Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jun, 2022

By Zack Hale

| The PJM Interconnection's latest capacity auction results reflected the 13-state grid operator's transition to a cleaner energy mix. Source: Alexandr Muşuc/Getty Creative via Getty Images |

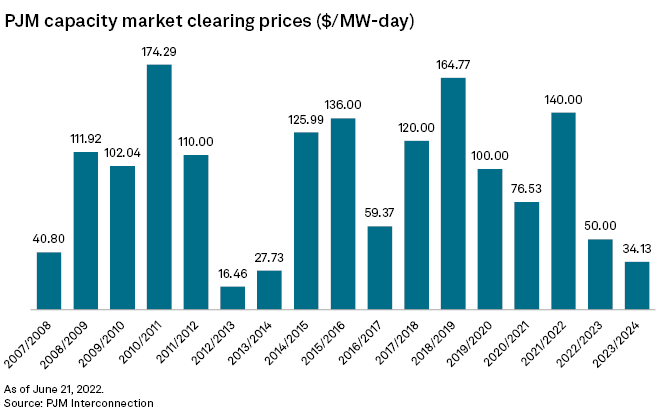

The PJM Interconnection LLC on June 21 reported a marketwide clearing price of $34.13/MW-day for its most recent forward capacity auction, a decrease from the previous auction's clearing price of $50/MW-day.

The decrease was largely driven by the 13-state grid operator's transition to a cleaner energy mix as more expensive coal- and gas-fired generating units with higher marginal fuel costs continue to be retired.

PJM is one of three regional grid operators in the Eastern U.S. that runs mandatory capacity auctions to secure sufficient power supplies at all times. Similar to the ISO New England, PJM holds its capacity auctions three years in advance of delivery of supply. Clearing prices are set by the highest marginal bidder.

In addition to ensuring grid reliability, PJM's auction results are also intended to guide market entry and retirement decisions.

PJM's auction for the 2023/2024 delivery year was originally scheduled for May 2020, but the grid operator was forced to delay that auction for two years due to disputes at the Federal Energy Regulatory Commission over its application of a minimum offer price rule, or MOPR.

In December 2019, a Republican majority at FERC frustrated clean energy advocates by directing PJM to expand its MOPR to cover all new and some existing generation resources receiving material state subsidies. However, PJM jettisoned its expanded MOPR, which imposed an administratively-set price floor for subsidized units, after states with aggressive clean energy policies threatened to pull their power providers out of the PJM capacity market.

The 2023/2024 capacity auction marked the first PJM capacity auction without the expanded MOPR in place.

Auction results

"We are experiencing the transition to lower carbon-emitting resources, and we see that transition continuing with this auction," Stu Bresler, PJM's senior vice president of market services, said during a June 21 media briefing.

Overall, PJM's auction procured 144,871 MW for the commitment period covering June 1, 2023, through May 31, 2024, at a cost of $2.2 billion. That represents a $1.8 billion decrease in capacity costs from the auction for the 2022/2023 delivery year. The results will give PJM a 20.3% reserve margin, which exceeds its required reserve margin of 14.8%.

Transmission-constrained zones within PJM's footprint continued to post higher clearing prices than unconstrained zones. PJM's Mid-Atlantic Area Council region procured capacity at $49.49/MW-day, down from $95.79 in the previous auction.

Capacity zones covering Baltimore Gas and Electric Co.'s service territory, as well as the Delmarva Peninsula including most of Delaware, Maryland's Eastern Shore and two counties in Virginia, coincidentally posted the same clearing price of $69.95/MW-day. In the previous auction, the BG&E capacity zone procured capacity at $126.50/MW-day.

For the 2023/2024 delivery year, no capacity zone recorded a clearing price higher than $70/MW-day.

PJM noted in a news release that cleared carbon-free capacity grew year over year by 5,000 MW, led primarily by 5,315 MW of existing nuclear capacity that failed to clear in the previous auction. It did not identify specific nuclear units that cleared this year's auction.

Cleared solar capacity increased by 25%, totaling 1,868 MW, while wind capacity decreased by 434 MW to 1,294 MW. PJM said fewer wind resources were offered.

Bresler noted that PJM's latest auction was also the first in which the grid operator used an approach known as "effective load-carrying capability" to assign varying capacity values to different resource types.

"That had probably different impacts on different types of resources," Bresler said. "It could have resulted in a lower capacity value for certain resources, like wind, and potentially higher capacity values for certain resources like solar."

The auction cleared an additional 1,685 MW in natural gas-fired resources. An approximately 3,600-MW increase in gas-fired combined-cycle units was offset by a reduction in combustion turbine capacity.

"What I see there is, again, an increase in commitment of newer, less carbon-emitting, more efficient, more technologically advanced combined-cycle units," Bresler said.

PJM also saw a 7,200-MW reduction in cleared capacity for steam-fired units such as coal-fired generators.

Those results are in line with analysts' predictions that higher participation by zero-carbon resources, as well as a more restrictive market seller offer cap, could exert more pressure on thermal generators with higher marginal fuel costs.

Bresler stressed that "it would be purely speculative, if not impossible" for PJM to determine the precise effects that its revised market rules may have had on the auction results. "We can't speculate on how each market seller might determine their offers," he said.

PJM's next forward capacity auction, covering the 2024/2025 delivery period, is scheduled for December 2022.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.