Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Jun, 2021

By Beata Fojcik

Under Zbigniew Jagielło's tenure, PKO Bank Polski SA made a string of acquisitions and more than doubled its asset size, but the CEO's surprise resignation has raised questions about whether Poland's largest bank will face growing political interference.

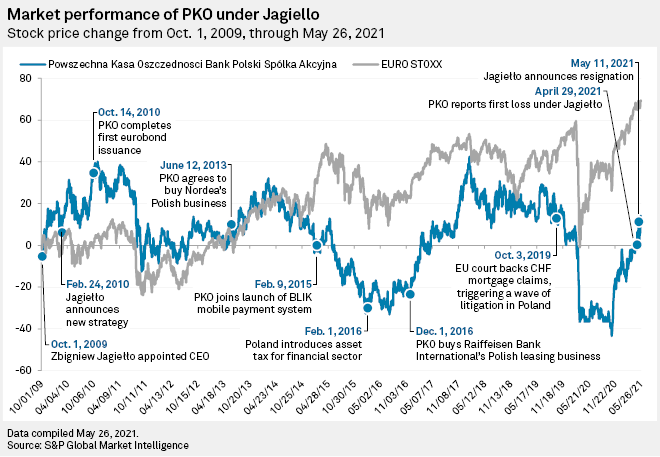

Jagiełło, who had survived several attempts to remove him from the post since his appointment in 2009, did not disclose why he resigned, but media outlets suggested it was linked to disputes within Poland's governing coalition, whose competing factions wanted to gain influence over the state-controlled bank. A few days after the resignation was announced May 11, the ruling PiS party's leader Jarosław Kaczyński said Jagiełło's successor would most likely be selected from among PKO's existing management board members.

Jagiełło is credited with implementing a commercial and digital transformation at PKO. In a 2019 interview with Rzeczpospolita, he said he initially had to change how the bank was viewed by its own employees, who were doubtful whether it could successfully combine the public mission of a state-owned bank with commercial goals.

State control

PKO has been a state-controlled financial institution since its inception. But Poland's ruling party PiS has, since coming to power in 2015, stepped up efforts to increase state control of the economy, including the financial sector.

The "redomestication" of banks promises greater autonomy in decision-making and improved resilience to global financial crises. But the participation of government has also led to concerns by investors that banks might be used to finance unprofitable entities or sectors.

Jagiełło's leadership of PKO over the last 12 years has been seen by the market as a sign of stability, and helped reposition it as a modern, digital financial institution and strengthen its leading position in the banking sector.

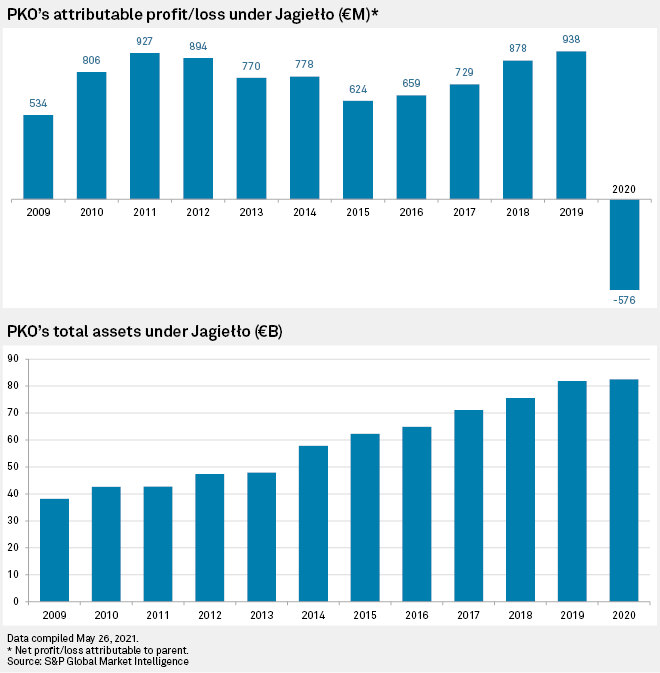

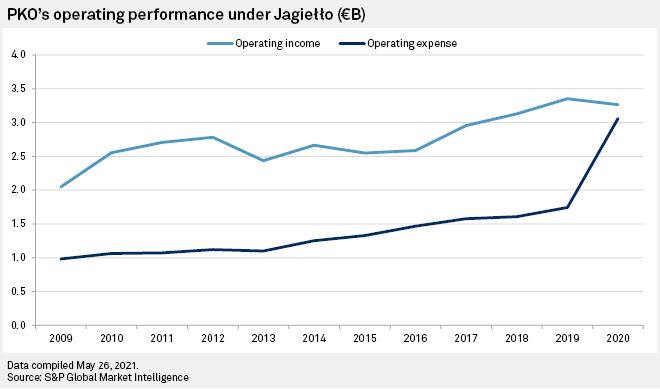

During his tenure, the bank's assets increased from less than €40 billion in 2009 to more than €80 billion in 2020, and its annual operating income has steadily grown. It strengthened its position in various markets via M&A, including the purchase of Nordea Bank Abp's Polish banking and insurance operations, the leasing unit of Raiffeisen Bank International AG and the local asset management business of KBC Group NV. The bank also opened branches in Germany, the Czech Republic and Slovakia as part of efforts to strengthen its regional and international presence.

However, in an interview published by Rzeczpospolita on the eve of his resignation, the executive said that "acquisitions have lost their charm" and there were no attractive M&A targets for the lender within the Polish banking sector.

In addition to potential political pressure, the new CEO will have to deal with the economic fallout from the COVID-19 pandemic and general risks the country's banking sector is facing in relation to its Swiss franc mortgage exposure.

Swiss franc mortgages

These factors played into a loss for 2020 — the first since Jagiełło's appointment as CEO. However, it reported a first-quarter 2021 net profit of 1.18 billion zlotys on lower credit losses and administrative expenses. With 6.7 billion zlotys already set aside for potential settlements with Swiss franc mortgage holders, the lender's top managers recently said the bank currently has no plans to create additional loan loss provisions on its Swiss franc mortgage portfolio and would like to return to dividend payments as soon as possible, subject to the decision of Poland's Financial Supervision Authority.

It will be difficult for the new CEO to gain the sort of market trust that Jagiełło enjoyed, according to Millennium Brokerage House analyst Marcin Materna, cited in Parkiet. The analyst also suggested that markets should watch out for information regarding PKO Bank's other key executives as their departure could be a negative for the lender.

As of May 31, US$1 was equivalent to 3.67 Polish zlotys.