North American oil and gas companies are joining utilities in committing to net-zero emissions by 2050. Pipeline companies Williams Cos. and Enbridge were first-movers. |

The number of North American energy companies setting net-zero absolute carbon emissions targets exploded during the second half of 2020, with utilities leading the way. Thanks to investors' increasing concerns about environmental, social and governance issues, however, the oil and gas industry is beginning to catch up.

.

|

"I think it's a combination of economic feasibility and political and social appetite," Katie Bays, managing director at FiscalNote Markets, said in an interview. "What was in 2012 a very alienating and divisive position that the Obama administration took to regulate CO2 emissions from power plants, for example, has now become a very mainstream position particularly."

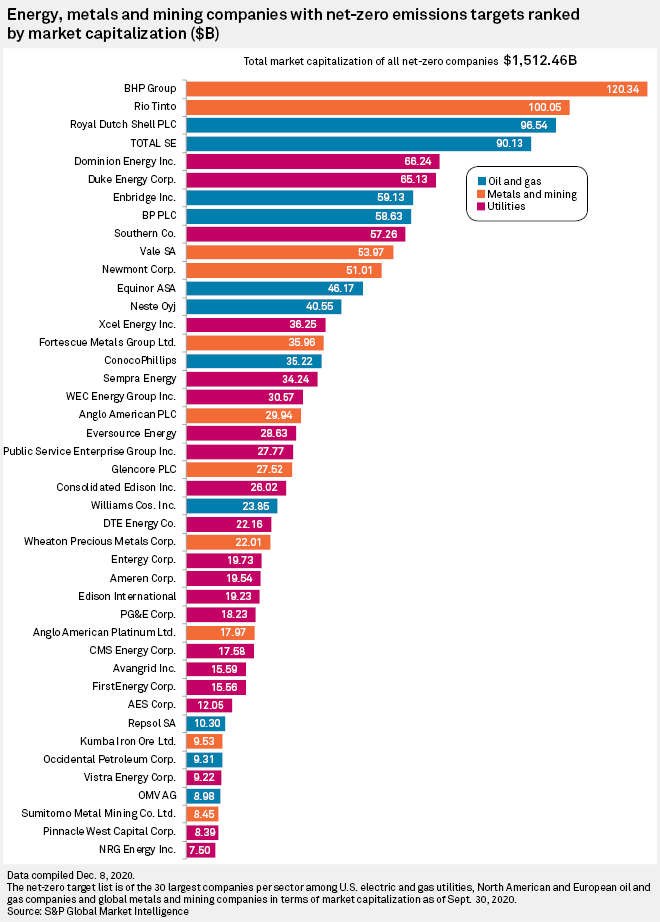

This is the first of four stories examining how the largest 30 companies in each of three sectors — oil and gas, utilities, and metals and mining — are tackling climate change, including the extent to which they are setting aggressive goals to achieve net-zero greenhouse gas emissions by 2050 or earlier.

Research by S&P Global Market Intelligence found that 21 of the 30 biggest utilities in the U.S., 11 of the 30 biggest metals and mining companies in the world, and 11 of the 30 largest oil and gas companies in Europe and North America have set net-zero targets by the middle of the century. This marks an increase from 13 U.S. utilities, eight global mining companies, and five oil and gas companies, as tallied by a Market Intelligence analysis published in July.

Williams Cos. Inc. and Enbridge Inc., two of the five biggest pipeline operators in North America, are leading the charge for hydrocarbons. Williams is eyeing net-zero carbon emissions by 2050 by targeting a 56% absolute reduction from its 2005 emissions by 2030, and Enbridge set a target to slash greenhouse gas emissions intensity by 35% by 2030 before reaching net-zero in 2050. Both plans include Scope 1 and Scope 2 emissions but not the Scope 3 emissions focused on how fossil fuels are produced upstream and used by customers downstream.

S&P Global's "Energy Evolution" podcast recently spoke with Williams President and CEO Alan Armstrong and Enbridge Chief Sustainability Officer Peter Sheffield about why the timing was right for embracing net-zero goals and how their companies intend to achieve them.

For Williams, its August announcement was a response to how the various agencies rating companies' ESG performance viewed pipelines.

"It became evident to us that the raters within the space were measuring a lot of things that frankly weren't really all that meaningful ... and so we really wanted to get on record and start to communicate what we thought were the important things to measure around long-term sustainability within this industry," Armstrong said.

Enbridge and Williams aim to decarbonize existing assets by using more fuels such as solar and wind to power operations, but they are also developing new renewable energy projects of their own. Williams delivers renewable natural gas, which comes from captured and processed methane emissions from landfills or dairy farms, in cooperation with energy companies in Washington, Idaho, Ohio and Texas. Enbridge's gas utility launched a C$5.2 million pilot project in November to blend renewable hydrogen produced at a power-to-gas facility in Markham, Ontario, into part of an existing natural gas network in 2021.

"Our story's not new here, but the commitments that we've made are providing a tangible view to what we'll be focused on over the next several decades," Sheffield said. "The feedback that we've gotten to date has been generally positive in terms of the level of transparency and I think the level of detail."

In terms of what comes next for the midstream sector once net-zero targets are reached, both executives emphasized that their companies are ultimately infrastructure and logistics companies whose systems can adapt to reflect demand.

"If you look at our portfolio and how it's changed over time, from exclusively a liquid infrastructure company to a company that has a large gas utility presence, and even more recently with the combination with Spectra Energy a very large gas transmission footprint, coupled with our renewables business ... you see our portfolio shifting to reflect the global energy mix," Sheffield said. "And you'll see perhaps opportunities to leverage that existing infrastructure ... in different ways."

Armstrong agreed that midstream companies will continue to operate beyond net-zero targets, particularly given the role of natural gas in the energy transition.

"I do think that people that have these big valuable networks, like Williams does, that ... getting energy into those locations is going to continue to be valuable for a long, long time," Armstrong said. "The bottom line is that any fair analysis that you look at right now that really gets after decarbonization pretty quickly has to lean on natural gas pretty heavily ... and you have to stay focused on the economic viability of that."

Results from a recent survey of primarily North American investors by UBS reinforces Sheffield and Armstrong's assertions. The bank's research arm asked 218 clients Oct. 5-14 about how investors see gas fitting into the energy mix and concluded they are less concerned about renewable energy pricing out gas than about "ESG investing momentum against fossil fuels."

"Although a significant majority of