U.S. bank margins hit a new low in the first quarter as excess liquidity continued to swell on institutions' balance sheets.

The banking industry's aggregate taxable equivalent net interest margin dropped to 2.53% in the first quarter of 2021, down nearly 10 basis points from the prior quarter and down notably from 3.16% in the year-ago period.

The median margin across the industry dipped to 3.31% from 3.37% in the fourth quarter, while the median among the 20 largest U.S. banks fell to 2.10% from 2.18% in the prior quarter.

Margins were hit again by persistently low rates and a glut of cash fueled by explosive deposit growth. Loan growth, meanwhile, has remained hard to come by as weak borrower demand persists.

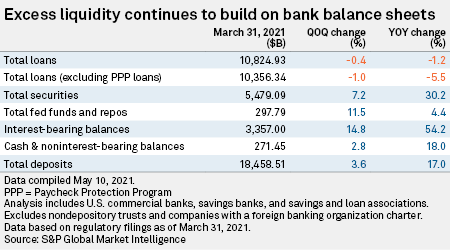

Through the first quarter, deposits rose 17.0% from the year-ago period, when funds had already begun to surge into the banking system during the early days of the pandemic. Loan balances dipped 1.2% year over year but actually dropped 5.5% when excluding loans made through the Paycheck Protection Program.

As deposits continued to flood bank balance sheets, the industry's loan-to-deposit ratio plunged to 58.64% in the first quarter from 69.48% a year earlier.

Deposit growth has shown no signs of slowing as the Federal Reserve's monetary policy remains accommodative, while consumers and commercial customers continue to stockpile cash. Since the end of the first quarter, the Federal Reserve's H.8 report, which tracks commercial bank balances, shows that deposits continued to grow through the week ending May 5, increasing 2.2% since March 31.

Deposit growth has been supported by the Fed's efforts to flood the markets with liquidity through quantitative easing, which in turn has increased the level of reserves in the banking system. The Fed has maintained that it will continue asset purchases until its employment and inflation goals are met.

Government stimulus has supported deposits as well, sending U.S. savings rates above 12% in every month since April 2020. Before the pandemic began, the monthly savings rate exceeded 10% just once since January 2000. Consumers have accumulated nearly $2.4 trillion in excess savings since the pandemic began. That figure is estimated by assuming every dollar over the monthly average savings between January 2017 and February 2021 was excess.

Deposit growth has also been supported by PPP borrowers parking the funds they received. While small-business borrowers utilized some of those funds, bankers have said that deposit balances crept back up after PPP loans were forgiven. Some institutions have said that commercial borrower behavior appears to have changed after coming under stress during the pandemic. Now, some of those commercial customers want to operate with less leverage and plan to hold more cash at the bank going forward.

Banks do not appear to have deployed much of the excess liquidity since the end of first quarter of 2021 either. While banks reported in the Federal Reserve’s latest Senior Loan Officer Opinion Survey published in April that demand in several loan categories such as auto, credit card and construction and land development loans had increased in the first quarter, that does not appear to have manifested into much growth yet.

The Fed's H.8 data shows that loans had barely grown since the end of the first quarter through the week ended May 5.

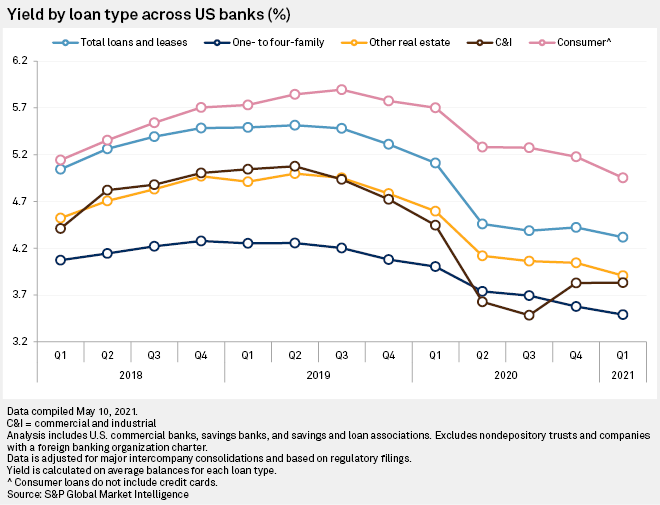

The few newly originated credits coming on banks' books have carried low yields due to historically low interest rates. The pressure on loan yields has been exacerbated since PPP loans have been responsible for much of the recent loan growth and those credits carry rates of just 1%. The program offered small businesses low-rate, forgivable financing provided that borrowers use a majority of the funds for payroll. While the loans carry low rates, the credits are expected to bring fees of about 3% on average once loans are forgiven.

The PPP forgiveness process helped keep yields on commercial and industrial credits steady in the first quarter. Yields on other asset classes declined though as higher-yielding loans originated before interest rates plunged paid off or matured.

The industry's loan yield dipped to 4.32% in the first quarter from 4.42% in the fourth quarter of 2020 and 5.11% a year ago.

Margins were also negatively impacted by banks putting more funds to work in low-yielding assets like interest-bearing balances due — deposits at other banks— which jumped 54.2% year over year off an already high base. Interest-bearing balances jumped in the early days of the pandemic as banks parked the flood of deposits at the Fed. The low-yielding assets have continued to rise notably since then due to the lack of attractive opportunities to put cash to work.

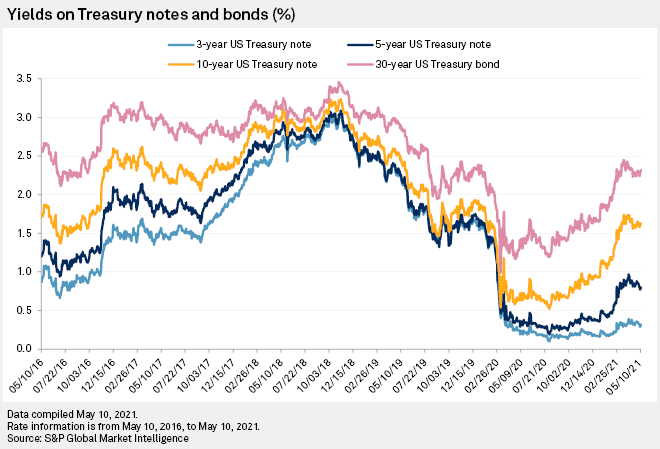

Banks have continued to grow their securities portfolios at an elevated rate, increasing those portfolios 7.2% from the prior quarter and 30.2% from year-ago levels. Yields on new investments likely remain below pre-pandemic levels but have improved over the last quarter, with the average yield on the 10-year Treasury jumping 46 basis points in the first quarter from the linked quarter. Long-term rates have risen further since then, with the average 10-year Treasury yield increasing another 31 basis points through mid-May from the levels witnessed in the first quarter.

Further increases in long-term rates should offer some support for bank margins, but the key profitability metric is unlikely to expand notably until institutions can effectively deploy excess liquidity into their loan portfolios.