Asia-Pacific's financial technology acquisition boom may have further to run as operators and private equity investors target a sector experiencing a pandemic-fueled growth spurt.

Payment providers, in particular, will likely drive activity due to rising demand, capital-light business models and the ability to cross-sell other financial services, such as loans, said Ben Balzer, partner and head of private capital for Asia-Pacific at consultancy firm Oliver Wyman. Regionwide payment revenues will likely grow as much as 11% in 2021 from $900 billion in 2020, according to McKinsey & Co.

"Payments is an attractive sector," Balzer said, adding that private equity firms like the recurring revenue and low capital expenditure while industry buyers see value in the close touchpoint with customers.

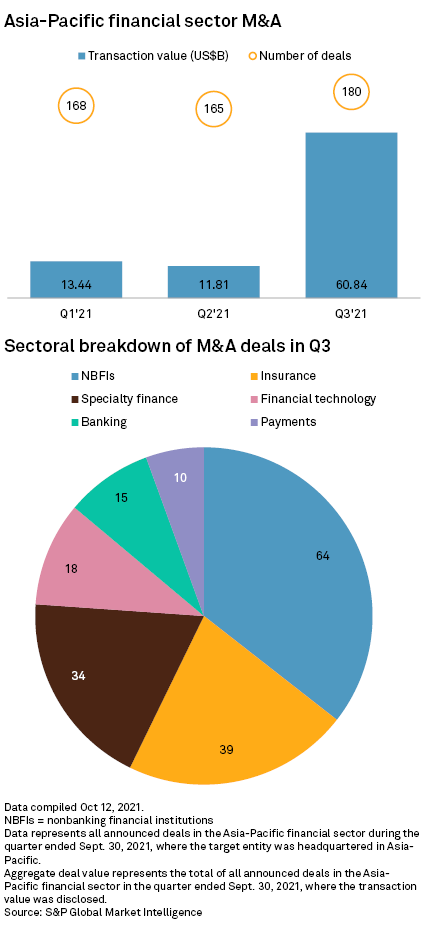

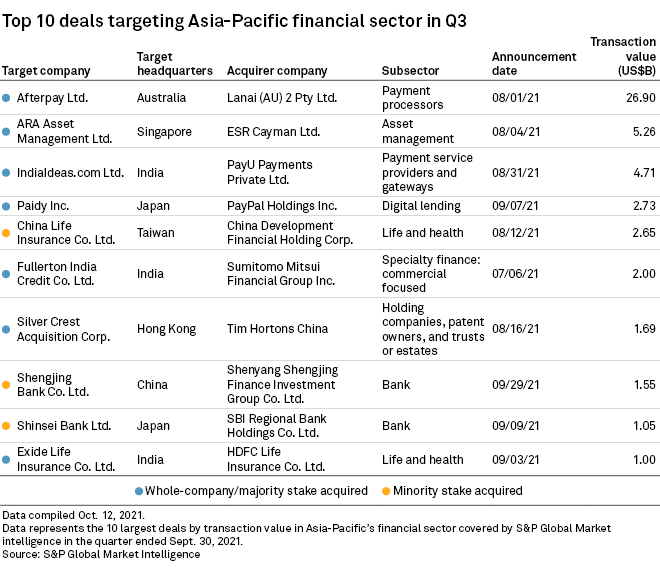

Square Inc.'s $26.90 billion acquisition of Australian buy-now, pay-later operator Afterpay Ltd. in August highlighted the payments trend in the Asia-Pacific region. It also pushed third-quarter acquisitions in the finance industry to $60.84 billion, more than double the tally for the first half of 2021 and the highest quarterly value in at least five years.

Among other deals, PayPal Holdings Inc. agreed to buy Japanese digital lender Paidy Inc., while PayU Payments Pvt. Ltd. added payment solutions provider BillDesk in India, as fintech companies look to enter new countries or broaden their services. Similarly, India-based Pine Labs Pvt. Ltd. announced a deal to buy Fave Asia Technologies Sdn. Bhd., a Southeast Asian app that provides digital payments for brick-and-mortar businesses.

Within fintech, payments will see more activity and wealth technology is gaining rapid traction, Balzer said, adding that the outlook for deals in financial services remains strong for the final months of 2021 and into 2022.

"We expect well-funded, entrenched fintechs to remain on the lookout for deals as they eye rapid geographic expansion and diversification in the Asia-Pacific region," said Sampath Sharma Nariyanuri, fintech analyst at S&P Global Market Intelligence.

Geography matters

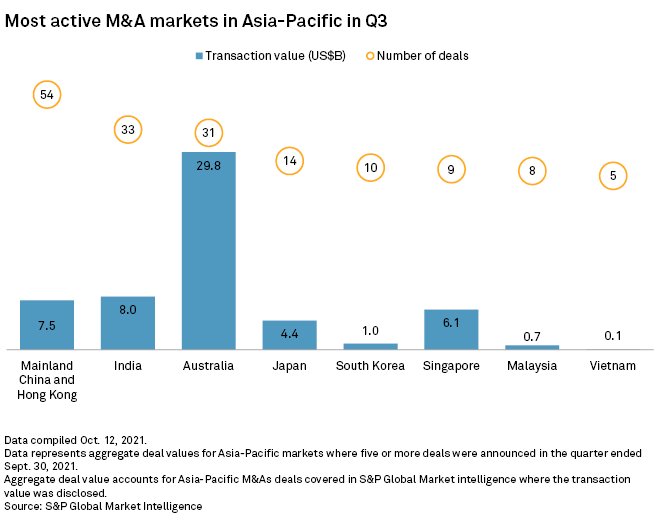

Australia was the hottest market for M&A in the financial sector in the third quarter, with 31 deals totaling $29.8 billion, Market Intelligence data shows. India had 33 deals totaling $8 billion. Hong Kong and Mainland China had the highest number of deals at 54, adding $7.5 billion in value.

Analysts expect more activity in Southeast Asia due to a rise in digital banking and digital financial services. Indonesia in May saw the merger of e-commerce giant PT Tokopedia and ride-hailing service PT Aplikasi Karya Anak Bangsa, which operates as Gojek. The deal is expected to boost the merged company's digital financial services business.

Deals in Southeast Asia may also get a boost from greater regulatory scrutiny of digital financial services in China and India. The two countries have taken a stricter stance over the sector in the past year or so, deterring outside investors.

The regulatory challenges in the world's two most populous countries and competition have contributed to a shift to Southeast Asia as investors and firms look to capitalize on the growth of the region's payments industry and take advantage of the more favorable regulatory environment, said Zennon Kapron, director of Singapore-based consultancy Kapronasia.

Singapore is awaiting its first blank-check company listings after its regulatory framework for special purpose acquisition companies came into effect Sept. 3. Rival financial hub Hong Kong is closing public consultation on its proposed SPAC framework Oct. 31.

De-SPAC transactions, or the reverse merger of a SPAC that results in a private company becoming listed, and strategic consolidation may be the M&A route for some companies, said Steven Sha, Hong Kong-based partner at law firm White & Case. Earlier-stage firms would likely turn to capital raising and growth, including by M&A, Sha said.

Still, several risks remain. The fintech sector in Asia-Pacific may be subject to more volatility than in the rest of the world, Sha said. "With a higher proportion of earlier stage and high growth companies and markets, circumstances may turn on a dime."

The growth of Asia's technology and fintech industries has also caused some companies to be overvalued, Sha said. That may increase investor scrutiny and greater demands, including on environmental, social and governance matters.