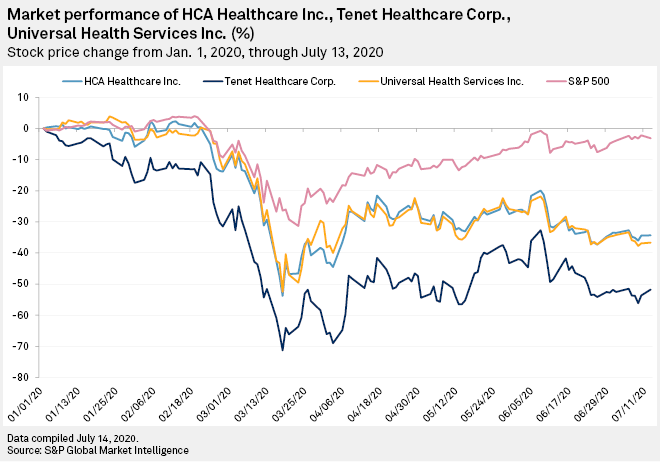

After U.S. hospitals suffered declines of patient and surgery volumes in the first quarter due to the coronavirus pandemic, the second quarter could be worse for the industry's largest players even as volumes climb back to pre-pandemic levels.

For-profit hospital companies like HCA Healthcare Inc., Universal Health Services Inc. and Tenet Healthcare Corp. all reported first-quarter losses because of declines in elective care, one of the industry's most lucrative business lines. However, these losses came primarily from volume declines in the final two weeks of the quarter.

The downward trend continued into April, and because the second quarter will include a longer period of reduced elective or nonemergent care, observers should "brace themselves" for second quarter results, Rick Gundling, senior vice president of healthcare financial practices for the Healthcare Financial Management Association, said in an interview.

While some CFOs have said volumes rose slightly in June, most do not believe normal levels will return until the first quarter of 2021, Gundling said.

After seeing substantial volume and revenue declines in March and April, reports showed that certain admissions volumes were rebounding in May.

Tenet even reported that in May and the first half of June, some volumes were back to between 65% and 95% of prepandemic levels. However, the American Hospital Association, an industry trade group, projected that U.S. hospitals would lose at least $323 billion in 2020, primarily from volume declines.

Some of the "snapback" in volumes in May and June could have simply been delayed procedures being rescheduled, and future volumes will be harder to project, Jonathan Kanarek, an analyst with Moody's Investors Service, told S&P Global Market Intelligence.

"It's unclear as we look to July and August, and thereafter, what true demand is," Kanarek said. "I don't think the progression back to normal will be linear. I think there will be bumps in the road, and ... I think those bumps will vary substantially across geographies."

Kanarek said that he is "cautiously optimistic" that volume trends will be comparable to 2019 levels by early 2021.

Recent volume rebounds are a positive signal of the industry's comeback, but they won't be enough to outweigh the losses experienced in April after being "absolutely gutted" of highly profitable surgeries, Whit Mayo, a healthcare analyst with UBS, said in an interview.

"We're still not seeing the more profitable service lines returning remotely close to normal levels to offset the challenges we saw in April," Mayo said.

Congress has approved $175 billion in economic relief funds for providers hit by the pandemic, and the U.S. Department of Health and Human Services has distributed tens of billions of dollars. However, Mayo said the funding won't cover the industry's losses and available liquidity is essential.

HCA, Tenet and Universal Health "don't have any liquidity issues," and may enter 2021 with even more cash on hand than before the pandemic, in part due to accelerated Medicare payments from the federal government, Mayo said. But this still won't adequately offset earnings losses if volumes are subdued for a protracted period.

"The biggest question that the industry has is: what will 2021 look like?" Mayo said. "In the absence of a vaccine, there's almost no scenario that many people see to return back to a sustainable normal level — define that however you will."

Another factor looming over the industry's potential comeback is when patients will feel comfortable to return for nonemergent care.

Some hospitals have spent money on marketing efforts to help ease patients' concerns about going to an emergency room, Kanarek said. However, Gundling and Kanarek said that it is hard to project when patient behavior will change.

COVID-19 cases resurging

The rebounding hospital industry will also have to deal with a resurgence of COVID-19 cases across the country, particularly in big states like California, Florida and Texas.

Texas Republican Gov. Greg Abbott limited elective services in major counties across the state in late June. The impact is likely to be felt by HCA and Universal Health — which derive 26% and 16% of their revenue from Texas, respectively, according to a June 30 Moody's report — as well as Dallas-based Tenet, which has about 23% of its hospital beds in the state.

California Gov. Gavin Newsom closed bars, indoor restaurants and other businesses July 13 in response to his state's climbing COVID-19 cases. However, the Democratic governor did not restrict or suspend elective care.

In Florida, Republican Gov. Ron DeSantis has also allowed elective care to continue, but HCA stopped elective surgeries in multiple counties in the state as of July 11 in a bid to free up capacity, it said in a July 8 press release.

Over 3.4 million people in the U.S. have tested positive for COVID-19 as of July 14, with the disease claiming at least 136,000 lives, according to Johns Hopkins University's Center for Systems Science and Engineering. With new pandemic hotspots continuing to emerge in the U.S., Gundling, Kanarek and Mayo all said the industry is in a better position to handle patient surges than in March and April, when elective care was canceled across the country to conserve resources like hospital beds and personal protective equipment.

Fresh reports of heightened concerns about potential shortages of supplies, staff and hospital beds as patient volumes spike in parts of California and Texas suggest these issues may return. But while responses will vary by region, overall, hospitals and hospital staff should be in a better position now than three months ago, Mayo said.