Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Dec, 2021

By Shreya Tyagi

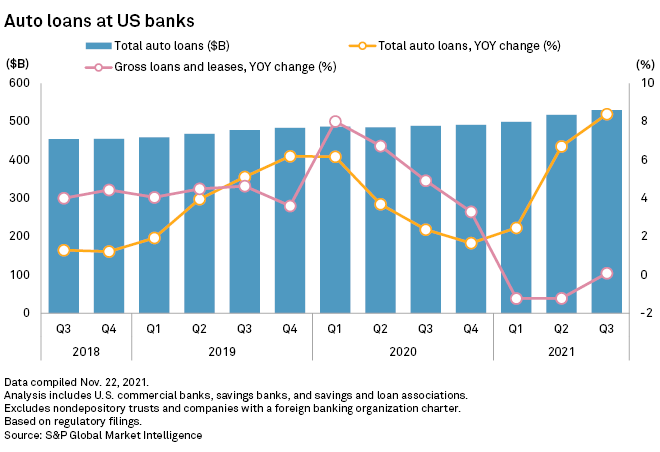

The auto segment continued to be the ace up lenders' sleeves during the third quarter in terms of loan originations, revenue and credit. Auto loans recorded solid growth, rising 8.4% year over year for the quarter ended Sept. 30, whereas gross loans and leases rose 0.1% in the same period.

Banks' total auto loans rose to $530.20 billion in the third quarter, up from $518.11 billion in the second quarter and $489.16 billion in the year-ago period.

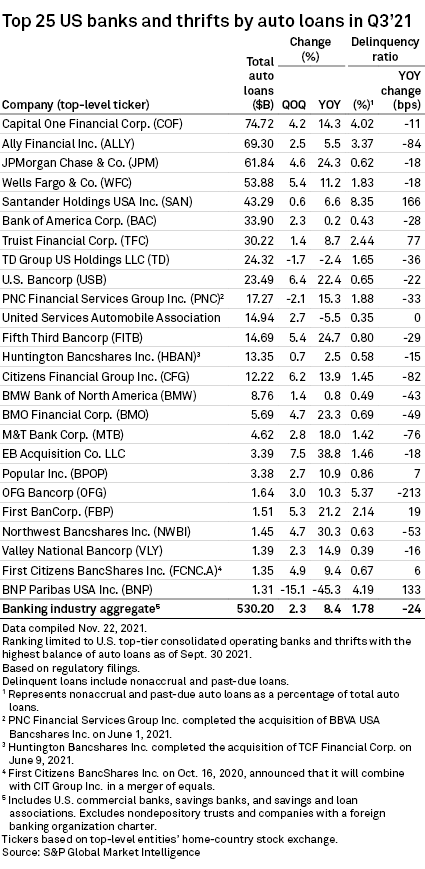

Of the top 25 banks and thrifts by auto loans in the third quarter, Capital One Financial Corp. stayed in the No.1 spot as the top auto loan lender for the fourth consecutive quarter. The bank, with a loan book size of $74.72 billion in total auto loans, posted a 4.2% quarter-on-quarter and a 14.3% year-over-year rise in auto loans.

During the third-quarter earnings call, Capital One CEO Richard Fairbank said that driven by auto, third-quarter ending loans increased 12% year over year in the consumer banking business.

Highlighting the "exceptional" growth in the auto industry, he said that it's like "four or five planets that are aligned in the auto business that I don't think in our lifetimes are going to align again."

Ally Financial Inc., whose total auto loans rose 2.5% sequentially and 5.5% on a year-over-year basis to $69.30 billion, took the second position. In the group, EB Acquisition Co. LLC recorded the highest sequential rise in auto loans at 7.5%, while BNP Paribas USA Inc. and TD Group US Holdings LLC were outliers as they posted declines from both the quarter-ago and year-ago periods.

Despite strong consumer demand, the global chip shortage has plagued auto sales and driven car prices higher. While there's no consensus view on when the chip-crisis will end, Ally's CFO Jennifer LaClair expects inventories and chip dynamics to normalize by late 2022 or early 2023. Recently, Commerce Secretary Gina Raimondo urged the House of Representatives to pass legislation that supports U.S. production of semiconductor chips to tackle supply disruptions, according to a CNBC report.

However, this phenomenon has little affected lenders and dealers' margins, which have been increasing due to high demand and elevated car prices. To protect consumer demand, lenders have resorted to offering competitive product offerings, while dealers are providing a discount on sales.

"We are seeing growing competition in the auto business. It's showing up across the board from big banks, credit unions, and smaller independent lenders, and we're seeing it play out across all credit segments. It's showing up in pricing, underwriting and loan terms," Fairbank said.

Going into 2022, LaClair expects "robust application flow and robust originations likely in that $40 billion, maybe not quite to $45 billion. So there could be some modest reductions." She added that a detailed outlook is likely in January.

Fairbank proposed adopting a cautious approach about "where the marketplace will go and also understand that ... at some point those planets won't be as aligned as they have been."

Click here for an industry document detailing auto loan holdings.