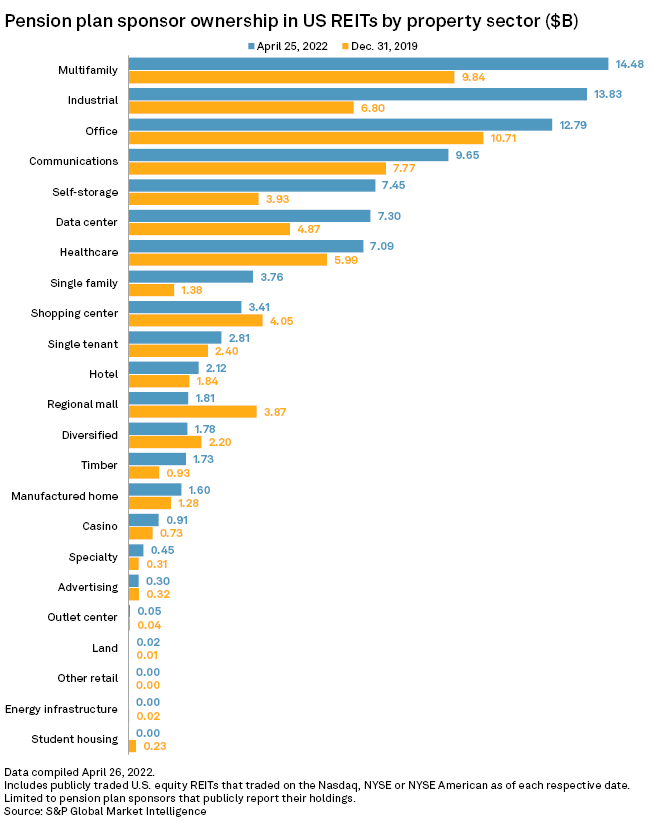

Pension plan sponsors have significantly increased their investments in U.S. real estate investment trusts that specialize in multifamily, office and industrial properties since the end of 2019, S&P Global Market Intelligence data shows.

Multifamily investments were $14.5 billion as of April 25, up by 47.2% from the end of 2019. Industrial investments were $13.8 billion, up by 103.4%, while office investments increased to $12.8 billion, up by 19.4% during the same period.

The findings are in line with the 2022 Pension Real Estate Association Intentions Survey, which found that 31% of planned capital deployments by institutions this year are targeting multifamily, while 28% are targeting industrial.

"Low vacancy and record rent growth in multifamily makes it an especially attractive sector, while industrial continues to benefit from the boom in online retailing, and huge demand for modern logistics space, which was only accelerated by COVID-19," PREA Director of Research Greg MacKinnon said in an interview.

The sector's preference for certain property types is reflected in the individual REITs that have seen the greatest uptick in pension fund investment since the onset of the pandemic.

Los Angeles-based office REIT Hudson Pacific Properties Inc. had the largest increase in pension fund investment, up 8.9 percentage points as of April 25 since the end of 2019, the data showed. The firm primarily owns office properties in California and Washington state.

Atlanta-based Americold Realty Trust, an industrial REIT that focuses on cold storage facilities, saw an increase of 7 percentage points in pension fund investment during the same period. Highlands Ranch, Colo.-based UDR Inc. a multifamily REIT, saw an increase of 4.5 percentage points.

Office has typically attracted pension fund investment in the past, and during the pandemic, further interest may have been spurred by a downside overreaction, MacKinnon said. While office REIT prices fell significantly on negative discussions about the return to the office, the reality was never as bad or permanent as many thought at the time.

"Values of the underlying office properties were not affected nearly as much as REIT prices [were] during COVID, leaving office REITs undervalued in the eyes of many investors and hence attracting capital," MacKinnon said.

That said, office is expected to attract much less capital than multifamily or industrial in 2022, due to continuing uncertainty and long-term risks surrounding future demand for office space.

Institutional investors are also becoming more interested in nontraditional property sectors like build-to-rent single-family homes, data centers, student housing, medical office and biotechnology lab space.

"Much of this interest began pre-COVID, but has accelerated in the aftermath of the pandemic," MacKinnon said.

MacKinnon said REITs will continue to attract significant and increased investment from institutional investors. According to the PREA survey, the average allocation to real estate in an institutional portfolio at the end of 2021 was 8.9%, while the average target allocation was 10.1%.

"Not only is the average investor currently below target, but 61% of institutional investors expect their allocation to real estate to increase during 2022-23," MacKinnon said.