Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jun, 2021

| Public Service Enterprise Group's 1,172-MW Hope Creek nuclear plant in Salem County, N.J. PSEG unregulated arm PSEG Power, which owns Hope Creek, cleared 6,310 MW of capacity in the PJM Interconnection's 2022-2023 auction at an average price of $98/MW-day. Source: Public Service Enterprise Group Inc. |

The low clearing prices in the PJM Interconnection's 2022-2023 capacity auction are expected to further impair merchant generators and coal-fired power plants already struggling to compete in the market.

The clearing price for the majority of PJM's footprint fell to $50/MW-day in the 2022-2023 capacity auction, down from $140/MW-day for the unconstrained regional transmission organization region in the 2021/2022 capacity auction.

Prices in regions with transmission constraints cleared higher but were still lower than the 2021-2022 auction results, PJM said June 2.

Working on a compressed time frame, PJM will hold its next capacity auction in December, but it is unclear if prices will rebound for the 2023-2024 delivery year.

"I do think it doesn't bode well for merchant generation," Glenrock Associates LLC analyst Paul Patterson said in a June 9 interview. "Somebody's got to get bumped."

The capacity auction, last held in May 2018, was pushed back after the Federal Energy Regulatory Commission determined that PJM's capacity market rules failed to protect the market from the price-suppressive impacts of out-of-market state support for certain resources, such as renewable and nuclear generation.

FERC mandated that PJM expand its minimum offer price rule to set administrative price floors for all new and some existing resources seeking to bid into its capacity market that receive material state subsidies.

Operating under the rule change, the delayed capacity auction procured 144,477 MW of resources in the RTO for the June 2022 to May 2023 delivery year at a total cost of $3.9 billion and with a 21% reserve margin, PJM announced.

On the renewables front, more than 1,700 MW of wind and more than 1,500 MW of solar cleared the 2022-2023 auction, the results show.

About 23,000 MW of unconstrained capacity did not clear.

Well below expectations

Dominion Energy Inc. subsidiary Dominion Energy Virginia, known legally as Virginia Electric and Power Co., removed about 17,000 MW of resources and load out of the May capacity auction by pursuing the fixed resource requirement, or FRR, route.

It remains unclear whether Dominion's decision help or hurt clearing prices.

In a June 7 report, Moody's said the auction results came in well below the rating agency's expectations, with the outcome "credit negative for power projects and power generation companies because it reduces high-visibility, high-margin revenue and directly impacts cash flow."

In addition, Moody's said the auction result "raises the possibility of a similar low outcome in the 2023-24 auction this December, absent significant supply reductions or an upward revision to the demand curve."

"The negative credit impact is magnified for power generation projects or companies because they consist of a single asset or a small portfolio of assets and are less diversified than the larger, unregulated utility companies that also compete in PJM," Moody's analyst Gayle Podurgiel wrote in the report. "Issuers with a high proportion of peaking assets and those located in regional areas with the greatest pricing declines relative to the previous auction are most exposed. The capacity market outcome is positive for load-serving entities in PJM because it lowers the price for their end-use customers."

Waning coal generation

Glenrock's Patterson said "the writing has been on the wall" for coal generation and older units.

There was a reduction of 8,175 MW of coal generation from the previous auction, when accounting for resources committed to FRR plans, according to PJM.

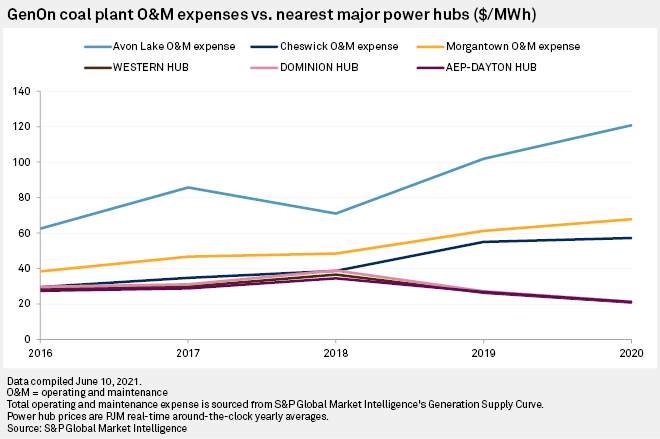

While not blaming the auction itself, independent power provider GenOn Holdings LLC on June 9 announced it will retire about 2,400 MW of coal capacity at its Avon Lake, Cheswick and Morgantown power plants beginning in September. All three plants operate in the PJM market.

"The decision to initiate the retirement of these coal units is driven by unfavorable economic conditions, higher costs including those associated with environmental compliance, an inability to compete with other generation types, and evolving market rules that promote subsidized resources," GenOn said in a news release.

GenOn previously planned to retire the Morgantown units by Oct. 1, 2027, as part of a deal reached in December 2020 with Maryland state lawmakers.

Moody's noted that the auction outcome "likely accelerates coal plant retirements."

"Incremental coal retirements announced ahead of the December 2021 auction will be positive for that auction's outcome because they reduce supply," Podurgiel wrote.

Merchants hurting

Nuclear generation, meanwhile, cleared an additional 4,460 MW compared to the 2018 auction when accounting for FRR elections.

Still, Exelon Generation Co. LLC's 2,346-MW Byron Generating Station, 1,805-MW Dresden and 1,819-MW Quad Cities nuclear plants in Illinois failed to clear the auction, parent company Exelon Corp. said June 3.

The company is continuing to advocate for legislative support for its nuclear plants, though it has also said it will shut Byron and Dresden later this year. Quad Cities receives subsidies under Illinois legislation approved in 2017.

In addition, Exelon in late February announced the separation of its regulated utility business and its competitive power generation business into two publicly traded companies.

Nearly 20,000 MW of the generation fleet is in the PJM footprint, according to S&P Global Market Intelligence data.

Independent power producer Vistra Corp. announced June 3 that it cleared 7,218 MW in the capacity auction at a weighted-average clearing price of $66.89/MW-day, or a total capacity revenue of $176 million.

Public Service Enterprise Group Inc. disclosed in a June investor presentation that unregulated arm PSEG Power LLC cleared 6,310 MW of capacity in the 2022-2023 auction at an average price of $98/MW-day. PSEG Power cleared 7,700 MW in the 2021-2022 capacity auction at an average price of $166/MW-day. Months before the auction, PSEG announced it was exploring strategic alternatives for PSEG Power's non-nuclear generation fleet.

In a June 3 investor presentation, NRG Energy Inc. disclosed it cleared 2,417 MW of capacity at an average price of $71.36 in the 2022-2023 auction. NRG cleared 4,619 MW in the 2021-2022 capacity auction at an average price of $191.12. The company, which operates more than 5,000 MW of net generation capacity in PJM, said it is "evaluating all options to mitigate lower capacity prices."

The future for merchant generation continues to look bleak, according to industry observers, especially as PJM continues to procure capacity in excess of its reserve margin.

"You're going to have more supply in an anemic demand market," Patterson said. "That doesn't look good."