, BNP Paribas Bank Polska SA analysts said in an April 25 note.

Ahead of upcoming parliamentary elections in 2023, politicians in Poland could be tempted "to prove themselves" by implementing consumer-friendly actions such as the mortgage repayment holidays the government is proposing, Kozłowski said.

In the short term, the requirement to pay an additional 1.4 billion zlotys into the existing 600-million-zloty borrowers' support fund will have the greatest impact on banks, reducing aggregate 2022 earnings by about 7%, according to Michał Konarski and Mikołaj Lemańczyk, analysts at the brokerage unit of Commerzbank's Polish unit mBank SA. But returns on equity should stay above the cost of capital, and loan repayment holidays should not have a big effect, they wrote in an April 26 note.

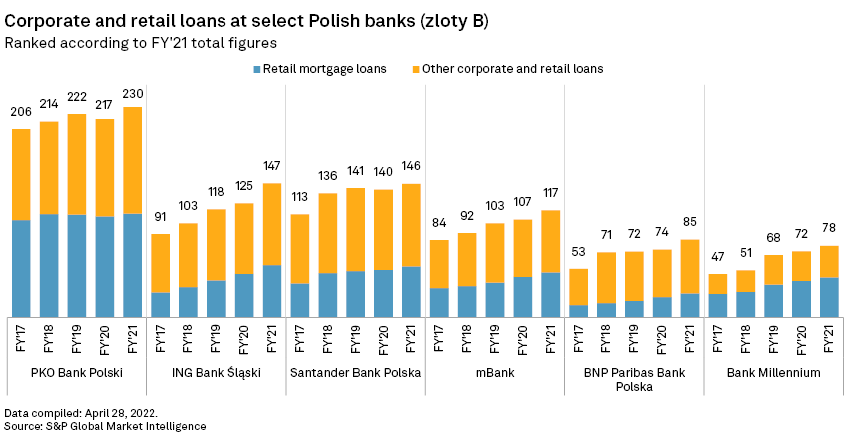

Banco Comercial Português SA's Polish unit, Bank Millennium SA, and PKO Bank Polski SA have the greatest number of mortgages as a proportion of total loans among Poland's big banks — 55.9% and 49.4%, respectively, as of the end of 2021. BNP Paribas Bank Polska has the lowest proportion, Market Intelligence data shows.

Bank Millennium is likely to be the most affected by the government plan, according to the mBank analysts. Bank Millennium did not comment on the plan when contacted by Market Intelligence, saying it was awaiting more details.

Poland's largest lender PKO said the plan is "an adequate response" to the challenges facing borrowers. Other banks contacted by Market Intelligence declined to comment or did not respond.

Wibor replacement

The banks, along with Wibor rate-setting organization GPW Benchmark, will have until the end of 2022 to work out a replacement for Wibor to calculate mortgage interest rates. If they fail to do so, Wibor could be replaced by the Polonia overnight interbank rate, which is set by the central bank, according to Polish government officials.

Most mortgage loans in Poland have floating interest rates, which are tied to the three- or six-month Wibor. The three-month Wibor increased to over 6% in early May from 0.25% in October 2021, responding to rising central bank rates. The Polonia interbank rate was 4.46% as of May 5.

As well as impacting banks' margins, the proposed Wibor replacement could encourage customers to file lawsuits against banks, according to DM BOŚ's Sobolewski. Polish media outlets earlier reported on several lawsuits launched by borrowers arguing that Wibor does not reflect the actual cost of financing for banks and thereby creates unfair opportunities for them to increase their earnings.