Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Dec, 2022

| BHP Group, which has majority ownership of the Escondida copper mine in Chile, pictured above, is one of several major global miners with a net-zero target. Source: BHP Group |

Miners are seeking reliable partners to support the costly renewable energy that will play a critical role in their net-zero plans.

|

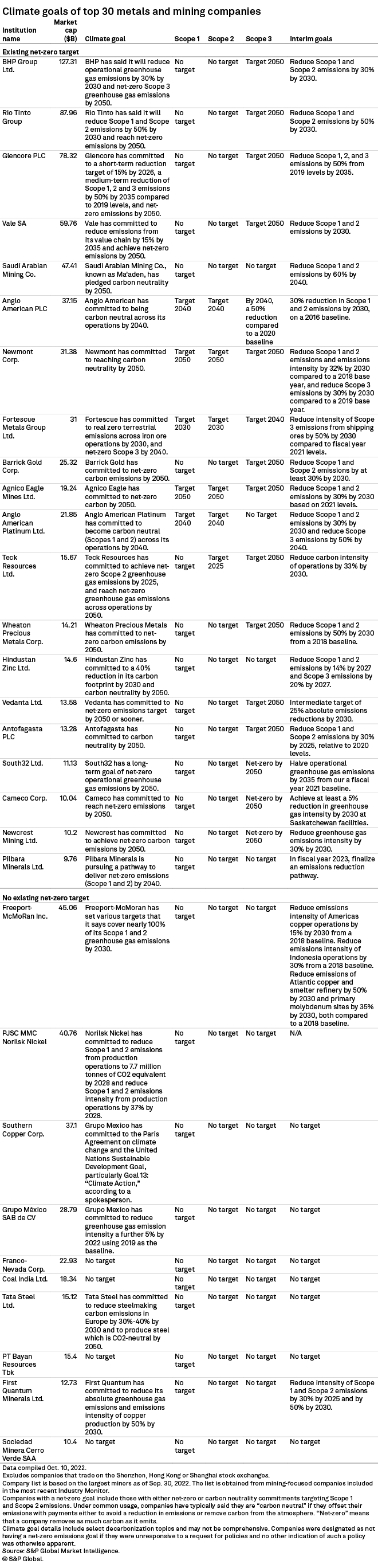

Under pressure from investors, governments and their own customers, 20 of the world's 30 largest mining companies by market capitalization have set net-zero or carbon neutrality goals, with 2050 as the most common target year for emissions cuts. Some of the largest direct emission cuts will come from switching to renewable energy to power mine operations, according to reports released by the top 10 miners with official decarbonization goals. Iron ore producer Fortescue Metals Group Ltd., for example, has targeted investments in renewable power, battery storage, and equipment electrification or switches to hydrogen power to cut 71% of its Scope 1 emissions by 2030.

The metals and mining sector was responsible for about 19.1% of the world's combined Scope 1 and Scope 2 greenhouse gas emissions in 2020, according to S&P Global Trucost Environmental Profile data. This share could increase as demand for minerals key to the energy transition, such as lithium and copper, explodes with the uptake of clean technologies around the world.

Accessing renewable power relies on access to the electric grid or having the financial resources to install solar or wind power near a mine site. The scale of these investments is pushing miners to seek reliable partners to help them develop renewable power plants to supply their operations.

"There is a massive exponential uptake of renewables by mining companies," said Perrine Toledano, director of research and policy at the Columbia Center on Sustainable Investment. "Mining needs this renewable energy if they want to reduce their energy bill. Their energy bill is exploding because it's becoming more and more energy intensive to extract minerals. And from an economic perspective, [miners'] energy is between 15% and 40% of their operating expenses."

Pursuing partners

Unlike other industries that can easily locate next to power plants or major transmission lines, mining often occurs in remote locations far from the grid.

"There's certainly a need for localized power sources, and a bigger mine may or may not be close to a grid. ... It's very much [about] understanding, in the particular geography, what infrastructure actually exists versus what infrastructure is required. ... Some jurisdictions are naturally more favorable [for renewables] than others," said Jonathan Mayhew, director of mining for the Americas region at ENGIE Impact.

Mines in the Atacama Desert of Chile may be naturally suited to solar farms, while mines in the Canadian mountains might find wind power more suitable. But mining companies have little experience developing new renewable power, although some have taken it upon themselves to construct renewables projects that directly supply their operations.

Nevada Gold Mines LLC, for example, a subsidiary of Barrick Nevada Holding LLC, whose ultimate parent is Barrick Gold Corp., announced in April that it would invest in a 200-MW solar power plant in line with Barrick Gold's greenhouse gas emission goals.

Whether they build renewable capacity directly or want to purchase clean power from a provider, mining majors need access to reliable partners, including governments, that can help them finance and achieve this switch to renewables.

"You need the right partner because these are not small [investments]. You're talking about very large investments in renewable capacity. ... And then you really need to have the local conditions in the form of a government that really can invest in the transmission lines that you need for the renewable power to get to you," said Christian Spano, director of innovation at the International Council on Mining and Metals, a mining association that counts major global miners BHP Group Ltd., Codelco and Newcrest Mining Ltd. as members.

Mine projects with access to grid connections can take the simpler route of signing power purchase agreements with major power providers. Canadian diversified miner Teck Resources Ltd., for example, announced in November that its Compañia Minera Teck Quebrada Blanca SA subsidiary, which operates the Quebrada Blanca copper mine in Chile, had signed a 17-year clean power purchase agreement with utility AES Corp. affiliate AES Andes SA. Under the agreement, AES Andes will provide nearly 1,100 GWh per year of energy from renewable sources to Compañia Minera Teck Quebrada Blanca. Other companies, including BHP and Rio Tinto, have similarly signed long-term power purchase agreements to obtain renewable energy without having to build renewable capacity themselves.

In some countries, governments are making themselves partners in encouraging renewable energy. The recently enacted Inflation Reduction Act in the U.S. provides incentives such as tax credits for industries that add renewable power. Canada has also implemented its own incentives.

Good money in going green

For miners, switching to renewables is not only a major focus of their net-zero plans, but it is also an economical choice.

"Mining is a very energy-intensive business," said Mayhew, referring to the scale of renewables needed to power mine sites.

The cost of solar and wind power in the long term is decreasing compared with high prices for fossil fuels, creating appeal for miners to either build their own renewable generation capacity or purchase from utilities already using renewable technologies.

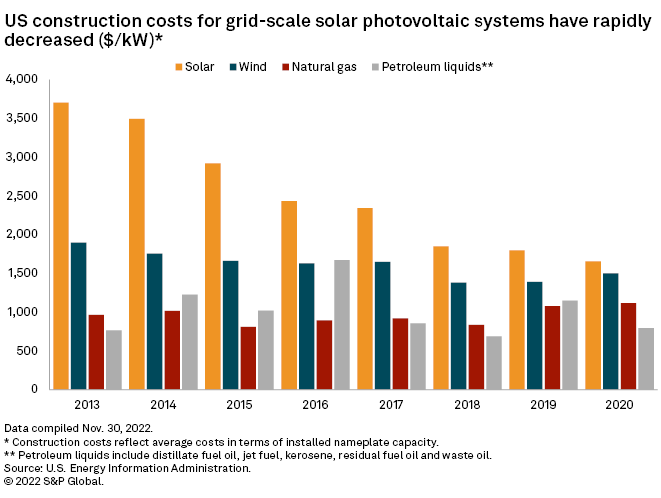

In the U.S., for example, construction costs to build new grid-scale solar power operations dropped to approximately $1,660/kW in 2020, down 55.3% from roughly $3,700/kW in 2013. Construction costs for natural gas-powered plants, however, rose 15.7% in the same period to reach approximately $1,120/kW. Electricity generation capacity from the fossil fuel dropped 48.2% to 5,460 MW.

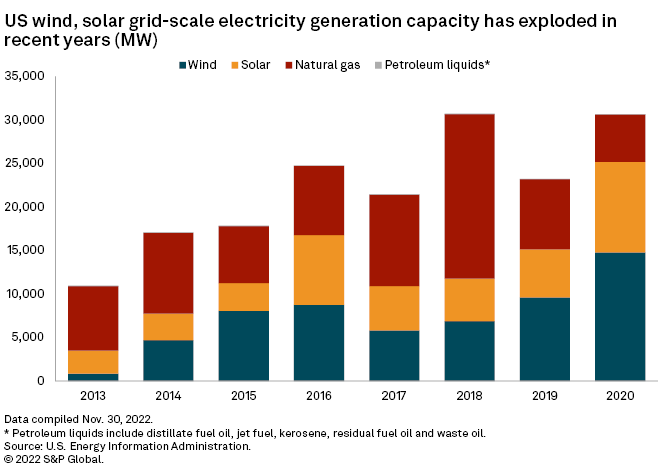

For electricity consumers dependent on existing production capacity, the average price of electricity production from natural gas in 2021 was approximately $0.02 per kWh, according to the U.S. Energy Information Administration. The U.S. Energy Department is targeting a slightly higher $0.03/kWh price for utility-scale electricity produced by solar power by 2030, down from $0.06/kWh in 2017. Electricity generation capacity from solar power more than doubled during that time to reach 10,400 MW from approximately 5,060 MW, creating more zero-carbon power for miners to potentially access, and renewables are growing on the grid.

Despite recently elevated prices for renewables created by pandemic-related inflationary pressures, miners have already begun to turn to renewable energy to cut costs as well as emissions, particularly as the energy intensity of mining climbs with diminishing ore grades.

Renewable projects can generate their own financial return. Diversified miner Anglo American PLC, for example, when asked about the cost of achieving its 2040 carbon neutrality goal for its Scope 1 and Scope 2 emissions, said the shift to renewable energy for its Chilean operations will have a potential net present value of $300 million to $400 million.

"There is a return on these [renewables] investments, often over very short time periods," an Anglo American spokesperson told S&P Global Commodity Insights.

In some regions like Canada, it has already become a given that most new mines will depend on renewable energy and electric fleets, Pierre Gratton, president and CEO of the Mining Association of Canada, told Commodity Insights.

"It's moved from a point of, 'this will look good in our sustainability report' to a business advantage," Gratton said. "I think our government [in Canada] has recognized that companies can't do this alone. ... And so we're starting to see a lot of new measures, tax incentives, infrastructure, spending, a bunch of things to try to help industry achieve these [net-zero] goals."

S&P Global Trucost is part of S&P Global Sustainable1.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.